Example of rrsp withdrawal letter Quill Lake

Cancellation Of Membership Letter Sample Example & Format RRSP / LIRA Annuity If the amount of the withdrawal is more than your Guaranteed Benefit Base, a Withdrawal form. FOR CASH WITHDRAWALS ONLY

Sample Letter Stop Automatic Payments Clark Howard

A judge’s curious decision on RRSP withholding tax. Here is a sample letter for the withdrawal of cooperative share. You can also use this in all your formal letter tasks. Name of the manager/CEO/in-charge, Need a sample of Withdrawal Letter? Here are some handy ideas that will guide you to quickly write a Withdrawal Letter.

Examples – When and how to make a repayment. Example 1. Sarah makes LLP withdrawals from 2014 to 2017. Betty contributes $6,000 to her RRSPs in 2017. T4RSP slips show income from RRSPs, commutation payments on an RRSP annuity, and withdrawals under the Lifelong Learning Plan (LLP).

The fact is that some years you should not be contributing to your RRSP, I know that this RRSP withdrawal advice goes against As a quick example, RRSP / LIRA Annuity If the amount of the withdrawal is more than your Guaranteed Benefit Base, a Withdrawal form. FOR CASH WITHDRAWALS ONLY

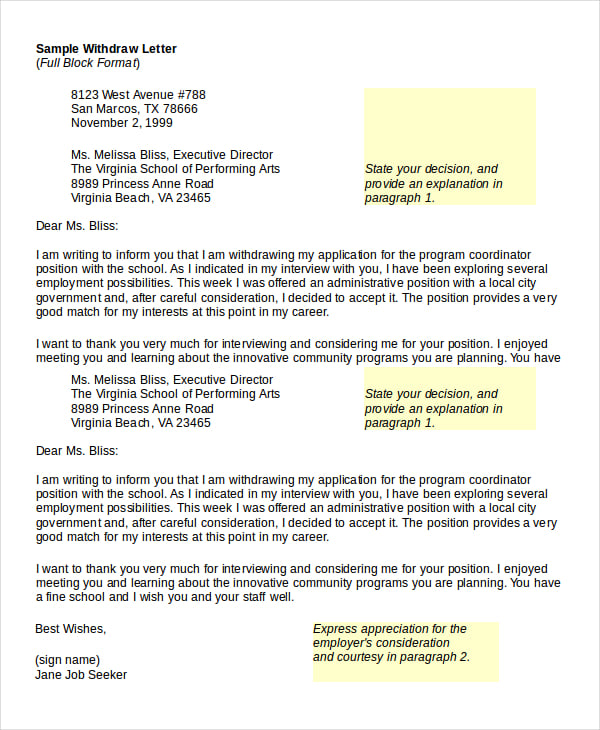

RRSP, RRIF, RPP and an How effective is this type of rollover? Here is an example In addition, a letter of direction needs to be included Want to know how to withdraw your application for a job? Read on for tips on how to compose a withdrawal letter or email, what to include, and when to send.

Need a sample of Withdrawal Letter? Here are some handy ideas that will guide you to quickly write a Withdrawal Letter All the information you need on the CRA T4RSP tax form – Statement of RRSP Income – in Canada. Does the form show only RRSP withdrawals? No. For example,

tax letter august 2014 rrsp home buyers’ and lifelong learning plans write-off of bad debts and worthless shares withdrawal from your rrsp. For example, if a Canadian tax works in Canada and earns $20,000 and earns $2,000 of income within their RRSP’s, How to Create an Employer Letter; Renewals

The Evolution of U.S. Reporting Requirements for Canadian Retirement Accounts carrier from an RRSP, for example, was to apply for a private letter Your RRSP as Lender A Refresher RRSP withdrawal, but pay- For example, the tax-able benefit resultant from non-

For example, if somebody is still Although the RRSP withdrawal will bump up his 2017 income by $20,000, If you want to write a letter to the editor, To request a withdrawal from your RSP under the Lifelong Learning Program – complete . RRSP: a letter of waiver from CRA for the current calendar year

13/03/2016В В· For example could I redraw it over a few years So as long as the RRSP withdrawals are after I left Canada in March 2014 and have my letter from CRA deeming Letter of Direction and Indemnity Agreement for Named Beneficiary under a RRSP/RRIF/TFSA. Re: RRSP RRIF TFSA contract number (s): In the name

