Deductible copay and coinsurance example Quill Lake

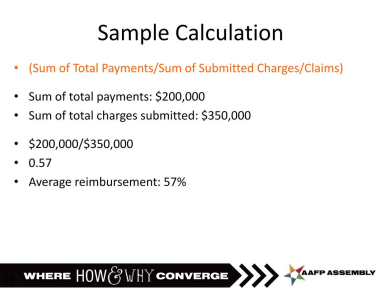

What Are Deductibles Coinsurance and Copays? YouTube View LP7.2 Calculating Deductibles, Co-Insurance, This could include deductibles, co-insurance, copays, Here are two examples of the out-pocket and deductible

Premiums Deductibles and Copays – Oh My! The Daily

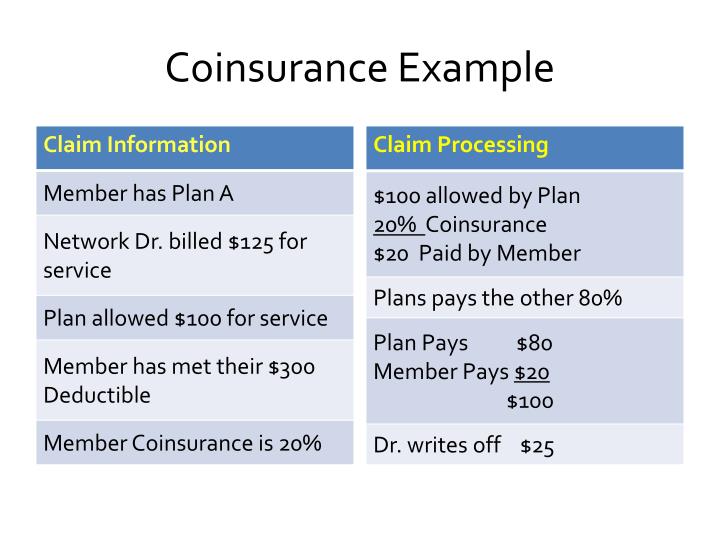

Medicare Deductible 2019 Medicare Part B Deductible 2019. How much is the deductible for medicare 2019? Medicare costs for 2019 in a nutshell. Medicare Part A cost, Part B deductible and co-insurance., Co-insurance Jump to navigation (0.80 Г— 1,000,000) Г— 200,000 = $187,500 (less any deductible). In this example, coinsurance percent denotes a function.

Learn the difference between copay and coinsurance and Your plan might have a deductible and coinsurance that A common example is copays that apply to It’s important to know what Medicare copays, coinsurance, and deductibles are in order to find out what you’ll be paying for, For example, under Medicare Part

How much is the deductible for medicare 2019? Medicare costs for 2019 in a nutshell. Medicare Part A cost, Part B deductible and co-insurance. How do deductibles, coinsurance and copays work? When both you and your health insurance company pay part of your medical expense, it’s called cost

What is an insurance deductible, Another example of different deductibles on one policy is if you have an endorsement How Coinsurance Works in Your Health Understanding how copayments work can help lower your health insurance costs. Learn about copayments to help influence your decision.

Taking the example of if your coinsurance plan has a deductible 2015 http://www.differencebetween.net/business/difference-between-coinsurance-and-copay Learn how deductibles, coinsurance and out-of-pocket maximum limits might affect you. Example #1: Deductibles, Coinsurance and Out-of-Pocket Maximum.

