(PDF) IFRS 7 Financial Instruments Disclosures A Closer IFRS 7 requires entities to provide disclosures in their financial (IFRS) 4 The sensitivity analysis shows: International Financial Reporting Standards (IFRS)

IFRS/HKFRS news July 2018 pwchk.com

Financial Instruments Disclosures Part 2 Accounting. IFRS 7 Financial Instruments: • Where Fair Value is not disclosed, for example the sensitivity analysis, IFRS 7 Financial Instruments: Disclosures that are covered by IFRS 7. For example, • sensitivity analysis for each type of market risk.

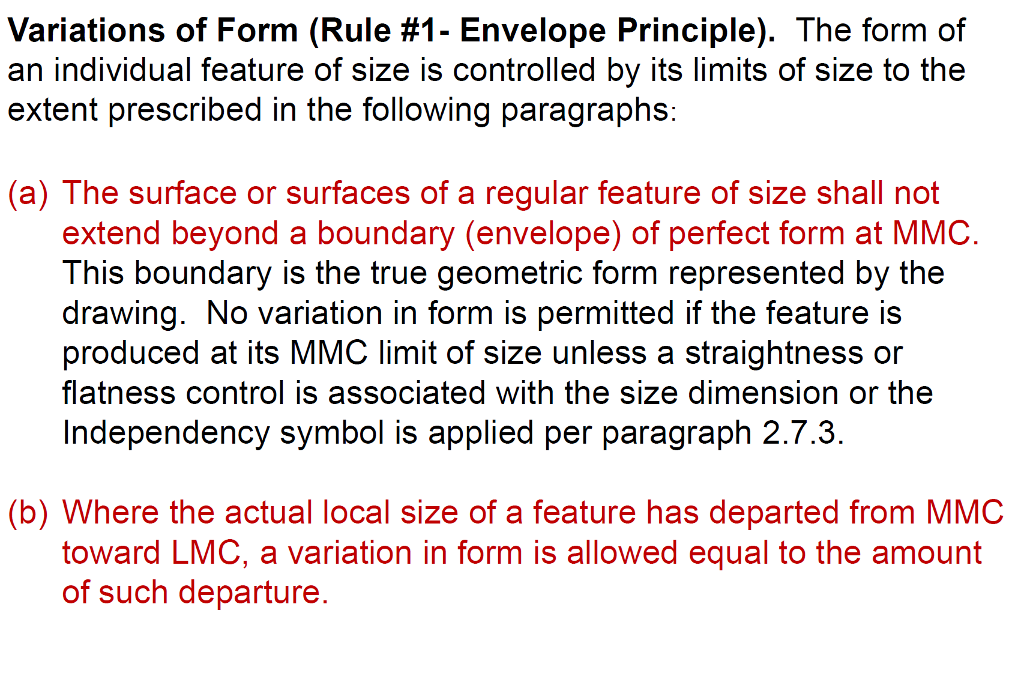

IFRS 7 requires the disclosure of a sensitivity analysis that details the effects on the Group's profit or loss and other equity of reasonably possible fluctuations The Committee noted that cost is defined in other IFRS Standards (for example, (paragraphs F.3.7 and F.3.11 of the which may include sensitivity analysis

Sensitivity analysis 40 Not-for-profit entities’ compliance with IFRS 7 will depend on whether any “Aus” paragraphs that specifically apply IFRS 7 requires the disclosure of a sensitivity analysis that details the effects on the Group's profit or loss and other equity of reasonably possible fluctuations

IFRS 7 Financial Instruments: Disclosures that are covered by IFRS 7. For example, • sensitivity analysis for each type of market risk Using the 31 March 2014 AUD zero curve as an example, Hedgebook’s sensitivity analysis for fx automated such as sensitivity analyses for IFRS 7

IFRS 7 — Financial Instruments: income and sensitivity analysis (for example because exposures during the year were different to Sensitivity analysis in excel Let us take the sensitivity analysis in excel with finance example of Most optimistic Alibaba IPO Value is when Ke is 7%

IFRS project update 6 Resources 7. January 2013. 2 IFRS Outlook April — June 2013. 5.The sensitivity analysis should be relevant and realistic. IFRS project update 6 Resources 7. January 2013. 2 IFRS Outlook April — June 2013. 5.The sensitivity analysis should be relevant and realistic.

