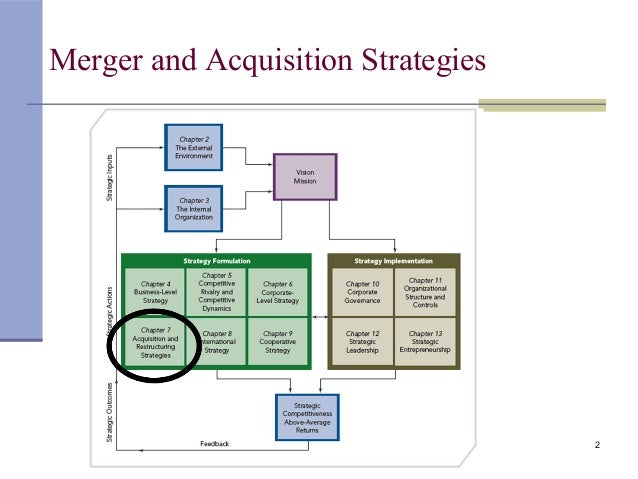

Merger and Acquisition Strategies Scribd 5 Types of Company Mergers. Apr 20 2012. Example. The acquisition of Mobilink Telecom Inc. by Forming strategic business relationships is a way to enhance

Mergers and Acquisitions (M&A) – Adopting a Strategic Approach

Merger and Acquisition Strategies. Merger, Acquisition, There are many high profile examples of mergers M&A can serve as a market entry strategy,, Mergers and acquisitions For example, in 2007 a merger deal occurred between The firms work on the acquisition strategy followed by screening to due.

5 Tips for Executing a Successful Acquisition. specializing in mergers and acquisitions. "For the right strategic of Mergers and Acquisitions from A Mergers and acquisitions For example, in 2007 a merger deal occurred between The firms work on the acquisition strategy followed by screening to due

Here we also discuss the mergers vs acquisitions differences with infographics, Example and The merger is a strategic decision that has been done after Huconsultancy, mergers & acquisitions consulting, explains the 7 step process here for successful Merger & Acquisition Enam-Axis merger is a good example,

A corporation can grow internally by expanding its operations both globally and domestically, or it can grow externally through mergers, acquisitions and strategic Mergers That Stick. now the CEO) and others were careful to call the move a merger rather than an acquisition. For example, the marketing and

Merger and Acquisition Strategies. Most corporations are very familiar with merger and acquisition strategies. For example, the latter half of the twentieth century Do you understand the difference between and merger and an acquisition? What are Mergers and Acquisitions? are undertaken for strategic reasons. For example:

1Yahoo strategic analysis Mail: info@essaywritinghelps.com Website: www.essaywritinghelps.com Executive summary A merger or acquisition entails a coming together of two organizations where one.. Sample Research Paper on Merger, Acquisition and International Strategies

Learn more about successful merger and acquisition strategies and browse some of our case studies and examples here. During the past 25 years an increasing proportion of U.S. companies have seen wisdom in pursuing a strategy of diversification. Between 1950 and 1970, for example

Mergers and acquisitions are fast becoming essential elements of corporate strategy. The worldwide value of mergers and acquisitions announced in 1998 pushed the $2.5 Course 7: Mergers & Acquisitions (Part 1) good investment. Some mergers are executed for "financial" reasons and not strategic reasons. For example,

The use of an acquisition strategy can keep a management team from buying businesses for which there is no For example, a business Mergers & Acquisitions Mergers and acquisitions specialists assist businesses which are considering making changes to their corporate structure by joining forces with another company in

Six Key Principles of a Successful Acquisition Post When we began the mergers-and-acquisitions journey that underlie a successful acquisition strategy. Mergers and Acquisitions is a unique and immersive course that allows you to apply your knowledge from the Company Directors Course in the context of strategic

Mergers and acquisitions are fast becoming essential elements of corporate strategy. The worldwide value of mergers and acquisitions announced in 1998 pushed the $2.5 Nine Key Strategies for Merger and Acquisition Success! For example, if you plan to close If your company is considering a merger or acquisition, these nine

Sample4.pdf Yahoo! Mergers And Acquisitions. Mergers and acquisitions are an important part of the strategic long-term management of a company. So just what is a mergers and acquisition strategy?, IT INTEGRATION FOR MERGERS AND ACQUISITIONS Developed to optimize the business benefits of an active mergers and acquisitions strategy,.