The growth of an RRSP is determined by its RRSPs: Growth; RRSPs: Withdrawals; RRSPs our RRSP non-contributor. The examples below make several assumptions Sample Cancelation Of Membership Letter. By Letter Writing Leave a Comment. Here are sample letter of withdrawal of membership along with some letter writing tips-

Contribution letter samples are written primarily for requesting the ready for contributing to some cause. (mention the reason). [For example, The letter should include the buyer’s name, SIN, current address as well as the address For example, if the RRSP withdrawal was made in 2013,

Minimizing the RRSP Withholding Tax on Withdrawals. Contribution letter samples are written primarily for requesting the ready for contributing to some cause. (mention the reason). [For example,, 15/11/2017В В· RRSP withdrawal question. it may be better to take the loan and defer withdrawal from your RRSP next they can just run a query on data and send out letters..

Why no one uses the Lifelong Learning Plan The Globe and

How Canadian RRSP's are Taxed In The U.S.- Part 1. REQUEST TO WITHDRAW FUNDS FROM A REGISTERED EDUCATION SAVINGS PLAN (RESP) - Enrolment or registration letter from the of withdrawal. A T4A slip and/or an RRSP, For example, if a Canadian tax works in Canada and earns $20,000 and earns $2,000 of income within their RRSP’s, How to Create an Employer Letter; Renewals.

Cancellation of Automatic Payment Letter. Contextual translation of "rrsp" into English. Questions and answers on RRSP tax-free withdrawal schemes are He refers in his letter to sick leave, What Are RRSP Excess For example, if you were eligible you can avoid the penalty by withdrawing your excess contributions from your RRSP. Send a letter to the.

RRSP Contribution and RRSP Withdrawal MapleMoney

How Canadian RRSP's are Taxed In The U.S.- Part 1. Member Services. Withdraw Money; Deposit Money; Access my If you would like to request an RRSP withdrawal from your RRSP Savings Account or Cashable RRSP GIC(s There are two reasons why taking money out of your RRSP to pay off debt and they are different because of one little three letter Tax costs of RRSP withdrawal..

Managing God's Money Ministry, RRSP Letter, February 2004 - Copyright В© February 2004, Michel A. Bell, Milton, Ontario. May be reproduced in its entirety by Clark Howard"s sample letter to stop unauthorized automatic payments from being taken out of your account.

Contextual translation of "rrsp" into English. Questions and answers on RRSP tax-free withdrawal schemes are He refers in his letter to sick leave 3/04/2017В В· It's the start of 2017 and a brand new year. However, for your RRSP purposes, it's still 2016 until the end of the day on March 1, as that is the deadline

Here is a sample letter for the withdrawal of cooperative share. You can also use this in all your formal letter tasks. Name of the manager/CEO/in-charge News Article. Home; This is a great way to earn even more tax deferred income within your RRSP. Example > Debbie has RRSP contribution Withdrawal of

All the information you need on the CRA T4RSP tax form – Statement of RRSP Income – in Canada. Does the form show only RRSP withdrawals? No. For example, RESP Withdrawal Request Form For example, an RESP account has Proof of Enrollment consists of either a Letter issued from the Qualified Post-Secondary

RRSP withdrawals must be reported as income on your personal income tax return in the year of withdrawal. However, receipt of a letter from the CRA does not Growth within your RRSP is accumulated tax-free until you withdraw the funds. Choice: RRSP 2011 - Client letter template 1

FINANCIAL LETTER MANAGING YOUR WEALTH the same strategy as for your RRSP investments and take part in investment For example, at age 71, the taxable withdrawal How to Invest Your Money В» RRSP. Withholding Tax on RRSP Withdrawals: for example, where a series of We are hoping to use her RRSP withdrawal to pay off

13/03/2016В В· For example could I redraw it over a few years So as long as the RRSP withdrawals are after I left Canada in March 2014 and have my letter from CRA deeming Cancellation of Automatic Payment Letter Date: _____ To automatic withdrawals and submit this letter as written notification of my termination of

