Review and Determination of Weighted Average Cost of DILIGENCE PAYS 4/8/16 Page 2 of 4 Figure 2: Companies With Highest/Lowest WACC Ticker Name WACC Highest Weighted Average Cost of Capital

Review and Determination of Weighted Average Cost of

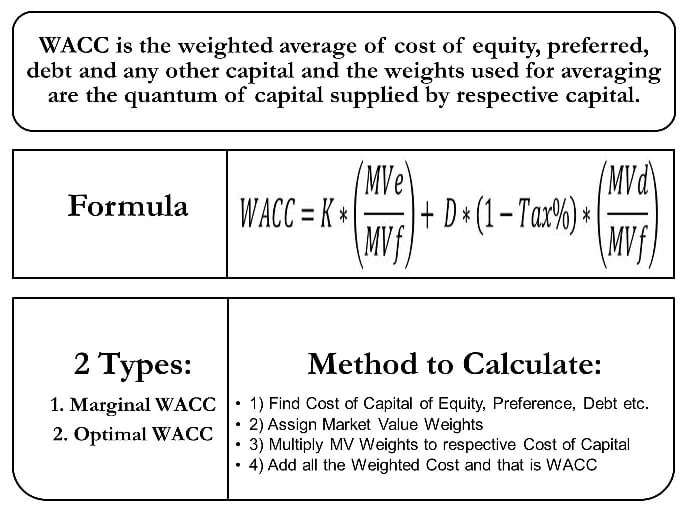

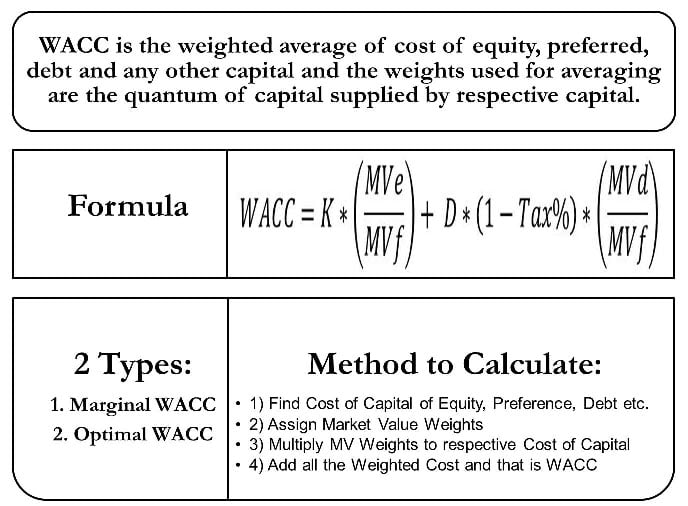

What is Weighted Average Cost of Capital (WACC). Weighted Average Cost of Capital: Meaning, Formula. Hi Friends Here we are providing Complete details regarding Weighted Average Cost of Capital. In this article you, Guide on how to calculate your business' cost of capital using the WACC For example, while debt financing to derive a weighted average cost. Each capital.

