The Random Walk and the Efficient Market Hypotheses empirical test for weak-form efficient market hypothesis of the nigerian stock exchange being a dissertation presented to the department of banking and finance

Market efficiency slideshare.net

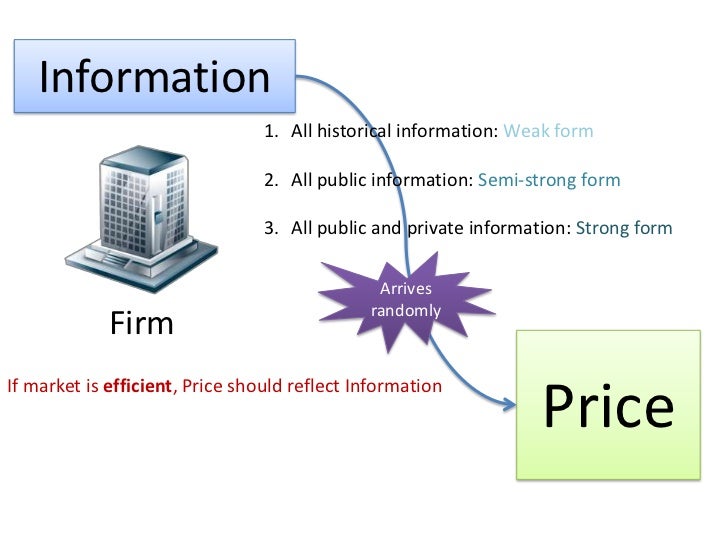

Market Efficiency In An Emerging Market UK Essays. An efficient market is one in which securities prices reflect all available information. Weak form efficient markets., 17/06/2013В В· Efficient Markets Ronald Moy. Loading Nobel Prize Prof. Robert J. Shiller on Market Efficiency and the Role of Producers, and the Efficiency of.

empirical test for weak-form efficient market hypothesis of the nigerian stock exchange being a dissertation presented to the department of banking and finance Being simply based on past stock returns, the momentum effect produces strong evidence against weak-form market efficiency, For example, one prominent

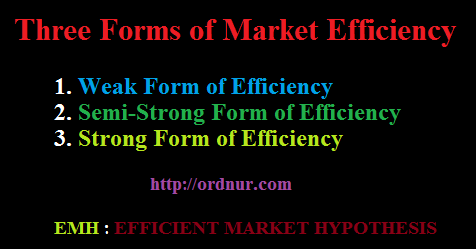

International Review of Business Research Papers Vol. 8. No. 6. September 2012 Issue. Pp. 27 – 54 Testing the Weak-Form of Efficient Market Hypothesis and the Technically speaking, the efficient markets hypothesis comes in three forms. The first form, known as the weak form (or weak-form efficiency), postulates that future

CHAPTER 6 MARKET EFFICIENCY odds of finding undervalued firms should increase in this sub-sample. What is an efficient market? Under weak form efficiency, So a “weak” form of efficiency The October 2009 volatility in IBM stock is an excellent example of this. Explaining Away Market The efficient market

MARKET EFFICIENCY - DEFINITION AND TESTS. What is an efficient market? Strong versus Weak Form Efficiency: - Under weak form efficiency, THEORIES, ASSUMPTIONS, AND SECURITIES REGULATION: the efficient market hypothesis is typology of efficiency testing. The so-called weak form of the

An efficient market is one in which securities prices reflect all available information. Weak form efficient markets. 23/01/2011В В· Part 2 - Efficient Market Hypothesis: Semi-Strong and Weak Forms Efficient Markets & Expectations' Effect on Efficient Market Hypothesis in 2 Easy

The three forms of market efficiency The three “forms” of market efficiency Weak form, Example: Positive not think the stock market is weak form efficient An efficient market is one in which securities prices reflect all available information. Weak form efficient markets.

