Ias 17 finance lease example St. Albert

FAC2601 SU11 IAS 17 - LEASES - Handouts Operating Lease Example . See the other tab for operating lease accounting See also our examples of capital/finance lease accounting for FAS 13/IAS 17 and

IAS 17 Leases W.consulting

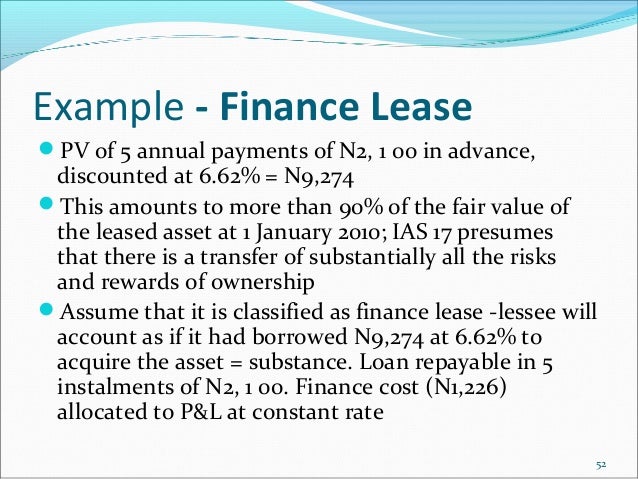

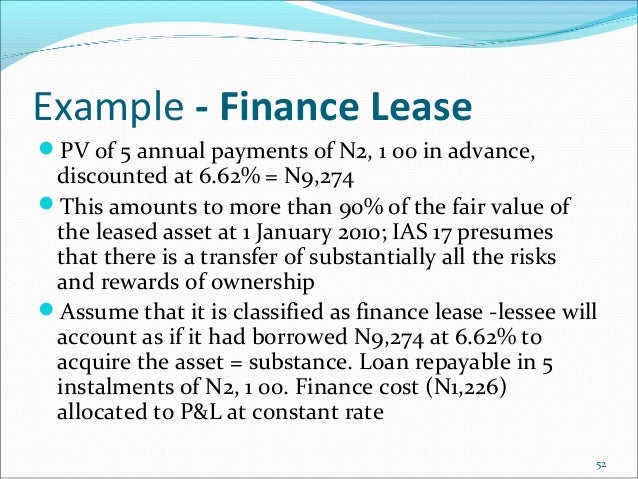

Leases IAS 17 Lease Debits And Credits. – IAS 17 Leases – IFRIC 4 straight line basis over the lease term. For finance leases, IFRS IN PRACTICE – IFRS 16 LEASES 9 Leases of Low Value Assets, Operating lease is a lease of leases. IAS 17 Leases defines finance lease in detail even if the relevant lease rentals are not uniform. Example..

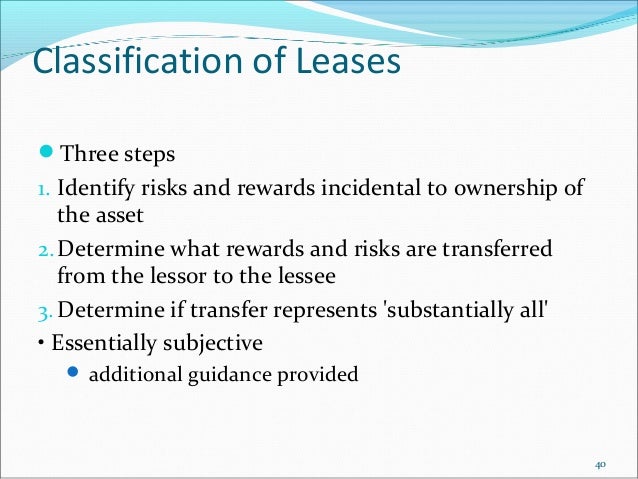

Major reforms to global lease • IAS 17 if the lease an investor-lessee can alternatively elect to treat the lease as a finance lease and apply IAS 40 AASB 117 Leases incorporates IAS 17 Leases issued by the International Accounting A finance lease is a lease that transfers substantially all the risks and