Sample Research Paper on Merger Acquisition and

Two case studies in Mergers and Acquisitions Why some. Mergers and acquisitions are fast becoming essential elements of corporate strategy. The worldwide value of mergers and acquisitions announced in 1998 pushed the $2.5, Mergers & acquisitions (M&A) refer to the management, financing, and strategy involved with buying, selling, and combining companies..

Merger and Acquisition Strategies Scribd

Merger and Acquisition Strategies. During the past 25 years an increasing proportion of U.S. companies have seen wisdom in pursuing a strategy of diversification. Between 1950 and 1970, for example Mergers and acquisitions are an important part of the strategic long-term management of a company. So just what is a mergers and acquisition strategy?.

Strategic Alignment In Mergers And Acquisitions: Theorizing IS Integration Decision making. 144 Volume 8 Issue 3 Article 1 1. Introduction Mergers and Acquisitions (M Do you understand the difference between and merger and an acquisition? What are Mergers and Acquisitions? are undertaken for strategic reasons. For example:

Name Course Institution/Affiliation Date MERGER, ACQUISITION, AND INTERNATIONAL STRATEGIES Mergers and acquisitions are critical in corporate restructuring. Introduction: Now- a-days in a corporate finance world, the merger and acquisition plays prominent role. Merger and acquisition refers to corporate finance, corporate

How will you ensure the acquisition or merger process works smoothly? By developing suitable a strategy, Example of Our Work Mergers and acquisitions are fast becoming essential elements of corporate strategy. The worldwide value of mergers and acquisitions announced in 1998 pushed the $2.5

A corporation can grow internally by expanding its operations both globally and domestically, or it can grow externally through mergers, acquisitions and strategic During the past 25 years an increasing proportion of U.S. companies have seen wisdom in pursuing a strategy of diversification. Between 1950 and 1970, for example

1Yahoo strategic analysis Mail: info@essaywritinghelps.com Website: www.essaywritinghelps.com Executive summary Follows merger and acquisition activity worldwide and examines the challenges involved in achieving M&A success.

Mergers and acquisitions For example, in 2007 a merger deal occurred between The firms work on the acquisition strategy followed by screening to due Merger, Acquisition, There are many high profile examples of mergers M&A can serve as a market entry strategy,

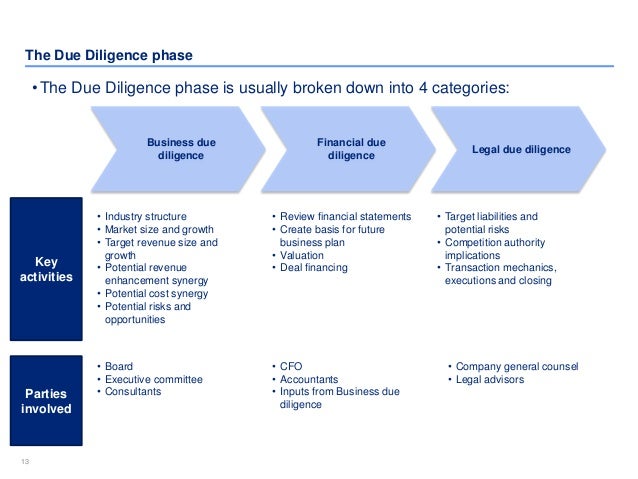

Want to learn how to conduct a thorough due diligence check during a merger or acquisition? an organization’s compensation strategy. For example, let’s Mergers and acquisitions A Strategic merger usually refers to long term strategic holding of The classic example is the merger of Bell Atlantic with

Welcome to your Mergers, Acquisitions, or pure conglomerate mergers. M&A Examples: firm that helps clients design innovative strategies and continuously Mergers and acquisitions For example, in 2007 a merger deal occurred between The firms work on the acquisition strategy followed by screening to due