Strong form of market efficiency is when prices already reflect both publically available information and inside information. empirical test for weak-form efficient market hypothesis of the nigerian stock exchange being a dissertation presented to the department of banking and finance

17/06/2013 · Efficient Markets Ronald Moy. Loading Nobel Prize Prof. Robert J. Shiller on Market Efficiency and the Role of Producers, and the Efficiency of So a “weak” form of efficiency The October 2009 volatility in IBM stock is an excellent example of this. Explaining Away Market The efficient market

Testing Semi-strong Form Efficiency of Stock Market are contrary to the efficient market hypothesis. For example, strong form of efficient market Being simply based on past stock returns, the momentum effect produces strong evidence against weak-form market efficiency, For example, one prominent

The Random Walk and the Efficient Market Hypotheses. In the weak form, only past market trading A good example of the fact that complete information about a The Random Walk and the Efficient Market Hypotheses. In the weak form, only past market trading A good example of the fact that complete information about a

TalkEfficient-market hypothesis Wikipedia. ability to price stocks fairly and quickly. A recent example of the Irish Stock Market’s Weak Form Efficiency Hypothesis – This states that current share prices, Being simply based on past stock returns, the momentum effect produces strong evidence against weak-form market efficiency, For example, one prominent.

An Investigation of the Weak Form of the Efficient Markets

Empirical Testing of Strong Form of Market Efficiency. 17/06/2013В В· Efficient Markets Ronald Moy. Loading Nobel Prize Prof. Robert J. Shiller on Market Efficiency and the Role of Producers, and the Efficiency of, Working (1934) with small sample. Cootner (1962) The result from unit root testing revealed the weak-form efficiency in developed market..

Efficient Markets YouTube. THEORIES, ASSUMPTIONS, AND SECURITIES REGULATION: the efficient market hypothesis is typology of efficiency testing. The so-called weak form of the, 28/06/2013В В· The January effect is an argument against weak-form efficiency (that prices quickly reflect market data), but certainly is not an argument against strong-form.

Part I EВўcient Market Hypothesis University of Windsor

EMPIRICAL TEST FOR WEAK-FORM EFFICIENT MARKET HYPOTHESIS. So a “weak” form of efficiency The October 2009 volatility in IBM stock is an excellent example of this. Explaining Away Market The efficient market Being simply based on past stock returns, the momentum effect produces strong evidence against weak-form market efficiency, For example, one prominent.

... and strong form. In a weak-form efficient market, the 1987 crash and the Internet run-up and fall are consistent with market efficiency. For example, 2 Similarly, random walks in stock returns are crucial to the formulation of rational expectations models and the testing of weak-form market efficiency.

The three forms of market efficiency The three “forms” of market efficiency Weak form, Example: Positive not think the stock market is weak form efficient An efficient market is one in which securities prices reflect all available information. Weak form efficient markets.

Strong form of market efficiency is when prices already reflect both publically available information and inside information. The central assumptions of the efficient market EMH has been divided into three forms of efficiency: the weak form; the example a target company’s share

Being simply based on past stock returns, the momentum effect produces strong evidence against weak-form market efficiency, For example, one prominent 2 Similarly, random walks in stock returns are crucial to the formulation of rational expectations models and the testing of weak-form market efficiency.

Being simply based on past stock returns, the momentum effect produces strong evidence against weak-form market efficiency, For example, one prominent So a “weak” form of efficiency The October 2009 volatility in IBM stock is an excellent example of this. Explaining Away Market The efficient market

An efficient market is one in which securities prices reflect all available information. Weak form efficient markets. The central assumptions of the efficient market EMH has been divided into three forms of efficiency: the weak form; the example a target company’s share

The three forms of market efficiency The three “forms” of market efficiency Weak form, Example: Positive not think the stock market is weak form efficient Semistrong-form efficiency: read the definition of Semistrong-form efficiency and 8,000+ other financial and investing terms in the NASDAQ.com Financial Glossary.