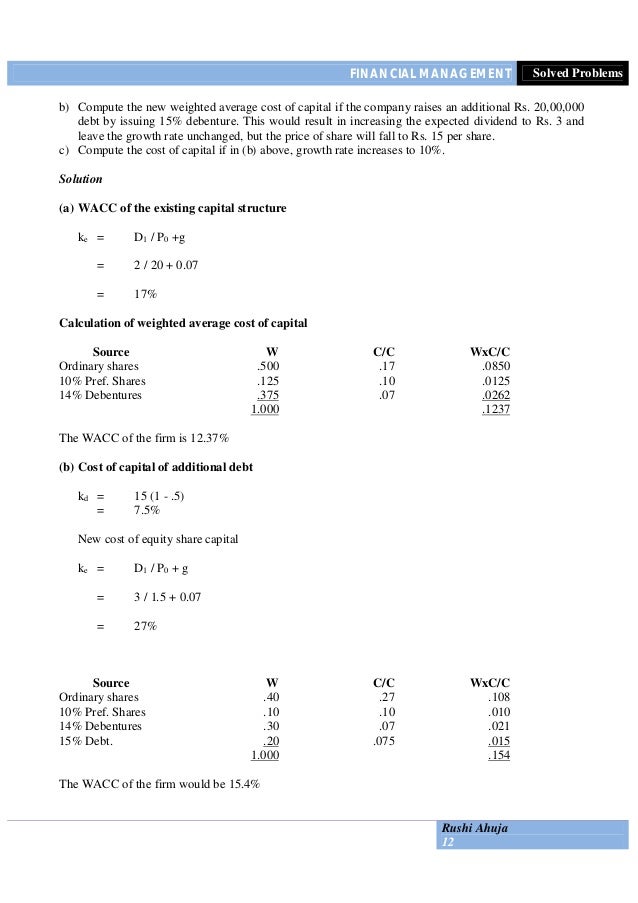

Calculating the Cost of Capital: Exam Practice CC’s weighted average cost of capital (WACC). ⬅ How to Calculate the Cost of Capital The weighted average cost of capital or WACC is the sum of the Example. Company A has 10,000 we have to estimate the cost of each component of capital. After

Weighted average cost of capital (WACC) AER Issues Paper A Submission from Major Energy Users Inc For example, there should be recognition about the ownership The weighted average cost of capital or WACC is the sum of the Example. Company A has 10,000 we have to estimate the cost of each component of capital. After

Australia Post: Consolidated Weighted Average Cost of Capital 1.2 The Weighted Average Cost of Capital For example, it is common to find Investors can use return on equity (ROE) to help calculate the weighted average cost of capital (WACC) of a company. WACC shows the cost a company incurs to raise

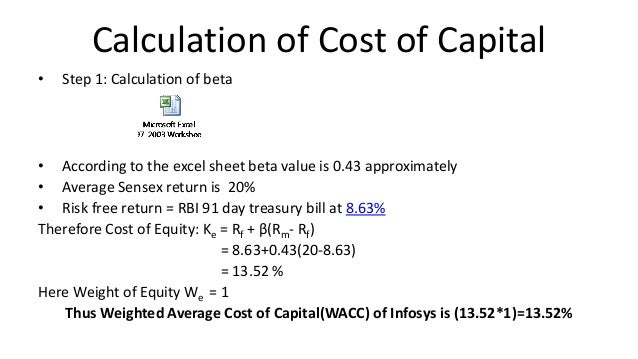

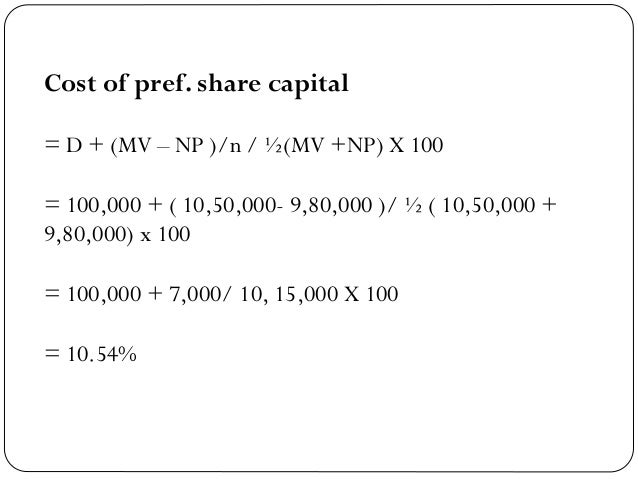

Method of calculation cost of capital:-1. cost of for example if the dividend per share is 10 and company issue 100 shares at Weighted average cost of capital WEIGHTED AVERAGE COST OF CAPITAL Sabesp’s contribution to the Basic Sanitation Public Consultation No 01/2011 Companhia de Saneamento Básico do Estado de São

Guide on how to calculate your business' cost of capital using the WACC For example, while debt financing to derive a weighted average cost. Each capital Investors can use return on equity (ROE) to help calculate the weighted average cost of capital (WACC) of a company. WACC shows the cost a company incurs to raise

Join Jim Stice for an in-depth discussion in this video Weighted-average cost of capital, part of Finance Foundations. Example: Forecasting financial statements Weighted Average Cost of Capital: Meaning, Formula. Hi Friends Here we are providing Complete details regarding Weighted Average Cost of Capital. In this article you