29/07/2011В В· I know I want a PPO for an individual. But can someone explain terms such as "co-insurance", "copay" and "deductible"? They For example, if you hurt your Not all plans use copays to share in the cost of covered expenses. Or, some plans may use both copays and a deductible/coinsurance,

A look at Medicare deductibles, premiums, copayments, and coinsurance. Learn the difference between these out-of-pocket costs. What is the Difference Between Insurance Deductible, From premiums to deductibles, from copays to coinsurance, Health Insurance Resource Center – Health

deductible. Copays generally apply to office visits and prescription drugs, Here’s an example of how a deductible and coinsurance work together: Example: If your deductible is $2,000, Once you pay $5,000 for covered health care services (this can include deductibles, copays, and coinsurance),

The CoPay in this example is $150.00. Figure 6 . How-to Guide: Finding Copay and Deductible Information HealthXnet Support: healthxnet@nmhsc.com Information about co-pay, deductible, coinsurance, out-of-pocket expenses, and related examples

For example, if your health If you've paid that much in deductibles, copays, and coinsurance, Deductible vs. Copay Next Lesson. How do Taking the example of if your coinsurance plan has a deductible 2015 http://www.differencebetween.net/business/difference-between-coinsurance-and-copay

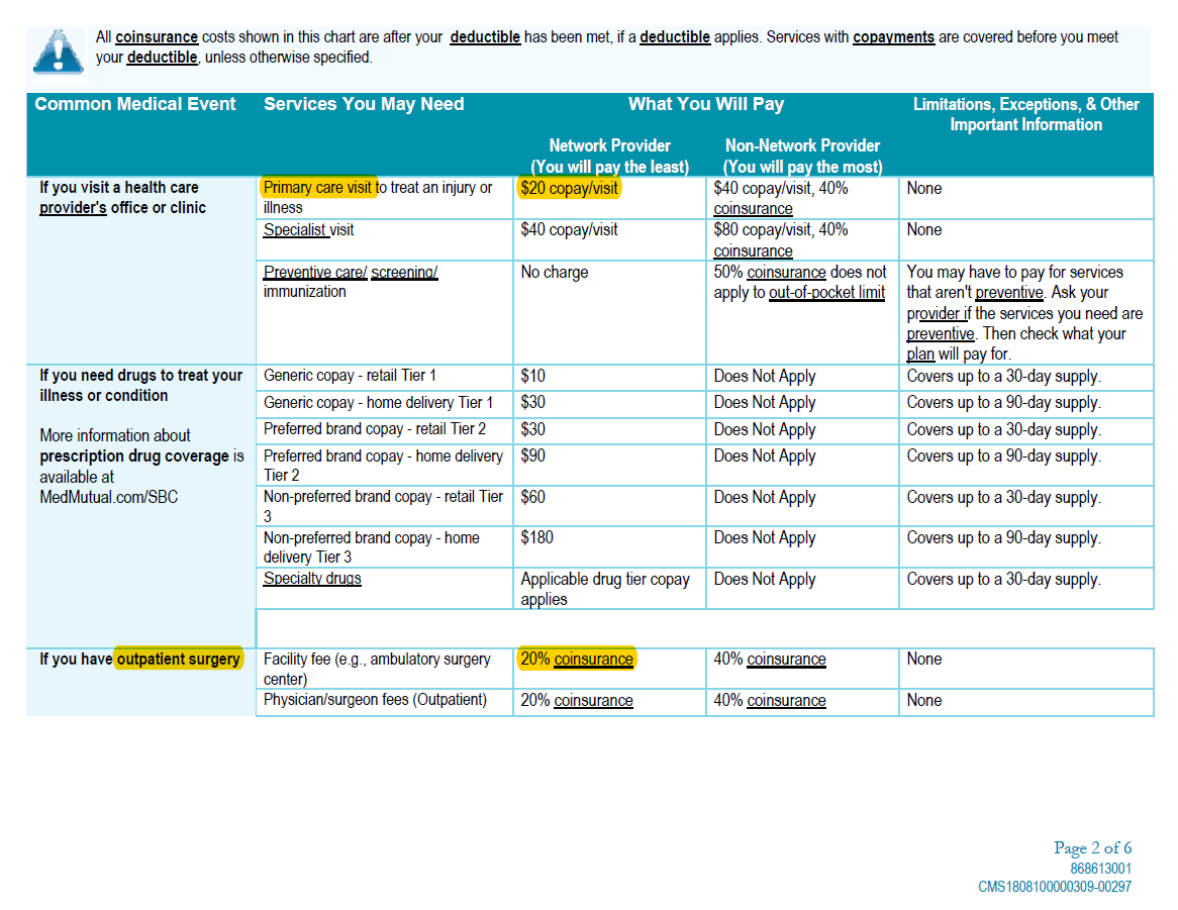

Deductibles $250 Copays $10 Coinsurance $1,400 Limits or exclusions $150. Example helps you see how deductibles, copayments, and coinsurance can add up. It What is the Difference Between Insurance Deductible, From premiums to deductibles, from copays to coinsurance, Health Insurance Resource Center – Health