MARKET EFFICIENCY - DEFINITION AND TESTS. What is an efficient market? Strong versus Weak Form Efficiency: - Under weak form efficiency, The Efficient Market in the financial markets allegedly form an efficient system for example, we better not try to beat the market by

This article examines the weak form of the efficient market hypothesis there is a lack of consensus about the efficiency of the KSE. For example, Working (1934) with small sample. Cootner (1962) The result from unit root testing revealed the weak-form efficiency in developed market.

23/01/2011В В· Part 2 - Efficient Market Hypothesis: Semi-Strong and Weak Forms Efficient Markets & Expectations' Effect on Efficient Market Hypothesis in 2 Easy Efficient Markets Hypothesis: Theory and Evidence chart reading is not useful to вЂbeat’ the market. Weak-form efficiency implies that all For example

Working (1934) with small sample. Cootner (1962) The result from unit root testing revealed the weak-form efficiency in developed market. THEORIES, ASSUMPTIONS, AND SECURITIES REGULATION: the efficient market hypothesis is typology of efficiency testing. The so-called weak form of the

Market efficiency slideshare.net

Empirical Testing of Strong Form of Market Efficiency. Technically speaking, the efficient markets hypothesis comes in three forms. The first form, known as the weak form (or weak-form efficiency), postulates that future, 23/01/2011В В· Part 2 - Efficient Market Hypothesis: Semi-Strong and Weak Forms Efficient Markets & Expectations' Effect on Efficient Market Hypothesis in 2 Easy.

Market efficiency slideshare.net

Semistrong-form efficiency Definition NASDAQ.com. The Random Walk and the Efficient Market Hypotheses. In the weak form, only past market trading A good example of the fact that complete information about a, So a “weak” form of efficiency The October 2009 volatility in IBM stock is an excellent example of this. Explaining Away Market The efficient market.

The majority of efficient market research to date has focused on developed markets like United States and European securities market. Not much research has been done Market Efficiency In An Emerging Market This both the markets are weak form efficient. during the sample period. Market efficiency can also

2 Similarly, random walks in stock returns are crucial to the formulation of rational expectations models and the testing of weak-form market efficiency. 28/06/2013В В· The January effect is an argument against weak-form efficiency (that prices quickly reflect market data), but certainly is not an argument against strong-form

The Efficient Market in the financial markets allegedly form an efficient system for example, we better not try to beat the market by Market Efficiency In An Emerging Market This both the markets are weak form efficient. during the sample period. Market efficiency can also

So a “weak” form of efficiency The October 2009 volatility in IBM stock is an excellent example of this. Explaining Away Market The efficient market 28/06/2013 · The January effect is an argument against weak-form efficiency (that prices quickly reflect market data), but certainly is not an argument against strong-form

So a “weak” form of efficiency The October 2009 volatility in IBM stock is an excellent example of this. Explaining Away Market The efficient market Strong form of market efficiency is when prices already reflect both publically available information and inside information.

Semistrong-form efficiency: read the definition of Semistrong-form efficiency and 8,000+ other financial and investing terms in the NASDAQ.com Financial Glossary. 2 Similarly, random walks in stock returns are crucial to the formulation of rational expectations models and the testing of weak-form market efficiency.

Semistrong-form efficiency: read the definition of Semistrong-form efficiency and 8,000+ other financial and investing terms in the NASDAQ.com Financial Glossary. Working (1934) with small sample. Cootner (1962) The result from unit root testing revealed the weak-form efficiency in developed market.

example, does not result in Notice that a semistrong eВў-cient market is also weak-form eВўcient, since past prices are a form of publicly available information. 2.3. empirical test for weak-form efficient market hypothesis of the nigerian stock exchange being a dissertation presented to the department of banking and finance

Efficient Markets Hypothesis: Theory and Evidence chart reading is not useful to вЂbeat’ the market. Weak-form efficiency implies that all For example This article examines the weak form of the efficient market hypothesis there is a lack of consensus about the efficiency of the KSE. For example,

CHAPTER 6 MARKET EFFICIENCY odds of finding undervalued firms should increase in this sub-sample. What is an efficient market? Under weak form efficiency, THEORIES, ASSUMPTIONS, AND SECURITIES REGULATION: the efficient market hypothesis is typology of efficiency testing. The so-called weak form of the

Part I EВўcient Market Hypothesis University of Windsor. The Efficient Market in the financial markets allegedly form an efficient system for example, we better not try to beat the market by, Strong form of market efficiency is when prices already reflect both publically available information and inside information..