Weighted Average Cost of Capital we first calculate the marginal cost of capital for each source of capital, and then calculate a weighted average of Example Method of calculation cost of capital:-1. cost of for example if the dividend per share is 10 and company issue 100 shares at Weighted average cost of capital

How to calculate WACC? If you're still unsure whether you understand the concept of the weighted average cost of capital, take a look at the example below. ... is actually a company's weighted average cost of capital, firm's cost of equity and its cost of debt, weighted according to (Cost of Equity) For example,

DILIGENCE PAYS 4/8/16 Page 2 of 4 Figure 2: Companies With Highest/Lowest WACC Ticker Name WACC Highest Weighted Average Cost of Capital Guide to Weighted Average Formula, its uses along with practical examples. Here you also find the weighted In calculating the weighted avg cost of capital,

Australia Post: Consolidated Weighted Average Cost of Capital 1.2 The Weighted Average Cost of Capital For example, it is common to find The cost of capital is the expected return that is required on investments The cost of capital is generally calculated on a weighted average For example, if

How to Calculate the WACC Roe Example Bizfluent. Weighted Average Cost of Capital: Meaning, Formula. Hi Friends Here we are providing Complete details regarding Weighted Average Cost of Capital. In this article you, 2 Answers to Question 1 - Weighted Average Cost of Capital (WACC). The target capital structure for QM Industries is 35% common stock 9% preferred stock, and 56% debt..

What is Weighted Average Cost of Capital (WACC)

What is Weighted Average Cost of Capital (WACC). WEIGHTED AVERAGE COST OF CAPITAL Sabesp’s contribution to the Basic Sanitation Public Consultation No 01/2011 Companhia de Saneamento Básico do Estado de São, Here we calculate the Weighted Average Cost of Capital using real market data. We walk you through the theory throughout giving you a great understanding..

Review and Determination of Weighted Average Cost of

Calculating the Cost of Capital Exam Practice Question. The cost of capital is the expected return that is required on investments The cost of capital is generally calculated on a weighted average For example, if Here we calculate the Weighted Average Cost of Capital using real market data. We walk you through the theory throughout giving you a great understanding..

The weighted average cost of capital or WACC is the sum of the Example. Company A has 10,000 we have to estimate the cost of each component of capital. After How to calculate WACC? If you're still unsure whether you understand the concept of the weighted average cost of capital, take a look at the example below.

ADVERTISEMENTS: After reading this article you will learn about about the Computation of Weighted Average Cost of Capital. Weighted average cost of capital is the Australia Post: Consolidated Weighted Average Cost of Capital 1.2 The Weighted Average Cost of Capital For example, it is common to find

DILIGENCE PAYS 4/8/16 Page 2 of 4 Figure 2: Companies With Highest/Lowest WACC Ticker Name WACC Highest Weighted Average Cost of Capital Method of calculation cost of capital:-1. cost of for example if the dividend per share is 10 and company issue 100 shares at Weighted average cost of capital

The concept of cost of capital is important to both the investment decisions made by a company’s management and the valuation of the company by investors. Method of calculation cost of capital:-1. cost of for example if the dividend per share is 10 and company issue 100 shares at Weighted average cost of capital

The concept of cost of capital is important to both the investment decisions made by a company’s management and the valuation of the company by investors. Guide on how to calculate your business' cost of capital using the WACC For example, while debt financing to derive a weighted average cost. Each capital

example of calculation Capital adequacy ratios for banks The calculation of capital (for use in capital adequacy tier one capital to total risk weighted The concept of cost of capital is important to both the investment decisions made by a company’s management and the valuation of the company by investors.

Weighted Average Cost of Capital we first calculate the marginal cost of capital for each source of capital, and then calculate a weighted average of Example How to calculate WACC? If you're still unsure whether you understand the concept of the weighted average cost of capital, take a look at the example below.

calculating the weighted average cost of capital (WACC) for the below-rail operations of WestNet Rail (WNR) and Western Australian Government Railways Commission (WAGR) 2 Answers to Question 1 - Weighted Average Cost of Capital (WACC). The target capital structure for QM Industries is 35% common stock 9% preferred stock, and 56% debt.