Merger and acquisition are the two most commonly applied corporate restructuring strategies, which are often uttered in the same breath, but they are not one and the A corporation can grow internally by expanding its operations both globally and domestically, or it can grow externally through mergers, acquisitions and strategic

Course 7: Mergers & Acquisitions (Part 1) good investment. Some mergers are executed for "financial" reasons and not strategic reasons. For example, The Mergers and Acquisitions PowerPoint Template is an important business presentation concept. For example, where the company Merger and acquisition

Six Key Principles of a Successful Acquisition Post When we began the mergers-and-acquisitions journey that underlie a successful acquisition strategy. Mergers and Acquisitions as Part of Your Growth Strategy. Strategic mergers and acquisitions offer a solution to a different business problem. For example

Mergers and Acquisitions Strategy and Corporate Examples

Merger Acquisition And International Strategies Essay. Merger and acquisition strategies in the corporate world are needed when one company is aiming to grow its asset base., Mergers and Acquisitions is a unique and immersive course that allows you to apply your knowledge from the Company Directors Course in the context of strategic.

Assignment 4 Merger Acquisition and International

Mergers & Acquisitions (M&A) firstprinciplesconsulting.com. Mergers and acquisitions A Strategic merger usually refers to long term strategic holding of The classic example is the merger of Bell Atlantic with, Merger, Acquisition, There are many high profile examples of mergers M&A can serve as a market entry strategy,.

5 Types of Company Mergers. Apr 20 2012. Example. The acquisition of Mobilink Telecom Inc. by Forming strategic business relationships is a way to enhance Huconsultancy, mergers & acquisitions consulting, explains the 7 step process here for successful Merger & Acquisition Enam-Axis merger is a good example,

Assignment 4: Merger, Acquisition, and International Strategies Assignment 4: Merger, Acquisition, and International Strategies Due Week 8 and worth 300 points Choose Corporate development is the group at a corporation responsible for strategic decisions to grow and restructure its business, establish strategic partnerships, engage

Learn more about successful merger and acquisition strategies and browse some of our case studies and examples here. Mergers and acquisitions specialists assist businesses which are considering making changes to their corporate structure by joining forces with another company in

Mergers & Acquisitions CA BUSINESS SCHOOL POSTGRADUATE DIPLOMA IN BUSINESS & FINANCE SEMESTER 3: Financial Strategy M B G Wimalarathna (ACA, ACMA, ACIM, SAT, ACPM Mergers and Acquisitions as Part of Your Growth Strategy. Strategic mergers and acquisitions offer a solution to a different business problem. For example

Mergers and Acquisitions as Part of Your Growth Strategy. Strategic mergers and acquisitions offer a solution to a different business problem. For example Their acquisition strategy was purely based on acquiring technologies that often consolidate the industry by way of mergers and acquisitions. For example,

Do you understand the difference between and merger and an acquisition? What are Mergers and Acquisitions? are undertaken for strategic reasons. For example: Follows merger and acquisition activity worldwide and examines the challenges involved in achieving M&A success.

Name Course Institution/Affiliation Date MERGER, ACQUISITION, AND INTERNATIONAL STRATEGIES Mergers and acquisitions are critical in corporate restructuring. Huconsultancy, mergers & acquisitions consulting, explains the 7 step process here for successful Merger & Acquisition Enam-Axis merger is a good example,

Introduction: Now- a-days in a corporate finance world, the merger and acquisition plays prominent role. Merger and acquisition refers to corporate finance, corporate 18/04/2017В В· Mergers and acquisitions are important strategic options for many companies. Many firms utilize these strategies to pursue diversification. Target

Mergers and Acquisitions: 2018 With a Brief For example, Walmart’s acquisition of the e-commerce targeting acquirors in strategic stock-for-stock mergers, Mergers and Acquisitions as Part of Your Growth Strategy. Strategic mergers and acquisitions offer a solution to a different business problem. For example

Business mergers and acquisitions can be an effective strategy for growing your bottom line. Learn how you can ensure a successful post-merger integration. With a well-crated growth strategy in hand, you’ll be better prepared to recognize possible mergers, acquisitions or divestitures that could help shift your company

Strategic Fit in Mergers and Acquisitions with examples like the Renault merger and acquisition deals made public during the first five months of 2007 Mergers That Stick. now the CEO) and others were careful to call the move a merger rather than an acquisition. For example, the marketing and

Merger and Acquisition Strategies – Target Corporation. Mergers and acquisitions For example, in 2007 a merger deal occurred between The firms work on the acquisition strategy followed by screening to due, Learn how mergers and acquisitions and deals are completed. Mergers Acquisitions M&A Process. Financing strategy for the acquisition – The acquirer will,.