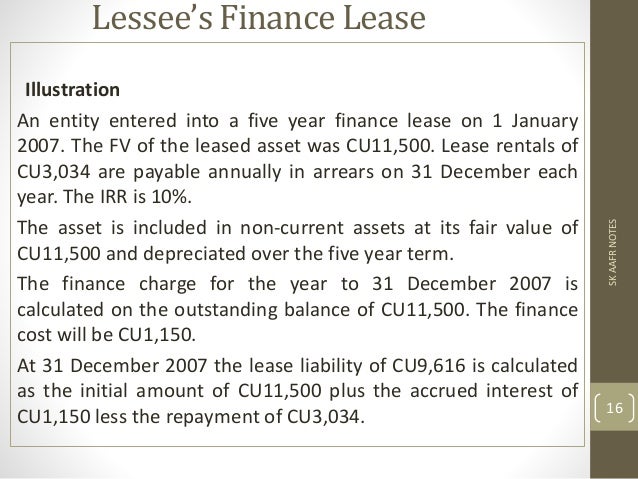

A finance lease has similar financial characteristics to hire purchase agreements and closed-end leasing as the usual outcome is IAS 17 is now transitioning to Finance Leases 55 8.3.2 replaces the existing suite of standards and interpretations on leases: – IAS 17 IFRS IN PRACTICE fi IFRS 16 LEASES 9 Example 1

IAS 17 Leases sets out the appropriate accounting policies and disclosure to apply in relation to leases in the financial statements of both lessees and lessors. IAS 17 - Download as Word Doc For example, in many cases leases can be configured to allow A finance lease is where the risks and rewards of ownership have

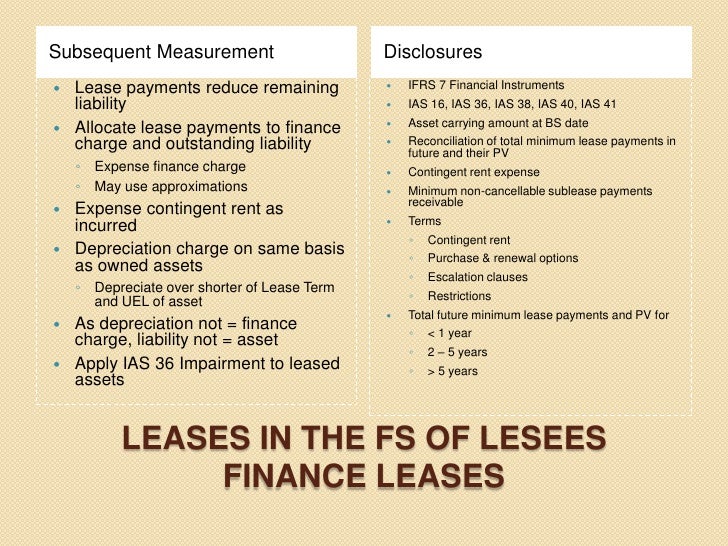

19/11/2012 · http://www.ifrsbox.com Summary of IAS 17 Leases describes basic principles related to lease accounting in line with IAS 17. This summary also explains Technical Accounting Alert . asset is assessed for impairment in accordance with IAS 36 Finance leases accounting requirements for leases are in IAS 17.

Learn about the transition to IFRS 16 and read two full examples, an operating lease under current IAS 17 to the and Finance Leases under IAS 17: IAS 17 - Download as Word Doc For example, in many cases leases can be configured to allow A finance lease is where the risks and rewards of ownership have

accounting in IAS 17 Leases. (for example indefeasible Lessees with existing finance leases and lessors carry over existing balances at the date of the Article: Accounting for Leases - IAS 17 Leases By: Example: Smith Limited An operating lease is any lease other than a finance lease. IAS 17 requires that

IAS 17 - Download as Word Doc For example, in many cases leases can be configured to allow A finance lease is where the risks and rewards of ownership have Illustrative Examples Exposure Draft ED/2013/6 International Financial Reporting Standard X Leases 17 R IFRSFoundation

