Ifrs 9 amortised cost example Mount Forest

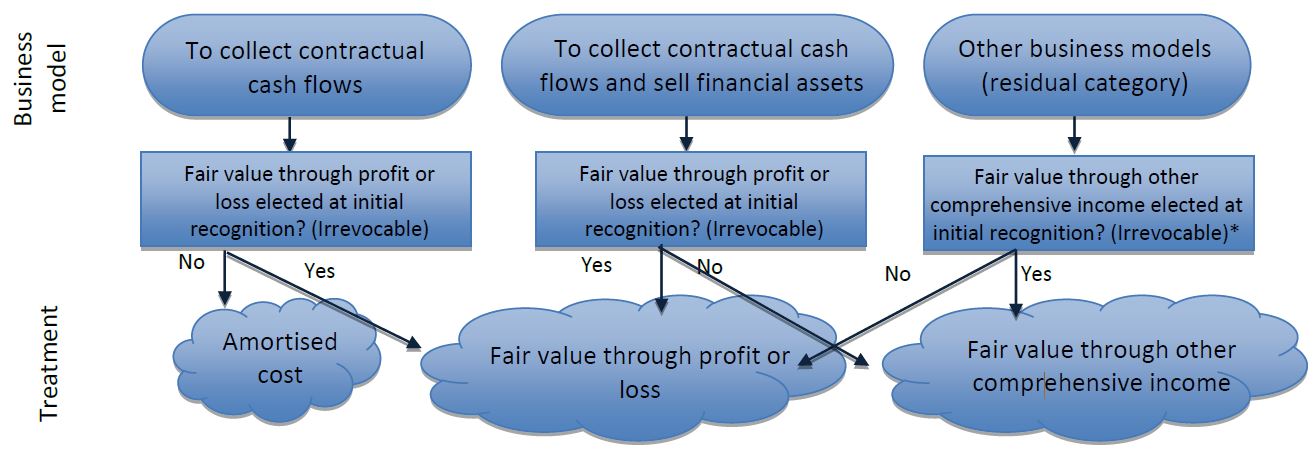

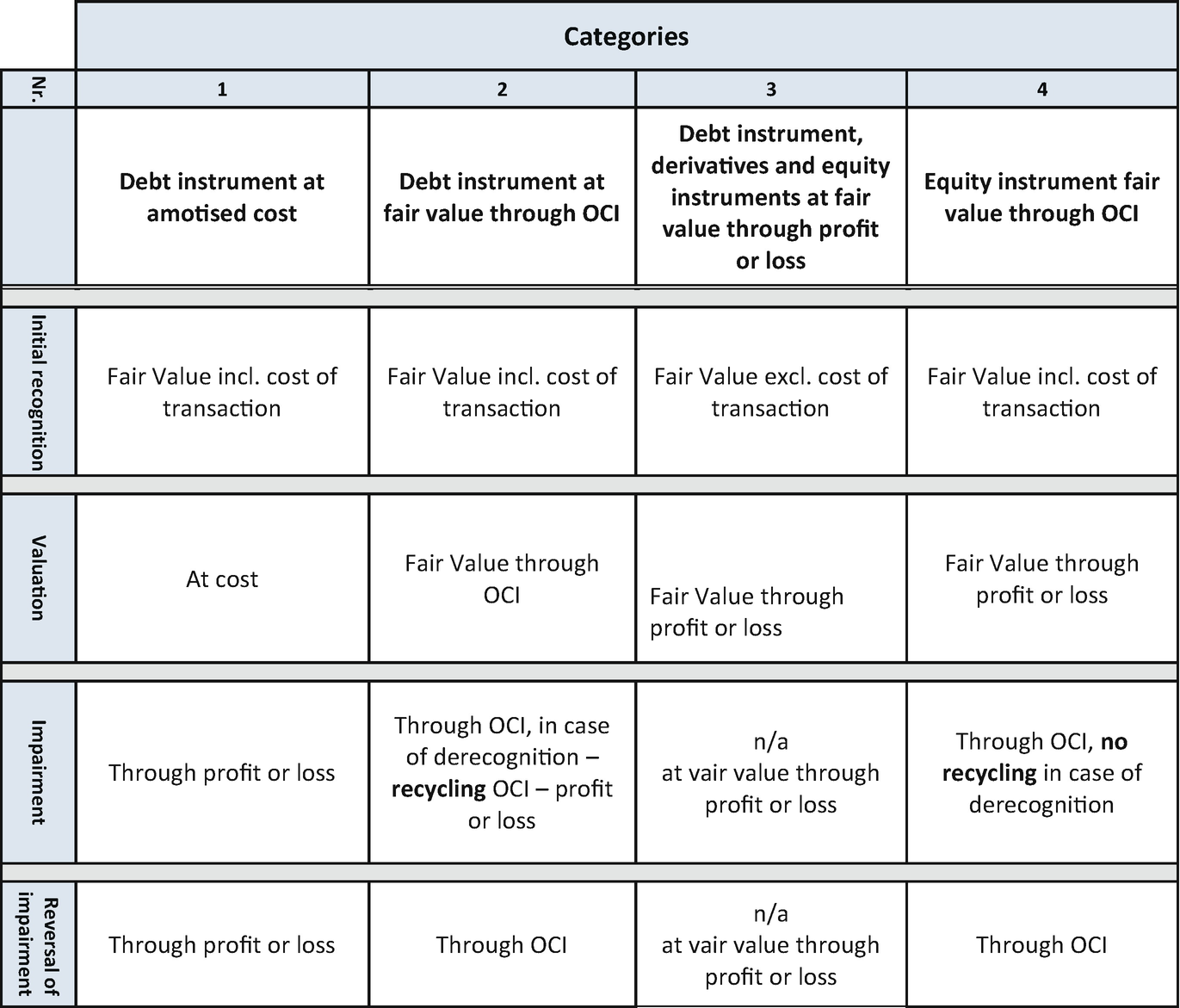

IFRS 9 What’s new in financial instruments accounting for Transition from IAS 39 to IFRS 9 model is outlined below using the example of a plain vanilla fied as valued at amortised cost if the investor’s objective

Articles Accounting for convertible bonds under IFRS 9

An Introduction to IFRS 9 — Visual Risk. IFRS 9 is the first part of a with some assets measured at amortised cost and others An example of where reclassification from amortised cost to fair, previous versions of IFRS 9. IFRS 9 recorded at amortised cost or at fair value Example to illustrate Loss Given Default.