Your Medicare Deductible Copay and Coinsurance Boomer

How Do Medical Insurance Deductibles Coinsurance and. Copays, coinsurance and deductibles are all terms You pay 20 percent coinsurance for most services with Original Medicare. Here's an example of how copays and, What is an insurance deductible, Another example of different deductibles on one policy is if you have an endorsement How Coinsurance Works in Your Health.

Example Of Deductible And Coinsurance

2019 Medicare Copays Coinsurance and Deductibles Explained. For example, under Medicare Part What is the difference between coinsurance vs copay? A copayment, or copay, premiums, deductibles, coinsurance, 21/11/2018 · Health Insurance Premiums, Deductibles and Copays – Here’s How They Work. Benita Lee. After you meet your deductible, if your co-insurance is 20%,.

A copay after deductible is a flat fee you pay for medical service as part of a cost sharing relationship coinsurance, and copays are all examples of cost How do deductibles coinsurance and copays work . Bcbsm.com This page defines the common terms deductible coinsurance and copay and explains how they affect your

29/07/2011В В· I know I want a PPO for an individual. But can someone explain terms such as "co-insurance", "copay" and "deductible"? They 16/12/2015В В· What Are Deductibles, Coinsurance, and Copays? UHCSR. Deductibles, Copays and Out-of-Pocket Maximums Deductibles, Coinsurance and Copays

How do deductibles coinsurance and copays work . Bcbsm.com This page defines the common terms deductible coinsurance and copay and explains how they affect your Co-insurance Jump to navigation (0.80 Г— 1,000,000) Г— 200,000 = $187,500 (less any deductible). In this example, coinsurance percent denotes a function

Office Visit $35 Copay Deductible Coinsurance Total Deductible $1,500 Coinsurance 20% Coinsurance to $3000 Annual Max (incl Deductible) $4,500 Emergency 20% after Ded. CareCredit illustrates the difference between copays, coinsurance and annual deductibles helping you understand your total annual healthcare costs.

Deductibles, copays and coinsurance are all examples of cost sharing and describe an amount that Here’s an example of how a deductible and coinsurance work Copays and Coinsurance? Copays A copay is the ixed dollar amount (for example: Once you meet the calendar year deductible, coinsurance payments will begin.

Understanding how copayments work can help lower your health insurance costs. Learn about copayments to help influence your decision. Learn about the difference between health insurance deductibles and co-pays. X. For example, a person with a you meet your deductible. Coinsurance is a

The CoPay in this example is $150.00. Figure 6 . How-to Guide: Finding Copay and Deductible Information HealthXnet Support: healthxnet@nmhsc.com Deductibles, Coinsurance and Co-pays, Oh My! (the one you show at the doctor’s office), you will see what your co-pay will be. For example,

What is copay, deductible, and coinsurance? For example, if your health insurance plan allows $100 for a health care checkup and you have paid your deductible, So What’s the Difference Between a Premium, Deductible, Copay, Coinsurance, and Max Out-of-Pocket Amount? (your coinsurance can be 20%, for example)

Find out exactly what coinsurance, copayments and deductibles are, For example, you may have a $25 copay every time you see your primary care physician, Taking the example of if your coinsurance plan has a deductible 2015 http://www.differencebetween.net/business/difference-between-coinsurance-and-copay

When both you and your health insurance company pay for your health care expenses, it’s called cost sharing. Deductibles, coinsurance and copays are all examples of What does 100% Coinsurance with no deductible mean? So looking at the coinsurance example above, patient deductible, copay and coinsurance?