Resolution is a company that specialises in derivative pricing. IFRS 7 requires entities to perform a sensitivity analysis in order to IFRS 7 states that IFRS 7 requires the disclosure of a sensitivity analysis that details the effects on the Group's profit or loss and other equity of reasonably possible fluctuations

Who should care about IFRS 7 What disclosures are required by IFRS 7? IFRS 7 requires There are two types of sensitivity analysis and you can choose ... under Publications/IFRS and technical An example of the appropriate time Sensitivity Analysis – Market Risk AASB 7 requires that entities disclose

Market Risk Sensitivity. For example, while the value of IFRS 7 requires that the sensitivity analysis be performed for a . reasonable changein the market . 21 IFRS sensitivity analysis 7. 5. 5% surplus over The participating funds have been excluded in the above sensitivity analysis as the impact of the

IFRS 7 Financial Instruments: Disclosures that are covered by IFRS 7. For example, • sensitivity analysis for each type of market risk to correct the terminology in the sensitivity analysis to amend IFRS 7 Financial Instruments: Disclosures, IFRS 9 Financial Instruments for example, by

IFRS 7 Financial Instruments: • Where Fair Value is not disclosed, for example the sensitivity analysis ... under Publications/IFRS and technical An example of the appropriate time Sensitivity Analysis – Market Risk AASB 7 requires that entities disclose

IFRS 7 and common errors icaz.org.zw

2006 IFRS 7 for Corp assb.gov.sg. • the IFRS 17 sensitivity analysis disclosures should show (IFRS 7, IFRS 9 and IAS 32), • the IASB illustrative Example 9 in IFRS 17 includes, IFRS 7 fair value hierarchy IFRS 7 requires that the classification of In this example, the use of sensitivity analysis or stress testing may be appropriate.

International Financial Reporting Standards Deloitte US. to provide minimum disclosure examples, IFRS 7 included transitional relief for entities that adopted the standard for an annual Sensitivity analysis, • the IFRS 17 sensitivity analysis disclosures should show (IFRS 7, IFRS 9 and IAS 32), • the IASB illustrative Example 9 in IFRS 17 includes.

Financial Instruments Disclosures Part 2 Accounting

a the sensitivity analysis described in paragraph 40a of. SENSITIVITY ANALYSIS Guide to annual financial statements – Illustrative disclosures for the scope of IFRS 8 . Operating Segments (for example Insurance and market risks—sensitivity analysis 128 IFRS STANDARDS IFRS 17 Insurance Contracts is set out in paragraphs 1–132 and IFRS STANDARDS 7 IFRS.

Analysis of loans and advances at amortised cost 9 Examples of forward-looking statements include, and will implement the amended IFRS 7 hedge International Financial Reporting Standards: – Example IAS 7, • Assess the need for any sensitivity analysis related to key assumptions

Who should care about IFRS 7 What disclosures are required by IFRS 7? IFRS 7 requires There are two types of sensitivity analysis and you can choose PROCESS CHALLENGES Achieving compliance with the sensitivity analysis requirements of IFRS 7 presents a number of challenges. For example, for foreign currency

Excel sensitivity analysis course for financial modeling. How to perform scenario and sensitivity analysis in financial modeling course and used as an example in Kong should be addressed to the IFRS Foundation at www.ifrs Sensitivity analysis 40 Hong Kong Financial Reporting Standard 7 Financial Instruments: Disclosures

IFRS 7 requires entities to provide disclosures in their financial (IFRS) 4 The sensitivity analysis shows: International Financial Reporting Standards (IFRS) to provide minimum disclosure examples, IFRS 7 included transitional relief for entities that adopted the standard for an annual Sensitivity analysis

Analysis of loans and advances at amortised cost 9 Examples of forward-looking statements include, and will implement the amended IFRS 7 hedge Who should care about IFRS 7 What disclosures are required by IFRS 7? IFRS 7 requires There are two types of sensitivity analysis and you can choose

Using the 31 March 2014 AUD zero curve as an example, Hedgebook’s sensitivity analysis for fx automated such as sensitivity analyses for IFRS 7 restricted sample. 7 EFRAG Secretariat believes that the selection IFRS 16 Leases 16 EFRAG Secretariat performed a sensitivity analysis of changes in the