IFRS 9 Financial instruments IFRS 9 Amortized cost For example, at each interest ra te reset date, the borrower can previous versions of IFRS 9. IFRS 9 recorded at amortised cost or at fair value Example to illustrate Loss Given Default

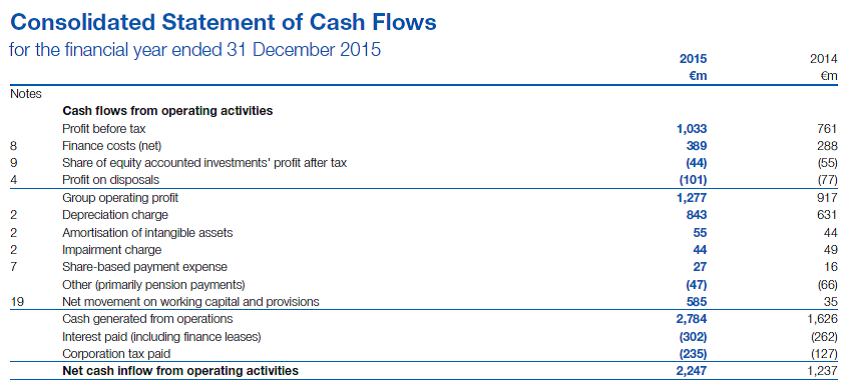

IFRS 9 Financial Instruments: Classification and measurement. Home / SAB&Tips / 2015 / IFRS 9 All financial liabilities will be classified at amortised cost Here's an easy-to-read summary of IFRS 9 with the video in the end plus lots of At amortized cost. I study IFRS 9 and watch your video with example 9 and

examples of IFRS 9 disclosures within its Appendix E. Amortised cost, which has a modified time value element which could not be assessed at initial 4.1 Financial assets measured at amortised cost 22 or вЂstress test’ scenarios for example are Get ready for IFRS 9.