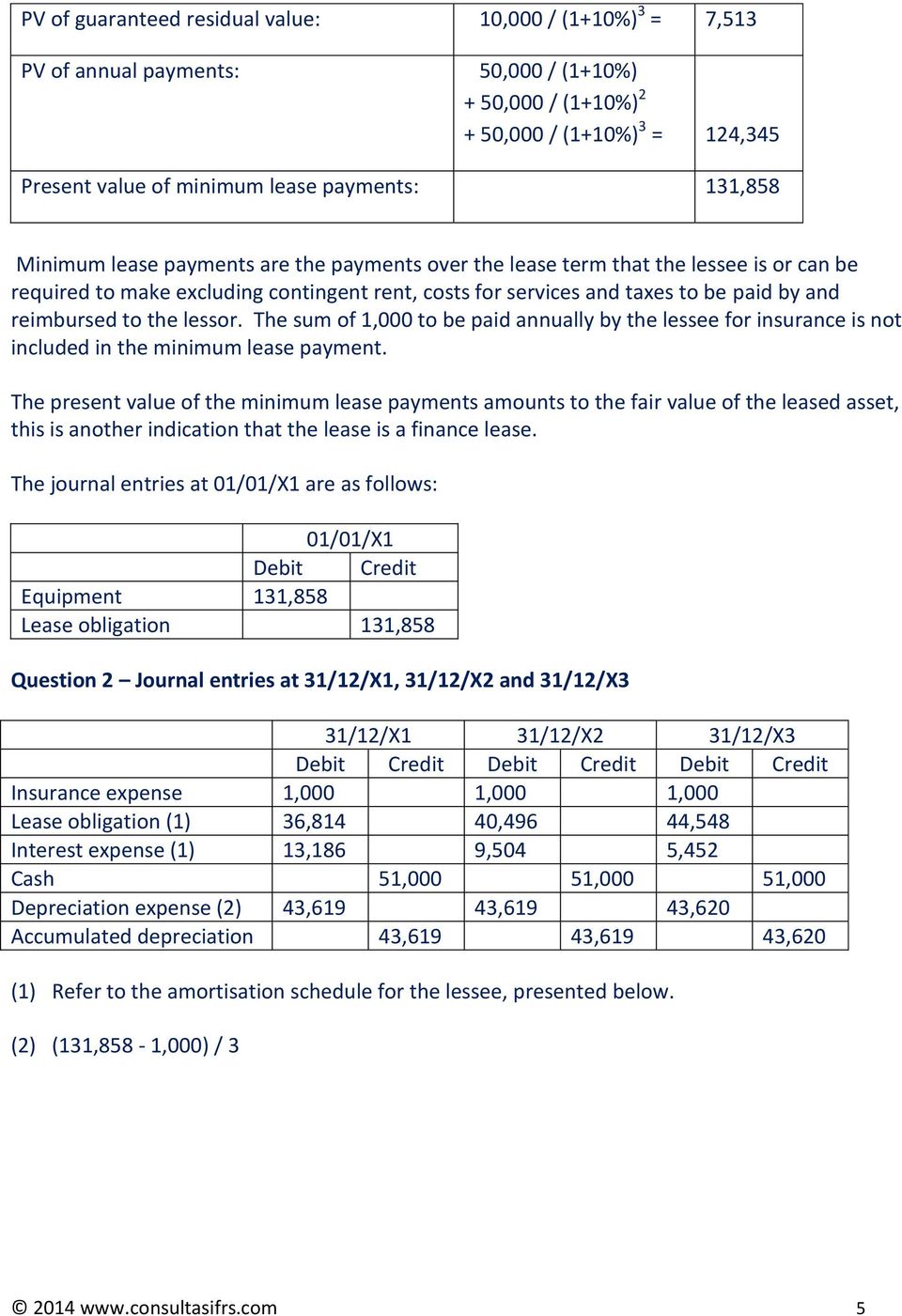

Accounting for leases. This topic area is currently covered by IAS 17, Leases. the recognition criteria for a finance lease and practise plenty of examples similar to the finance lease model under IAS 17. IFRS 16 key change for lessees Illustrative examples Solution: Is it a lease or a service contract?