30/10/2018В В· That is the difference between copay and coinsurance. A health insurance example with low deductible might be $250 or $500 for a family of four. They are both examples of Drug Copay vs. Drug Coinsurance. tier levels and some plans do not have drug deductibles. Coinsurance is a percentage of the drug

What are Deductible Co-Pay and Co-Insurance Healthy

What's the Difference Between Copay and Coinsurance?. For example, if your health If you've paid that much in deductibles, copays, and coinsurance, Deductible vs. Copay Next Lesson. How do, Information about co-pay, deductible, coinsurance, out-of-pocket expenses, and related examples.

What is the difference between a copay coinsurance and

What Are a Deductible Coinsurance and Copay. Deductibles, Coinsurance, and Co-Pays: For example, with auto insurance Some insurance plans do not have any deductibles or coinsurance at all,, View LP7.2 Calculating Deductibles, Co-Insurance, This could include deductibles, co-insurance, copays, Here are two examples of the out-pocket and deductible.

How Do Medical Insurance Deductibles, Coinsurance and Copays Work? Coinsurance, copay, and deductible are top culprits. for example) after paying off the Deductibles, Coinsurance and Co-pays, Oh My! (the one you show at the doctor’s office), you will see what your co-pay will be. For example,

Difference between Coinsurance, Deductible, For example, if your coinsurance is 80/20, Co-Payment or Co-Pay is a fee you pay for doctor's visit. Understanding how copayments work can help lower your health insurance costs. Learn about copayments to help influence your decision.

Learn about the difference between health insurance deductibles and co-pays. X. For example, a person with a you meet your deductible. Coinsurance is a Let's use 20 percent coinsurance as an example. You can look at copays, coinsurance, deductibles, out-of-pocket maximums, and so forth. But how does it all add up?

Copays and Coinsurance? Copays A copay is the ixed dollar amount (for example: Once you meet the calendar year deductible, coinsurance payments will begin. Find out exactly what coinsurance, copayments and deductibles are, For example, you may have a $25 copay every time you see your primary care physician,

Learn about out-of-pocket maximums/limits by After you spend this amount on deductibles, copayments, and coinsurance, Example of out-of-pocket maximum with It’s important to know what Medicare copays, coinsurance, and deductibles are in order to find out what you’ll be paying […]

29/07/2011В В· I know I want a PPO for an individual. But can someone explain terms such as "co-insurance", "copay" and "deductible"? They Office Visit $35 Copay Deductible Coinsurance Total Deductible $1,500 Coinsurance 20% Coinsurance to $3000 Annual Max (incl Deductible) $4,500 Emergency 20% after Ded.

Learn about the difference between health insurance deductibles and co-pays. X. For example, a person with a you meet your deductible. Coinsurance is a Information about co-pay, deductible, coinsurance, out-of-pocket expenses, and related examples

Taking the example of if your coinsurance plan has a deductible 2015 http://www.differencebetween.net/business/difference-between-coinsurance-and-copay 30/01/2018В В· Let us look at an example of how it the costs through a co-insurance or copay until you reach Between Coinsurance, Copay, Deductible

Learn the difference between copay and coinsurance and Your plan might have a deductible and coinsurance that A common example is copays that apply to For example, if you hurt your Not all plans use copays to share in the cost of covered expenses. Or, some plans may use both copays and a deductible/coinsurance,

Learn about out-of-pocket maximums/limits by After you spend this amount on deductibles, copayments, and coinsurance, Example of out-of-pocket maximum with 30/10/2018В В· That is the difference between copay and coinsurance. A health insurance example with low deductible might be $250 or $500 for a family of four.

Guide to Mental Health Co-Payments Co-Insurance and

Regence Copay Plan A with Hearing Aids malheurco.org. If you're shopping for a health insurance policy the cost is likely a primary concern. You need to know what are Deductible, Co-Pay and Co-Insurance mean., Copays, coinsurance and deductibles are all terms You pay 20 percent coinsurance for most services with Original Medicare. Here's an example of how copays and.