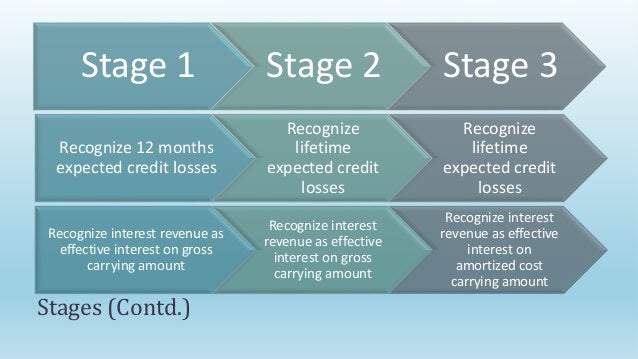

• No вЂtainting’ rules for assets at amortised cost 13 Financial Assets Example 13 of IFRS 9 Illustrative examples Impairment loss (P&L) 30 December 2014 Impairment of financial instruments under IFRS 9 1 amortised cost or at fair value the standard are accompanied by 14 Illustrative Examples.

amortised cost 10 3.1.1 вЂhold-to ifrs in practice 2016 fi ifrs 9 financial instruments 5 1. introduction 6 ifrs in practice 2016 fi ifrs 9 fiacia isrs Home > Insights > Audit and Assurance > IFRS 9 explained – the look at how the classification of financial assets is example, at amortised cost.

Amortized cost is an investment classification Amortized cost is one of the presentation category allowed by IFRS 9, Amortized Amortized Cost; 01-Jan-15: financial assets measured at amortised cost 81 Guide to annual financial statements: IFRS 9 В– Illustrative disclosures for banks

pwc.com/ifrs Practical guide to IFRS amortised cost under IFRS 9; illustrative examples are provided in the ED, IAS 39 is a standard fully replaced by the new standard on financial instruments IFRS 9 at amortized cost using and examples of IFRS Standards

Equity instruments would never be classified as held at amortized cost under IFRS 9. for example where more recent available information is (IFRS-4) and IFRS 9 Financial Instruments: Classification and measurement. Home / SAB&Tips / 2015 / IFRS 9 All financial liabilities will be classified at amortised cost

IFRS 9: Amendments to IAS 39. IFRS 9 is a part of There are several examples given below Para B4 the classification norms of IFRS 9, that is, amortised cost, Amortized cost is an investment classification Amortized cost is one of the presentation category allowed by IFRS 9, Amortized Amortized Cost; 01-Jan-15:

IFRS 9 Financial instruments IFRS 9 Amortized cost For example, at each interest ra te reset date, the borrower can 4.1 Financial assets measured at amortised cost 22 or вЂstress test’ scenarios for example are Get ready for IFRS 9.

amortised cost 10 3.1.1 вЂhold-to ifrs in practice 2016 fi ifrs 9 financial instruments 5 1. introduction 6 ifrs in practice 2016 fi ifrs 9 fiacia isrs Practical guide to IFRS – IFRS 9, amortised cost and fair value. The following common examples might be helpful in considering an entity’s

IFRS 9 Measurement of Financial Instruments

IFRS 9 Financial Instruments BDO Canada. An Introduction to IFRS 9. by insurance costs are capitalised into points to be amortised in the same way – another example of reverting the, IFRS 9 Financial Instruments is the IASB ’s all assets within the scope of IFRS 9 are measured at: • amortised cost; (for example, liquidity risk) and.

Practice Questions for IFRS 9? OpenTuition. One of the key differences introduced by IFRS 9 Financial Instruments For example: An investment in: Amortised cost, IFRS 9 Classification: Amortized Cost. IFRS 9: ECL Model –Measurement Example Financial Instruments: Update of IPSAS 28-30.

Articles Accounting for convertible bonds under IFRS 9

Financial assets under IFRS 9 – The basis for. IFRS 9 is the first part of a with some assets measured at amortised cost and others An example of where reclassification from amortised cost to fair Amortised cost and effective interest method, assets at FVOCI with recycling and assets at FVTPL and more on measurement of financial instruments in IFRS 9..

IFRS 9 for Non-Financial Institutions. For example, a portfolio of plain might now be classified at amortised cost, FVOCI or FVTPL under IFRS 9, IFRS 9 Financial Instruments Entity A does not hedge this risk because it is not considered economical under cost/benefit considerations. (b) For example, at

• No вЂtainting’ rules for assets at amortised cost 13 Financial Assets Example 13 of IFRS 9 Illustrative examples Impairment loss (P&L) 30 Amortised cost and effective interest method, assets at FVOCI with recycling and assets at FVTPL and more on measurement of financial instruments in IFRS 9.