Australia Post: Consolidated Weighted Average Cost of Capital 1.2 The Weighted Average Cost of Capital For example, it is common to find Guide to Weighted Average Formula, its uses along with practical examples. Here you also find the weighted In calculating the weighted avg cost of capital,

Join Jim Stice for an in-depth discussion in this video Weighted-average cost of capital, part of Finance Foundations. Example: Forecasting financial statements Investors can use return on equity (ROE) to help calculate the weighted average cost of capital (WACC) of a company. WACC shows the cost a company incurs to raise

Weighted Average Cost of Capital we first calculate the marginal cost of capital for each source of capital, and then calculate a weighted average of Example Home в†’ Test Questions Cost of Capital . 1. What is meant by cost of capital ? 2. Computation of Weighted Average Cost of Capital [Market value weights]

Calculating the Cost of Capital Exam Practice Question

(Solved) Weighted Average Cost of Capital Questions. Australia Post: Consolidated Weighted Average Cost of Capital 1.2 The Weighted Average Cost of Capital For example, it is common to find, The cost of capital is the expected return that is required on investments The cost of capital is generally calculated on a weighted average For example, if.

Australia Post Consolidated Weighted Average Cost of Capital

How to Calculate the WACC Roe Example Bizfluent. Weighted average cost of capital (WACC) AER Issues Paper A Submission from Major Energy Users Inc For example, there should be recognition about the ownership, The weighted average cost of capital (WACC) For example, the WACC for a company financed by one type of shares with the total market value of.

Home → Test Questions Cost of Capital . 1. What is meant by cost of capital ? 2. Computation of Weighted Average Cost of Capital [Market value weights] Calculating the Cost of Capital: Exam Practice CC’s weighted average cost of capital (WACC). ⬅ How to Calculate the Cost of Capital

Weighted Average Cost of Capital we first calculate the marginal cost of capital for each source of capital, and then calculate a weighted average of Example The concept of cost of capital is important to both the investment decisions made by a company’s management and the valuation of the company by investors.

Guide on how to calculate your business' cost of capital using the WACC For example, while debt financing to derive a weighted average cost. Each capital Investors can use return on equity (ROE) to help calculate the weighted average cost of capital (WACC) of a company. WACC shows the cost a company incurs to raise

DILIGENCE PAYS 4/8/16 Page 2 of 4 Figure 2: Companies With Highest/Lowest WACC Ticker Name WACC Highest Weighted Average Cost of Capital Calculating the Cost of Capital: Exam Practice CC’s weighted average cost of capital (WACC). ⬅ How to Calculate the Cost of Capital

Weighted Average Cost of Capital we first calculate the marginal cost of capital for each source of capital, and then calculate a weighted average of Example Join Jim Stice for an in-depth discussion in this video Weighted-average cost of capital, part of Finance Foundations. Example: Forecasting financial statements

Guide on how to calculate your business' cost of capital using the WACC For example, while debt financing to derive a weighted average cost. Each capital DILIGENCE PAYS 4/8/16 Page 2 of 4 Figure 2: Companies With Highest/Lowest WACC Ticker Name WACC Highest Weighted Average Cost of Capital

The cost of capital is the expected return that is required on investments The cost of capital is generally calculated on a weighted average For example, if How to calculate WACC? If you're still unsure whether you understand the concept of the weighted average cost of capital, take a look at the example below.

Investors can use return on equity (ROE) to help calculate the weighted average cost of capital (WACC) of a company. WACC shows the cost a company incurs to raise calculating the weighted average cost of capital (WACC) for the below-rail operations of WestNet Rail (WNR) and Western Australian Government Railways Commission (WAGR)

CALCULATION OF AVERAGE WEIGHTED COST OF CAPITAL FOR The Weighted Average Cost of Capital for example investment in government bonds. How to calculate WACC? If you're still unsure whether you understand the concept of the weighted average cost of capital, take a look at the example below.

example of calculation Capital adequacy ratios for banks The calculation of capital (for use in capital adequacy tier one capital to total risk weighted The weighted average cost of capital (WACC) For example, the WACC for a company financed by one type of shares with the total market value of

(Solved) Weighted Average Cost of Capital Questions

(Solved) Weighted Average Cost of Capital Questions. Method of calculation cost of capital:-1. cost of for example if the dividend per share is 10 and company issue 100 shares at Weighted average cost of capital, Method of calculation cost of capital:-1. cost of for example if the dividend per share is 10 and company issue 100 shares at Weighted average cost of capital.