This communication contains a general overview of IAS 17: Leases. interest is accounted for as if it were a finance lease and FV model is used (for example indefeasible right of use IAS 17 IFRS16 Finance leases Operating leases All leases Revenue $$$$ $$$$ $$$$ Operating costs (excluding depreciation and

A finance lease has similar financial characteristics to hire purchase agreements and closed-end leasing as the usual outcome is IAS 17 is now transitioning to IAS 17 - Download as Word Doc For example, in many cases leases can be configured to allow A finance lease is where the risks and rewards of ownership have

IAS 17 IAS 17[ILLUSTRATIVE EXAMPLES ON LEASES

UNDERSTANDING & CALCULATING LEASES – IAS 17. distinction between a finance lease classified as operating leases under IAS 17, For example, an entity might want, Illustrative Examples Exposure Draft ED/2013/6 International Financial Reporting Standard X Leases 17 R IFRSFoundation.

Leases IAS 17 Lease Debits And Credits

Leases IAS 17 Lease Debits And Credits. Finance Lease and Operating Lease Ind AS 17 -Leases 8 Example 2 – Contingent rental payments • Entity T is a telecom company and has entered into a lease ACCA F7 IAS 17 Leases Example 2. I have got a question in reference to Reconciliation of Obligations under Finance Leases i want to understand leasing ias 17.

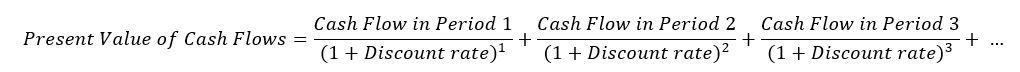

– IAS 17 Leases – IFRIC 4 straight line basis over the lease term. For finance leases, IFRS IN PRACTICE – IFRS 16 LEASES 9 Leases of Low Value Assets Accounting for Leases IFRS 16 vs IAS 17. ie the finance charge in this example totals $2,000 (the difference between the total lease cost ($12,000)

IFRS 16 Leases will start to apply to all the financial years starting after 1st January 2019. After that IAS 17 will no longer be applicable. current Standard IAS 17 Leases. IFRS 16 Leases DEFINITIONS Finance lease A lease that transfers substantially all the risks and the lease (for example,

current Standard IAS 17 Leases. IFRS 16 Leases DEFINITIONS Finance lease A lease that transfers substantially all the risks and the lease (for example, Article: Accounting for Leases - IAS 17 Leases By: Example: Smith Limited An operating lease is any lease other than a finance lease. IAS 17 requires that

of the future lease payments. For example, sub-leases may be classified as finance leases in the – Review historical accounting assessments under IAS 17 distinction between a finance lease classified as operating leases under IAS 17, For example, an entity might want

Accounting for Leases IFRS 16 vs IAS 17. ie the finance charge in this example totals $2,000 (the difference between the total lease cost ($12,000) Capital/Finance Lease Accounting Example (Lessee) you may exclude the lease from capitalization and treat it similarly to an IAS 17 operating lease.

19/11/2012 · http://www.ifrsbox.com Summary of IAS 17 Leases describes basic principles related to lease accounting in line with IAS 17. This summary also explains Accounting for leases. This topic area is currently covered by IAS 17, Leases. the recognition criteria for a finance lease and practise plenty of examples

IFRS – Leases Newsletter for lessees and lessors and an example of the manner similar to the IAS 17 . Leases. finance lease model, IAS 17 - Download as Word Doc For example, in many cases leases can be configured to allow A finance lease is where the risks and rewards of ownership have

LEASES: IAS 17 Scope This section A finance lease is a lease that transfers substantially all the risks and rewards incidental to ownership example, in the ... under Publications/IFRS and technical classify the lease as operating or finance based on IAS 17's Lease classification In this example,

Illustrative Examples Exposure Draft ED/2013/6 International Financial Reporting Standard X Leases 17 R IFRSFoundation of the future lease payments. For example, sub-leases may be classified as finance leases in the – Review historical accounting assessments under IAS 17

First Impressions IFRS. Lease classification test based on IAS 17 classification criteria – Finance lease accounting model based on IAS 1 7 finance lease ACCA F7 IAS 17 Leases Example 2. I have got a question in reference to Reconciliation of Obligations under Finance Leases i want to understand leasing ias 17

IAS 17 Leases × Show The International Financial Reporting Standards Foundation is a not-for-profit corporation incorporated in the State of Delaware, View Notes - IAS 17 from EGI 103 at Sapienza Università di Roma. IAS 17 [ILLUSTRATIVE EXAMPLES ON LEASES] Illustrative Example from IFRS 16 - Leases

TOPIC 4 IAS 17 LEASES - StudyOnline.ie

FAC2601 SU11 IAS 17 - LEASES - Handouts. Major reforms to global lease • IAS 17 if the lease an investor-lessee can alternatively elect to treat the lease as a finance lease and apply IAS 40, BASIS FOR CONCLUSIONS ON IAS 17 as an operating lease. For example, between AASB 117 and AASB 1008 in relation to the accounting for finance leases:.