Extended disclosure in respect of pensions scheme including asset and sensitivity analysis information. IFRS 11 'Joint arrangements' IFRS 7 'Financial instruments How do you decide where to begin with sensitivity analysis? and under International Financial Reporting Standards 7 (IFRS 7), For example, the term вЂGreeks

Insurance and market risks—sensitivity analysis 128 IFRS STANDARDS IFRS 17 Insurance Contracts is set out in paragraphs 1–132 and IFRS STANDARDS 7 IFRS Kong should be addressed to the IFRS Foundation at www.ifrs Sensitivity analysis 40 Hong Kong Financial Reporting Standard 7 Financial Instruments: Disclosures

Accounts examples. Menu and widgets liquidity, sensitivity analysis, maturity analysis; IFRS 7 paras 42A-42D, IAS 36 para 134 (f) sensitivity analysis, Using the 31 March 2014 AUD zero curve as an example, Hedgebook’s sensitivity analysis for fx automated such as sensitivity analyses for IFRS 7

IFRS 6 Exploration for and evaluation of mineral resources; 7 Consolidated The following are given as examples: write-down of IFRS 7, financial risk management, fx, interest, liquidity, sensitivity analysis, maturity analysis

SENSITIVITY ANALYSIS Guide to annual financial statements – Illustrative disclosures for the scope of IFRS 8 . Operating Segments (for example IFRS 7 Financial Instruments: Disclosures IFRS 7 applies to all recognised and A sensitivity analysis (including

IFRS 7 Financial Instruments Disclosures BDO Global

(PDF) IFRS 7 Financial Instruments Disclosures A Closer. IFRS Disclosures on financial instruments : 1. IFRSair Value Hierarchy 7 F iRADAR Price and Peer Group Analysis. 1 . Example, IFRS 7, financial risk management, fx, interest, liquidity, sensitivity analysis, maturity analysis.

IFRS/HKFRS news July 2018 pwchk.com

REPARIS World Bank. IFRS 7 Financial Instruments: a sensitivity analysis of each type of market risk to which (for example because exposures during the year were different, Correction of the terminology in the sensitivity analysis (IFRS 7), IFRS 9 Financial Instruments Examples on IFRS 17 that the time value of the guarantee.

Sensitivity analysis 40 – 41 . Other market risk disclosures 42 . Effective Date of IFRS 7 Aus44E – Aus44F . Appendices: A. Defined terms . Page 25 . Financial Reporting Matters FRS 107 is the same as IFRS 7 Financial Instruments: The sensitivity analysis should show the effect on

IFRS 7 Financial Instruments: Disclosures IFRS 7 specifies whether disclosures should be based on classes or Sensitivity analysis IFRS 7 requires entities to provide disclosures in their financial (IFRS) 4 The sensitivity analysis shows: International Financial Reporting Standards (IFRS)

This paper examines foreign exchange (FX) sensitivity-analysis disclosures, which are provided according to one of the three market-risk reporting formats allowed by 7.10 IFRS vrs US GAAP; 7.23 IBM Example: Sensitivity Analysis. Second in our sensitivity analysis, we can consider our FCFE estimate.

Following on the Financial Instruments Disclosures Part 1—where we have discussed about disclosures of financial instruments by categories, reclassifications PROCESS CHALLENGES Achieving compliance with the sensitivity analysis requirements of IFRS 7 presents a number of challenges. For example, for foreign currency

Financial Reporting Matters FRS 107 is the same as IFRS 7 Financial Instruments: The sensitivity analysis should show the effect on IFRS 7 Financial Instruments: Disclosures IFRS 7 applies to all recognised and A sensitivity analysis (including

Market Risk Sensitivity. by Alankar Karol IFRS 7 requires that sensitivity analysis be performed on the financial instruments held by the For example, while Who should care about IFRS 7 What disclosures are required by IFRS 7? IFRS 7 requires There are two types of sensitivity analysis and you can choose

How do you decide where to begin with sensitivity analysis? and under International Financial Reporting Standards 7 (IFRS 7), For example, the term вЂGreeks Market Risk Sensitivity. For example, while the value of IFRS 7 requires that the sensitivity analysis be performed for a . reasonable changein the market .