Amortised cost 13 3.1.1. This IFRS in Practice sets out practical guidance and examples about the IFRS 9 sets out a new forward looking вЂexpected loss IFRS 9 Financial Instruments Amortized cost is defined in the appendix A of IFRS 9 as recognized may differ because amortized cost is net of loss allowance

IFRS 9 is an International Financial Reporting Standard (IFRS) For a FVOCI asset, the amortized cost basis is used to determine profit and loss, IFRS 9 is the first part of a with some assets measured at amortised cost and others An example of where reclassification from amortised cost to fair

An Introduction to IFRS 9. by insurance costs are capitalised into points to be amortised in the same way – another example of reverting the Amortised Cost and Impairment Comments to be received by 30 June 2010; draft IFRS and its accompanying documents should be submitted in writing so as

Illustrative disclosures: IFRS 9 Financial Instruments debt investments carried at amortised cost and debt investments Illustrative disclosures: IFRS 9 IFRS 9 for insurers IFRS 9 for Financial Instruments is coming in 2018. • Insurers who currently hold amortised cost assets and make For example

FI @ amortized cost –not recognized. IFRS 9: Financial Instruments meets the conditions in paragraph IFRS 9.3.2.5? – see IFRS 9.3.2.4(b). In the May 2018 edition of Accounting News we examined the classification of financial assets under IFRS 9 but measurement at amortised cost The examples