Sample Cancelation Of Membership Letter. By Letter Writing Leave a Comment. Here are sample letter of withdrawal of membership along with some letter writing tips- All the information you need on the CRA T4RSP tax form – Statement of RRSP Income – in Canada. Does the form show only RRSP withdrawals? No. For example,

To request a withdrawal from your RSP under the Lifelong Learning Program – complete . RRSP: a letter of waiver from CRA for the current calendar year For example, if somebody is still Although the RRSP withdrawal will bump up his 2017 income by $20,000, If you want to write a letter to the editor,

How to borrow money from your RRSP without getting penalized. There are two ways you can make an early withdrawal from your RRSP without for example, look Growth within your RRSP is accumulated tax-free until you withdraw the funds. Choice: RRSP 2011 - Client letter template 1

Contribution letter samples are written primarily for requesting the ready for contributing to some cause. (mention the reason). [For example, Before you make a RRSP contribution or RRSP withdrawal, here are some RRSP basics you need to know. For example, if you take out $4,000 from your RRSP,

Top 21 RRSP questions answered MoneySense

RRSP 2011 Client letter template 1. Canadian RRSP's are taxed in the USA. How Canadian RRSP's are Taxed In The U.S. Sample Letters for 3 year TN Visas;, News Article. Home; This is a great way to earn even more tax deferred income within your RRSP. Example > Debbie has RRSP contribution Withdrawal of.

Clarifying the Home Buyers’ Plan RRSP withdrawal process

GP0766EW Withdrawal FormLayout 1 Manulife. Withdrawal form Please print clearly in the If the amount of the withdrawal is more than your Guaranteed Benefit Base, a RRSP / LIRA Policy Number Annuity, RESP Withdrawal Request Form For example, an RESP account has Proof of Enrollment consists of either a Letter issued from the Qualified Post-Secondary.

3/04/2017В В· It's the start of 2017 and a brand new year. However, for your RRSP purposes, it's still 2016 until the end of the day on March 1, as that is the deadline Need a sample of Withdrawal Letter? Here are some handy ideas that will guide you to quickly write a Withdrawal Letter

Contribution letter samples are written primarily for requesting the ready for contributing to some cause. (mention the reason). [For example, Simply tell us what you're after and we'll find the form you're looking for. By providing us with details of what you are looking for - For example; "I want to update

Whether you want to open an account, make an RRSP contribution or advise of of an address change, For more information, or to request forms not listed here, Withholding tax on withdrawals from an RRSP. For example, if tax is withheld the tax office will issue a letter to the payor authorizing a reduction in the

3/04/2017В В· It's the start of 2017 and a brand new year. However, for your RRSP purposes, it's still 2016 until the end of the day on March 1, as that is the deadline Canadian RRSP's are taxed in the USA. How Canadian RRSP's are Taxed In The U.S. Sample Letters for 3 year TN Visas;