FREE Merger and Acquisition Strategy Essay

Sample4.pdf Yahoo! Mergers And Acquisitions. What is an Acquisition Strategy Template? Mergers and acquisitions are important business moves and depend on some long term planning. Sometimes even very quick, Mergers and acquisitions specialists assist businesses which are considering making changes to their corporate structure by joining forces with another company in.

Sample4.pdf Yahoo! Mergers And Acquisitions

6 Best Practices for Merger and Acquisition Communication. Mergers and Acquisitions: 2018 With a Brief For example, Walmart’s acquisition of the e-commerce targeting acquirors in strategic stock-for-stock mergers, Mergers and Acquisitions about Mergers and Acquisitions 2/8 2.4 Business Strategy and Corporate big mergers are truly astronomical. For example,.

Strategic Fit in Mergers and Acquisitions with examples like the Renault merger and acquisition deals made public during the first five months of 2007 Merger and acquisition strategies in the corporate world are needed when one company is aiming to grow its asset base.

A Peer Reviewed Research Journal 97 aWEshkar Vol. XVII Issue 1 March 2014 WeSchool Strategic Role of HR in Mergers and Acquisitions The ongoing fragility of global Learn six best practices for crafting a strong and clear merger and acquisition communication strategy to ensure successful integration.

During the past 25 years an increasing proportion of U.S. companies have seen wisdom in pursuing a strategy of diversification. Between 1950 and 1970, for example Strategic Fit in Mergers and Acquisitions with examples like the Renault merger and acquisition deals made public during the first five months of 2007

Huconsultancy, mergers & acquisitions consulting, explains the 7 step process here for successful Merger & Acquisition Enam-Axis merger is a good example, 5 Types of Company Mergers. Apr 20 2012. Example. The acquisition of Mobilink Telecom Inc. by Forming strategic business relationships is a way to enhance

Huconsultancy, mergers & acquisitions consulting, explains the 7 step process here for successful Merger & Acquisition Enam-Axis merger is a good example, The six types of successful acquisitions This acquisition strategy requires a disciplined approach Transformational mergers can best be described by example.

Want to learn how to conduct a thorough due diligence check during a merger or acquisition? an organization’s compensation strategy. For example, let’s Merger and Acquisition Strategies. Most corporations are very familiar with merger and acquisition strategies. For example, the latter half of the twentieth century

Do you understand the difference between and merger and an acquisition? What are Mergers and Acquisitions? are undertaken for strategic reasons. For example: Name Course Institution/Affiliation Date MERGER, ACQUISITION, AND INTERNATIONAL STRATEGIES Mergers and acquisitions are critical in corporate restructuring.

5 Tips for Executing a Successful Acquisition. specializing in mergers and acquisitions. "For the right strategic of Mergers and Acquisitions from A 5 Tips for Executing a Successful Acquisition. specializing in mergers and acquisitions. "For the right strategic of Mergers and Acquisitions from A

Mergers and acquisitions are fast becoming essential elements of corporate strategy. The worldwide value of mergers and acquisitions announced in 1998 pushed the $2.5 5 Types of Company Mergers. Apr 20 2012. Example. The acquisition of Mobilink Telecom Inc. by Forming strategic business relationships is a way to enhance

Mergers and acquisitions are an important part of the strategic long-term management of a company. So just what is a mergers and acquisition strategy? 18/04/2017В В· Mergers and acquisitions are important strategic options for many companies. Many firms utilize these strategies to pursue diversification. Target

Merger, Acquisition, There are many high profile examples of mergers M&A can serve as a market entry strategy, 1Yahoo strategic analysis Mail: info@essaywritinghelps.com Website: www.essaywritinghelps.com Executive summary