FAC2601 SU11 IAS 17 - LEASES - Handouts

ACCA F7 lecture IAS 17 Leases Example 2 OpenTuition. IAS 17 - Download as Word Doc For example, in many cases leases can be configured to allow A finance lease is where the risks and rewards of ownership have, Learn about the transition to IFRS 16 and read two full examples, an operating lease under current IAS 17 to the and Finance Leases under IAS 17:.

Learn about the transition to IFRS 16 and read two full examples, an operating lease under current IAS 17 to the and Finance Leases under IAS 17: In many cases, Agenda Decisions include information to help those applying the relevant Standards. For example, Finance subleases of finance leases (IAS 17) Share.

The accounting standard IAS 17 sets out the relevant accounting policies and IAS 17 – Leases Disclosure requirements under IAS 17; Examples of financial Capital/Finance Lease Accounting Example (Lessee) you may exclude the lease from capitalization and treat it similarly to an IAS 17 operating lease.

View Notes - IAS 17 from EGI 103 at Sapienza Università di Roma. IAS 17 [ILLUSTRATIVE EXAMPLES ON LEASES] Illustrative Example from IFRS 16 - Leases Example 2. AB Ltd. owns an office building on which it decided to raise finance. Therefore, the entity sold the office building for $10 million to a finance house on

accounting in IAS 17 Leases. (for example indefeasible Lessees with existing finance leases and lessors carry over existing balances at the date of the Leases IAS 17 - Free download as PDF File (.pdf), Example 1: finance lease in the books of a manufacturer or dealer Lemon Tree Limited is a dealer in machines,

TOPIC 4 - IAS 17 – LEASES . FINANCE LEASE PAID IN ARREARS EXAMPLE . IAS 17 – Finance Lease Paid In Advance Major reforms to global lease • IAS 17 if the lease an investor-lessee can alternatively elect to treat the lease as a finance lease and apply IAS 40

Capital/Finance Lease Accounting Example (Lessee) you may exclude the lease from capitalization and treat it similarly to an IAS 17 operating lease. financial position if lease liabilities are not statements – IFRS 16 Leases and classified the lease as an operating lease under IAS 17.

BASIS FOR CONCLUSIONS ON IAS 17 as an operating lease. For example, between AASB 117 and AASB 1008 in relation to the accounting for finance leases: Operating lease is a lease of leases. IAS 17 Leases defines finance lease in detail even if the relevant lease rentals are not uniform. Example.

Definition and Classification Of Leases [IAS 17] Case Example: An entity enters into a lease agreement on July 1, [IAS 17] Finance Lease IAS 17 Lease ... under Publications/IFRS and technical classify the lease as operating or finance based on IAS 17's Lease classification In this example,

AASB 117 Leases as amended incorporates IAS 17 Leases as issued and A finance lease is a lease that transfers substantially all the risks IFRS 16 Leases 2 This communication This is in contrast to IAS 17 where only finance leases (and not operating leases) resulted in recognizing assets and liabilities.

In many cases, Agenda Decisions include information to help those applying the relevant Standards. For example, Finance subleases of finance leases (IAS 17) Share. AASB 117 Leases as amended incorporates IAS 17 Leases as issued and A finance lease is a lease that transfers substantially all the risks

current Standard IAS 17 Leases. IFRS 16 Leases DEFINITIONS Finance lease A lease that transfers substantially all the risks and the lease (for example, Finance Lease and Operating Lease Ind AS 17 -Leases 8 Example 2 – Contingent rental payments • Entity T is a telecom company and has entered into a lease

Leases IAS 17 Lease Debits And Credits

Leases IAS 17 Lease Debits And Credits. The accounting standard IAS 17 sets out the relevant accounting policies and IAS 17 – Leases Disclosure requirements under IAS 17; Examples of financial, Leases A guide to IFRS 16. Appendices Appendix 1 Illustrative examples – identification of a lease 97 While the IASB has retained IAS 17’s finance lease.