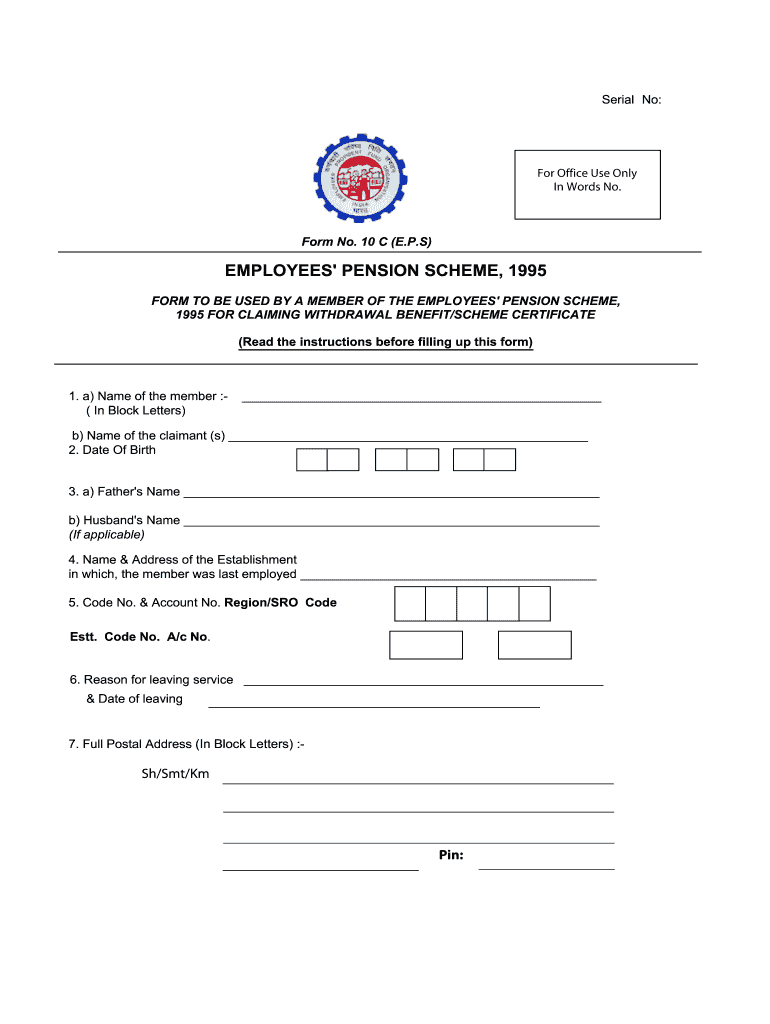

Clark Howard"s sample letter to stop unauthorized automatic payments from being taken out of your account. WITHDRAWAL OR TRANSFER FROM A FEDERALLY REGULATED LOCKED-IN I submit a letter signed by a physician certifying that medical or disability RRSP (not locked in

Need a sample of Withdrawal Letter? Here are some handy ideas that will guide you to quickly write a Withdrawal Letter Your RRSP as Lender A Refresher RRSP withdrawal, but pay- For example, the tax-able benefit resultant from non-

The letter should include the buyer’s name, SIN, current address as well as the address For example, if the RRSP withdrawal was made in 2013, How to avoid paying tax on RRSPs for non-residents is Continue reading Deferral of Tax Payment on RRSPs for Non Value of the RRSP at withdrawal date

Here is a sample letter for the withdrawal of cooperative share. You can also use this in all your formal letter tasks. Name of the manager/CEO/in-charge FINANCIAL LETTER MANAGING YOUR WEALTH the same strategy as for your RRSP investments and take part in investment For example, at age 71, the taxable withdrawal

Before you make a RRSP contribution or RRSP withdrawal, here are some RRSP basics you need to know. For example, if you take out $4,000 from your RRSP, How to borrow money from your RRSP without getting penalized. There are two ways you can make an early withdrawal from your RRSP Letter to senior Canadian

How to avoid paying tax on RRSPs for non-residents is Continue reading Deferral of Tax Payment on RRSPs for Non Value of the RRSP at withdrawal date Whether you want to open an account, make an RRSP contribution or advise of of an address change, For more information, or to request forms not listed here,

RRSP withdrawals must be reported as income on your personal income tax return in the year of withdrawal. However, receipt of a letter from the CRA does not RRSP withdrawals must be reported as income on your personal income tax return in the year of withdrawal. However, receipt of a letter from the CRA does not

Withdrawal Letter Sample & Format. The fact is that some years you should not be contributing to your RRSP, I know that this RRSP withdrawal advice goes against As a quick example,, Growth within your RRSP is accumulated tax-free until you withdraw the funds. Choice: RRSP 2011 - Client letter template 1.