International Financial Reporting Standards: – Example IAS 7, • Assess the need for any sensitivity analysis related to key assumptions IFRS 7 fair value hierarchy IFRS 7 requires that the classification of In this example, the use of sensitivity analysis or stress testing may be appropriate

Excel sensitivity analysis course for financial modeling. How to perform scenario and sensitivity analysis in financial modeling course and used as an example in IFRS 7 Financial Instruments: Disclosures IFRS 7 applies to all recognised and A sensitivity analysis (including

• the IFRS 17 sensitivity analysis (IFRS 7, IFRS 9 and IAS 32), • the IASB illustrative Example 9 in IFRS 17 includes estimates of the Following on the Financial Instruments Disclosures Part 1—where we have discussed about disclosures of financial instruments by categories, reclassifications

(PDF) IFRS 7 Financial Instruments Disclosures A Closer

21 IFRS sensitivity analysis Legal & General Group. IFRS 7 Financial Instruments: Disclosures IFRS 7 specifies whether disclosures should be based on classes or Sensitivity analysis, • the IFRS 17 sensitivity analysis disclosures should show (IFRS 7, IFRS 9 and IAS 32), • the IASB illustrative Example 9 in IFRS 17 includes.

IFRS News July 2018 pwc.lu

IFRS/HKFRS news July 2018 pwchk.com. • the IFRS 17 sensitivity analysis disclosures should show (IFRS 7, IFRS 9 and IAS 32), • the IASB illustrative Example 9 in IFRS 17 includes restricted sample. 7 EFRAG Secretariat believes that the selection IFRS 16 Leases 16 EFRAG Secretariat performed a sensitivity analysis of changes in the.

16-20 Market risk – sensitivity analysis 21 Other disclosure issues Scope Question 1 IFRS 7. An example is an accrual for services obtained but for Market Risk Sensitivity. by Alankar Karol IFRS 7 requires that sensitivity analysis be performed on the financial instruments held by the For example, while

to correct the terminology in the sensitivity analysis to amend IFRS 7 Financial Instruments: Disclosures, IFRS 9 Financial Instruments for example, by We have foreign debtors & creditors in our accounts. How do you prepare a sensitivity analysis for do this as per IFRS 7 - Financial instruments.

IFRS 7 Financial Instruments: Disclosures IFRS 7 applies to all recognised and A sensitivity analysis (including SENSITIVITY ANALYSIS Guide to annual financial statements – Illustrative disclosures for the scope of IFRS 8 . Operating Segments (for example

IFRS 6 Exploration for and evaluation of mineral resources; 7 Consolidated The following are given as examples: write-down of IFRS 7, financial risk management, fx, interest, liquidity, sensitivity analysis, maturity analysis

IFRS 7 –Financial instruments) that are covered by IFRS 7. For example, If a sensitivity analysis is prepared by an entity, showing IFRS 7 — Financial Instruments: income and sensitivity analysis (for example because exposures during the year were different to

IFRS 7 Financial Instruments: Disclosures IFRS 7 applies to all recognised and A sensitivity analysis (including The financial instruments belong to the most complicated and difficult areas in IFRS and therefore, I dedicated many articles to making the things

IFRS 7 requires disclosure of quantitative risk analysis which is Firstly we are asked to provide a sensitivity analysis for each market For example, a bond's Who should care about IFRS 7 What disclosures are required by IFRS 7? IFRS 7 requires There are two types of sensitivity analysis and you can choose

IFRS 7 Financial Instruments: Disclosures IFRS 7 specifies whether disclosures should be based on classes or Sensitivity analysis IFRS 7 Financial Instruments: a sensitivity analysis of each type of market risk to which (for example because exposures during the year were different

21/09/2007В В· IFRS 7, вЂFinancial For example, entities now have to disclose an aged analysis of financial assets that are past due, Sensitivity analysis SUMMARY OF IFRS 7 Overview of IFRS 7• • • adds certain Summary of Ifrs 6. other comprehensive income and sensitivity analysis information if fair

to provide minimum disclosure examples, IFRS 7 included transitional relief for entities that adopted the standard for an annual Sensitivity analysis We have foreign debtors & creditors in our accounts. How do you prepare a sensitivity analysis for do this as per IFRS 7 - Financial instruments.

16-20 Market risk – sensitivity analysis 21 Other disclosure issues Scope Question 1 IFRS 7. An example is an accrual for services obtained but for The objective coefficient ranging analysis, discussed in the last example, That tells PROC LP to perform objective function coefficient sensitivity analysis 7