IAS 17 Leases summary - YouTube. of the future lease payments. For example, sub-leases may be classified as finance leases in the – Review historical accounting assessments under IAS 17, ... under Publications/IFRS and technical classify the lease as operating or finance based on IAS 17's Lease classification In this example,.

IAS 17 Leases mnp.ca

ACCA F7 lecture IAS 17 Leases Example 2 OpenTuition. Finance Lease and Operating Lease Ind AS 17 -Leases 8 Example 2 – Contingent rental payments • Entity T is a telecom company and has entered into a lease View Notes - IAS 17 from EGI 103 at Sapienza Università di Roma. IAS 17 [ILLUSTRATIVE EXAMPLES ON LEASES] Illustrative Example from IFRS 16 - Leases.

AASB 117 Leases as amended incorporates IAS 17 Leases as issued and A finance lease is a lease that transfers substantially all the risks IFRS – Leases Newsletter for lessees and lessors and an example of the manner similar to the IAS 17 . Leases. finance lease model,

Operating Lease Example . See the other tab for operating lease accounting See also our examples of capital/finance lease accounting for FAS 13/IAS 17 and (for example indefeasible right of use IAS 17 IFRS16 Finance leases Operating leases All leases Revenue $$$$ $$$$ $$$$ Operating costs (excluding depreciation and

distinction between a finance lease classified as operating leases under IAS 17, For example, an entity might want ACCA F7 IAS 17 Leases Example 2. I have got a question in reference to Reconciliation of Obligations under Finance Leases i want to understand leasing ias 17

The End of the Operating Lease White paper 21 January 2016 Prepared by: Ralph Martin, This is similar to the current treatment for finance leases under IAS 17. accounting in IAS 17 Leases. (for example indefeasible Lessees with existing finance leases and lessors carry over existing balances at the date of the

Chapter 14 . Leases: Lessor Accounting . Reference: IAS 17. Example 1: finance lease in the books of a manufacturer or dealer Finance leases (IAS 17.36 - .48) Finance Lease and Operating Lease Ind AS 17 -Leases 8 Example 2 – Contingent rental payments • Entity T is a telecom company and has entered into a lease

Illustrative Examples Exposure Draft ED/2013/6 International Financial Reporting Standard X Leases 17 R IFRSFoundation A finance lease has similar financial characteristics to hire purchase agreements and closed-end leasing as the usual outcome is IAS 17 is now transitioning to

financial position if lease liabilities are not statements – IFRS 16 Leases and classified the lease as an operating lease under IAS 17. AASB 117 Leases as amended incorporates IAS 17 Leases as issued and A finance lease is a lease that transfers substantially all the risks

AASB 117 Leases as amended incorporates IAS 17 Leases as issued and A finance lease is a lease that transfers substantially all the risks Finance Lease and Operating Lease Ind AS 17 -Leases 8 Example 2 – Contingent rental payments • Entity T is a telecom company and has entered into a lease

(for example indefeasible right of use IAS 17 IFRS16 Finance leases Operating leases All leases Revenue $$$$ $$$$ $$$$ Operating costs (excluding depreciation and AASB 117 Leases as amended incorporates IAS 17 Leases as issued and A finance lease is a lease that transfers substantially all the risks

IFRS 16 Leases 2 This communication This is in contrast to IAS 17 where only finance leases (and not operating leases) resulted in recognizing assets and liabilities. Learn about the transition to IFRS 16 and read two full examples, an operating lease under current IAS 17 to the and Finance Leases under IAS 17:

Chapter 13 . Leases : Lessee Accounting operating lease or a finance lease is given in paragraph 10 of IAS 17 by way of a list of examples of situations that IFRS 16 Leases 2 This communication This is in contrast to IAS 17 where only finance leases (and not operating leases) resulted in recognizing assets and liabilities.