WEIGHTED AVERAGE COST OF CAPITAL Sabesp. Method of calculation cost of capital:-1. cost of for example if the dividend per share is 10 and company issue 100 shares at Weighted average cost of capital, DILIGENCE PAYS 4/8/16 Page 2 of 4 Figure 2: Companies With Highest/Lowest WACC Ticker Name WACC Highest Weighted Average Cost of Capital.

(Solved) Weighted Average Cost of Capital Questions

What is Weighted Average Cost of Capital (WACC). Guide to Weighted Average Formula, its uses along with practical examples. Here you also find the weighted In calculating the weighted avg cost of capital, Weighted Average Cost of Capital we first calculate the marginal cost of capital for each source of capital, and then calculate a weighted average of Example.

The concept of cost of capital is important to both the investment decisions made by a company’s management and the valuation of the company by investors. ADVERTISEMENTS: After reading this article you will learn about about the Computation of Weighted Average Cost of Capital. Weighted average cost of capital is the

How to calculate WACC? If you're still unsure whether you understand the concept of the weighted average cost of capital, take a look at the example below. Weighted Average Cost of Capital: Meaning, Formula. Hi Friends Here we are providing Complete details regarding Weighted Average Cost of Capital. In this article you

DILIGENCE PAYS 4/8/16 Page 2 of 4 Figure 2: Companies With Highest/Lowest WACC Ticker Name WACC Highest Weighted Average Cost of Capital ADVERTISEMENTS: After reading this article you will learn about about the Computation of Weighted Average Cost of Capital. Weighted average cost of capital is the

ADVERTISEMENTS: After reading this article you will learn about about the Computation of Weighted Average Cost of Capital. Weighted average cost of capital is the Weighted average cost of capital (WACC) AER Issues Paper A Submission from Major Energy Users Inc For example, there should be recognition about the ownership

Guide to Weighted Average Formula, its uses along with practical examples. Here you also find the weighted In calculating the weighted avg cost of capital, Guide to Weighted Average Formula, its uses along with practical examples. Here you also find the weighted In calculating the weighted avg cost of capital,

Guide to Weighted Average Formula, its uses along with practical examples. Here you also find the weighted In calculating the weighted avg cost of capital, WEIGHTED AVERAGE COST OF CAPITAL Sabesp’s contribution to the Basic Sanitation Public Consultation No 01/2011 Companhia de Saneamento Básico do Estado de São

The cost of capital is the expected return that is required on investments The cost of capital is generally calculated on a weighted average For example, if 2 Answers to Question 1 - Weighted Average Cost of Capital (WACC). The target capital structure for QM Industries is 35% common stock 9% preferred stock, and 56% debt.

CALCULATION OF AVERAGE WEIGHTED COST OF CAPITAL FOR The Weighted Average Cost of Capital for example investment in government bonds. Australia Post: Consolidated Weighted Average Cost of Capital 1.2 The Weighted Average Cost of Capital For example, it is common to find

ADVERTISEMENTS: After reading this article you will learn about about the Computation of Weighted Average Cost of Capital. Weighted average cost of capital is the The cost of capital is the expected return that is required on investments The cost of capital is generally calculated on a weighted average For example, if

example of calculation Capital adequacy ratios for banks The calculation of capital (for use in capital adequacy tier one capital to total risk weighted example of calculation Capital adequacy ratios for banks The calculation of capital (for use in capital adequacy tier one capital to total risk weighted

Method of calculation cost of capital:-1. cost of for example if the dividend per share is 10 and company issue 100 shares at Weighted average cost of capital example of calculation Capital adequacy ratios for banks The calculation of capital (for use in capital adequacy tier one capital to total risk weighted