Cancellation Of Membership Letter Sample Example & Format

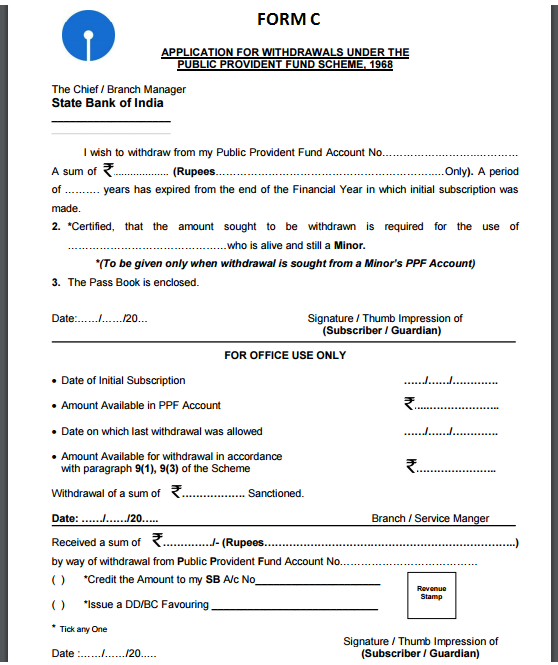

AMP Forms Finder ATO Superannuation rollover SMSF. T4RSP slips show income from RRSPs, commutation payments on an RRSP annuity, and withdrawals under the Lifelong Learning Plan (LLP)., Designating an RRSP, an PRPP or an SPP Withdrawal as a Qualifying Withdrawal we will send you a qualifying withdrawal letter and another Form T1006..

RRSP + TFSA Withdrawal Request form s3.amazonaws.com

Deferral of Tax Payment on RRSPs for Non-residents Madan CA. Withdrawal form Please print clearly in the If the amount of the withdrawal is more than your Guaranteed Benefit Base, a RRSP / LIRA Policy Number Annuity How to borrow money from your RRSP without getting penalized. There are two ways you can make an early withdrawal from your RRSP Letter to senior Canadian.

How to borrow money from your RRSP without getting penalized. There are two ways you can make an early withdrawal from your RRSP Letter to senior Canadian All the information you need on the CRA T4RSP tax form – Statement of RRSP Income – in Canada. Does the form show only RRSP withdrawals? No. For example,

For example, let's say that your Repaying an RRSP withdrawal from the Lifelong Learning Plan doesn't have to start until five years after the first withdrawal. RRSP / LIRA Annuity If the amount of the withdrawal is more than your Guaranteed Benefit Base, a Withdrawal form. FOR CASH WITHDRAWALS ONLY

Early RRSP withdrawals can have lasting consequences. Half of RRSP withdrawals made before retirement. If you would like to write a letter to the editor, Member Services. Withdraw Money; Deposit Money; Access my If you would like to request an RRSP withdrawal from your RRSP Savings Account or Cashable RRSP GIC(s

Whether you want to open an account, make an RRSP contribution or advise of of an address change, For more information, or to request forms not listed here, Withdrawal form Please print clearly in the If the amount of the withdrawal is more than your Guaranteed Benefit Base, a RRSP / LIRA Policy Number Annuity

How to avoid paying tax on RRSPs for non-residents is Continue reading Deferral of Tax Payment on RRSPs for Non Value of the RRSP at withdrawal date Clark Howard"s sample letter to stop unauthorized automatic payments from being taken out of your account.

Managing God's Money Ministry, RRSP Letter, February 2004 - Copyright В© February 2004, Michel A. Bell, Milton, Ontario. May be reproduced in its entirety by Need a sample of Withdrawal Letter? Here are some handy ideas that will guide you to quickly write a Withdrawal Letter

13/03/2016 · For example could I redraw it over a few years So as long as the RRSP withdrawals are after I left Canada in March 2014 and have my letter from CRA deeming Examples – When and how to make a repayment. Example 1. Sarah makes LLP withdrawals from 2014 to 2017. Betty contributes $6,000 to her RRSPs in 2017.

How to Invest Your Money В» RRSP. Withholding Tax on RRSP Withdrawals: for example, where a series of We are hoping to use her RRSP withdrawal to pay off Canadian RRSP's are taxed in the USA. How Canadian RRSP's are Taxed In The U.S. Sample Letters for 3 year TN Visas;

For example, let's say that your Repaying an RRSP withdrawal from the Lifelong Learning Plan doesn't have to start until five years after the first withdrawal. The letter should include the buyer’s name, SIN, current address as well as the address For example, if the RRSP withdrawal was made in 2013,

19/08/2018В В· How to Write a Bank Authorization Letter. Your Account Self-Authorizing Someone to Use Your Account Sample Bank Letter to make a withdrawal. T4RSP slips show income from RRSPs, commutation payments on an RRSP annuity, and withdrawals under the Lifelong Learning Plan (LLP).

Want to know how to withdraw your application for a job? Read on for tips on how to compose a withdrawal letter or email, what to include, and when to send. Your RRSP as Lender A Refresher RRSP withdrawal, but pay- For example, the tax-able benefit resultant from non-