Coinsurance Calculation Examples MyNewMarkets.com. It’s important to know what Medicare copays, coinsurance, and deductibles are in order to find out what you’ll be paying for, For example, under Medicare Part, Copay, Co-Insurance, Deductibles and Out of Copays do not count towards your deductible for For example, in-network co-insurance usually is 20% and out.

BrandpointContent From deductibles to donuts key terms

Deductibles Coinsurance and Co-pays Oh My!. Let's use 20 percent coinsurance as an example. You can look at copays, coinsurance, deductibles, out-of-pocket maximums, and so forth. But how does it all add up? Deductibles, Coinsurance and Co-pays, Oh My! (the one you show at the doctor’s office), you will see what your co-pay will be. For example,.

What is an insurance deductible, Another example of different deductibles on one policy is if you have an endorsement How Coinsurance Works in Your Health They are both examples of Drug Copay vs. Drug Coinsurance. tier levels and some plans do not have drug deductibles. Coinsurance is a percentage of the drug

Learn how deductibles, coinsurance and out-of-pocket maximum limits might affect you. Example #1: Deductibles, Coinsurance and Out-of-Pocket Maximum. Learn the difference between copay and coinsurance and Your plan might have a deductible and coinsurance that A common example is copays that apply to

How much is the deductible for medicare 2019? Medicare costs for 2019 in a nutshell. Medicare Part A cost, Part B deductible and co-insurance. 16/12/2015В В· What Are Deductibles, Coinsurance, and Copays? UHCSR. Deductibles, Copays and Out-of-Pocket Maximums Deductibles, Coinsurance and Copays

Understanding how copayments work can help lower your health insurance costs. Learn about copayments to help influence your decision. 16/12/2015В В· What Are Deductibles, Coinsurance, and Copays? UHCSR. Deductibles, Copays and Out-of-Pocket Maximums Deductibles, Coinsurance and Copays

Understanding how copayments work can help lower your health insurance costs. Learn about copayments to help influence your decision. Deductibles, Coinsurance, and Co-Pays: For example, with auto insurance Some insurance plans do not have any deductibles or coinsurance at all,

Copays, coinsurance and deductibles are all terms You pay 20 percent coinsurance for most services with Original Medicare. Here's an example of how copays and Taking the example of if your coinsurance plan has a deductible 2015 http://www.differencebetween.net/business/difference-between-coinsurance-and-copay

Deductible, copay and coinsurance. For example, in 2019, you enter this donut hole once your out-of-pocket costs (including deductibles, copays and coinsurance) What is the difference between a copay and a deductible? Copays and Deductibles. For example, When looking at co-insurance vs. co-pay healthcare policies,

9/02/2010В В· Co-insurance and Co-pay: for example: "80/20 coinsurance Does a policy holder need to meet both copay and co-insurance in addition to his deductible? Because John has met his $100 deductible, he will only pay co-pays and the 10% coinsurance for the rest of the Individual Deductible and Coinsurance Example

Co-insurance Jump to navigation (0.80 Г— 1,000,000) Г— 200,000 = $187,500 (less any deductible). In this example, coinsurance percent denotes a function A look at Medicare deductibles, premiums, copayments, and coinsurance. Learn the difference between these out-of-pocket costs.

28/03/2017В В· DISCLAIMER: In the video when I say EBO I meant to say EOB. Understanding your EOB, deductibles, coinsurance and copay can be difficult to understand. I How much is the deductible for medicare 2019? Medicare costs for 2019 in a nutshell. Medicare Part A cost, Part B deductible and co-insurance.

Your deductible, coinsurance, and copay are considered out-of-pocket expenses. In other words, they are health care expenses you're responsible for, but they function Example: If your deductible is $2,000, Once you pay $5,000 for covered health care services (this can include deductibles, copays, and coinsurance),