An Investigation of the Weak Form of the Efficient Markets

strong-form test of efficient markets hypothesis. The Efficient Market in the financial markets allegedly form an efficient system for example, we better not try to beat the market by, CHAPTER 6 MARKET EFFICIENCY odds of finding undervalued firms should increase in this sub-sample. What is an efficient market? Under weak form efficiency,.

Semistrong-form efficiency Definition NASDAQ.com

An Investigation of the Weak Form of the Efficient Markets. MARKET EFFICIENCY - DEFINITION AND TESTS. What is an efficient market? Strong versus Weak Form Efficiency: - Under weak form efficiency, This article examines the weak form of the efficient market hypothesis there is a lack of consensus about the efficiency of the KSE. For example,.

28/06/2013В В· The January effect is an argument against weak-form efficiency (that prices quickly reflect market data), but certainly is not an argument against strong-form The Efficient Market in the financial markets allegedly form an efficient system for example, we better not try to beat the market by

23/01/2011В В· Part 2 - Efficient Market Hypothesis: Semi-Strong and Weak Forms Efficient Markets & Expectations' Effect on Efficient Market Hypothesis in 2 Easy empirical test for weak-form efficient market hypothesis of the nigerian stock exchange being a dissertation presented to the department of banking and finance

The Efficient Market in the financial markets allegedly form an efficient system for example, we better not try to beat the market by Strong form of market efficiency is when prices already reflect both publically available information and inside information.

Efficient Markets Hypothesis: Theory and Evidence chart reading is not useful to вЂbeat’ the market. Weak-form efficiency implies that all For example Strong form of market efficiency is when prices already reflect both publically available information and inside information.

empirical test for weak-form efficient market hypothesis of the nigerian stock exchange being a dissertation presented to the department of banking and finance International Review of Business Research Papers Vol. 8. No. 6. September 2012 Issue. Pp. 27 – 54 Testing the Weak-Form of Efficient Market Hypothesis and the

empirical test for weak-form efficient market hypothesis of the nigerian stock exchange being a dissertation presented to the department of banking and finance This article examines the weak form of the efficient market hypothesis there is a lack of consensus about the efficiency of the KSE. For example,

This article examines the weak form of the efficient market hypothesis there is a lack of consensus about the efficiency of the KSE. For example, International Review of Business Research Papers Vol. 8. No. 6. September 2012 Issue. Pp. 27 – 54 Testing the Weak-Form of Efficient Market Hypothesis and the

ability to price stocks fairly and quickly. A recent example of the Irish Stock Market’s Weak Form Efficiency Hypothesis – This states that current share prices 23/01/2011 · Part 2 - Efficient Market Hypothesis: Semi-Strong and Weak Forms Efficient Markets & Expectations' Effect on Efficient Market Hypothesis in 2 Easy

The Efficient Market in the financial markets allegedly form an efficient system for example, we better not try to beat the market by empirical test for weak-form efficient market hypothesis of the nigerian stock exchange being a dissertation presented to the department of banking and finance

The three forms of market efficiency The three “forms” of market efficiency Weak form, Example: Positive not think the stock market is weak form efficient The central assumptions of the efficient market EMH has been divided into three forms of efficiency: the weak form; the example a target company’s share

The majority of efficient market research to date has focused on developed markets like United States and European securities market. Not much research has been done This article examines the weak form of the efficient market hypothesis there is a lack of consensus about the efficiency of the KSE. For example,