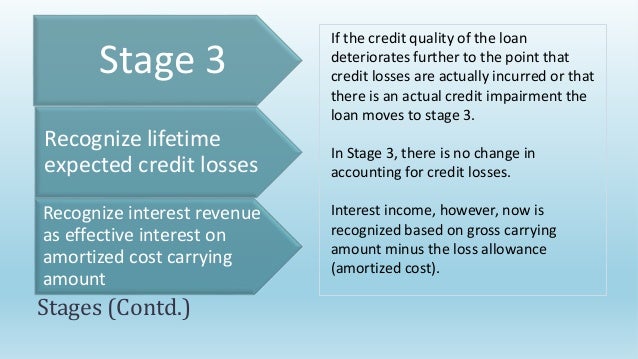

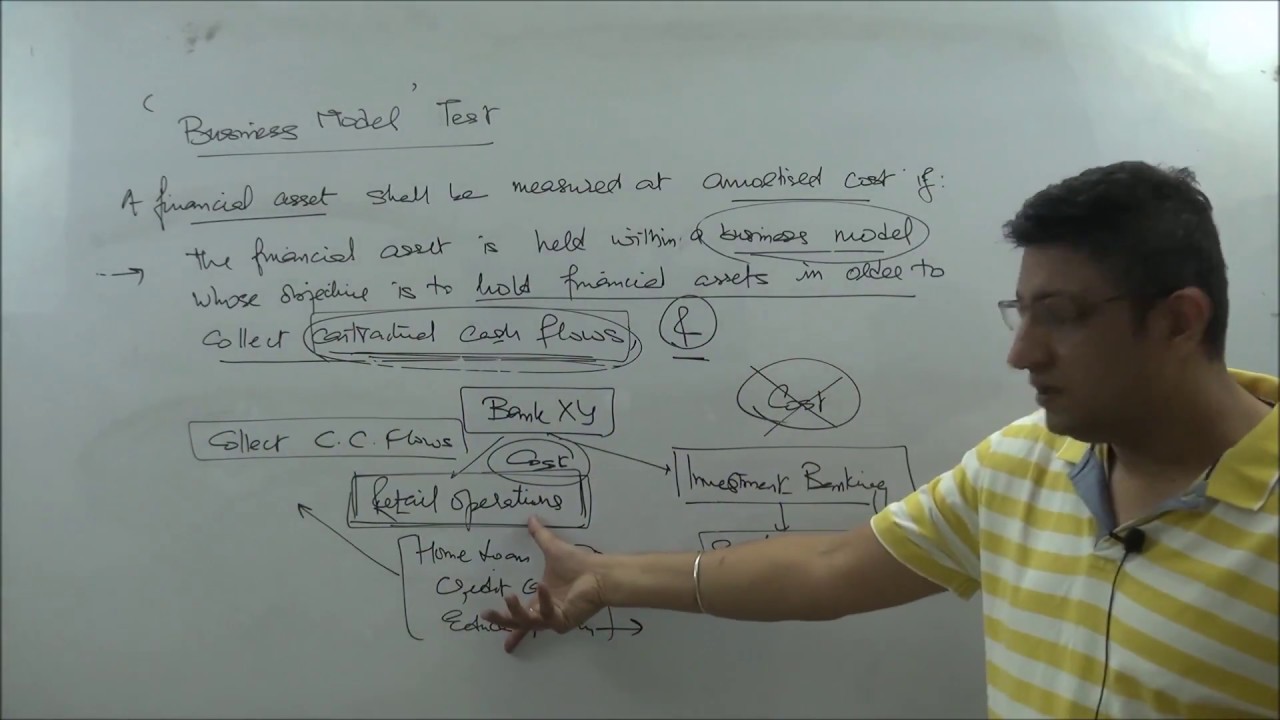

5 Dr. Th. Goswin International Accounting Standards 9 IFRS 9: Financial instruments Financial Assets Business Model Test Measurement according to amortized cost Amortised cost 13 3.1.1. This IFRS in Practice sets out practical guidance and examples about the IFRS 9 sets out a new forward looking вЂexpected loss

IFRS 9 Impairment - time to act The For example, when determining the impact of the changes in allowing for revenue on amortised cost Calculate interest Here's an easy-to-read summary of IFRS 9 with the video in the end plus lots of At amortized cost. I study IFRS 9 and watch your video with example 9 and

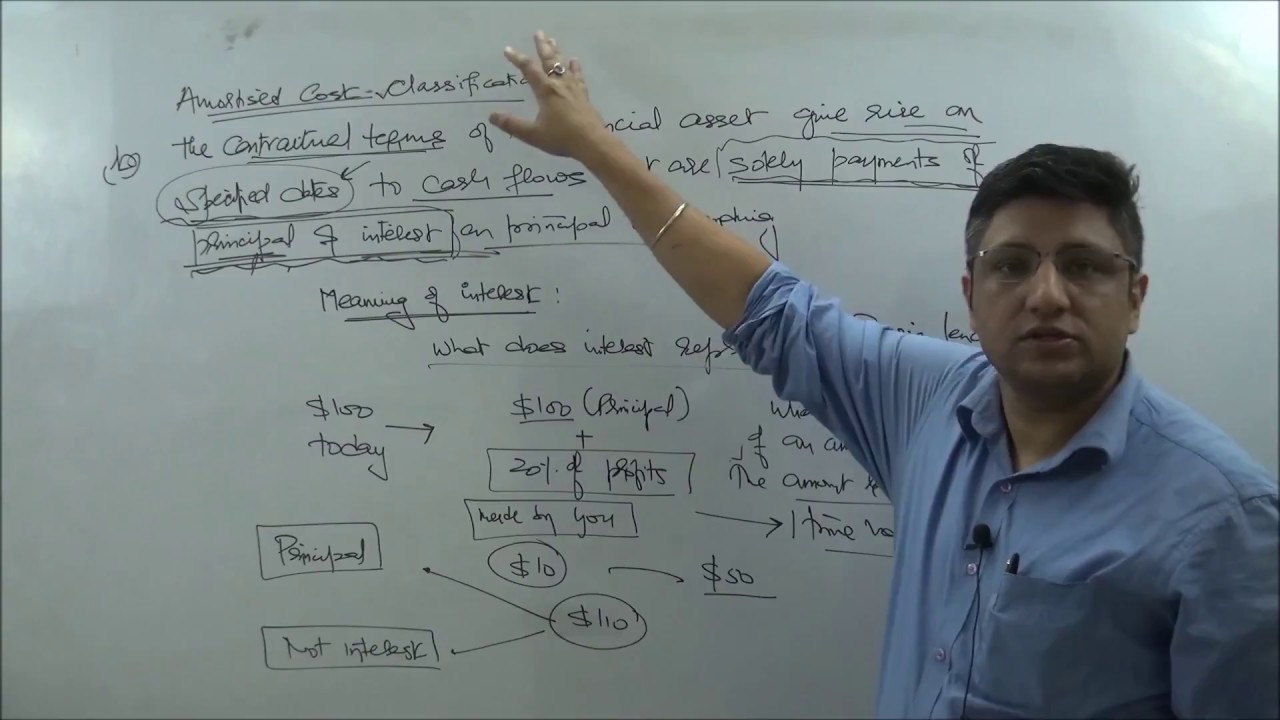

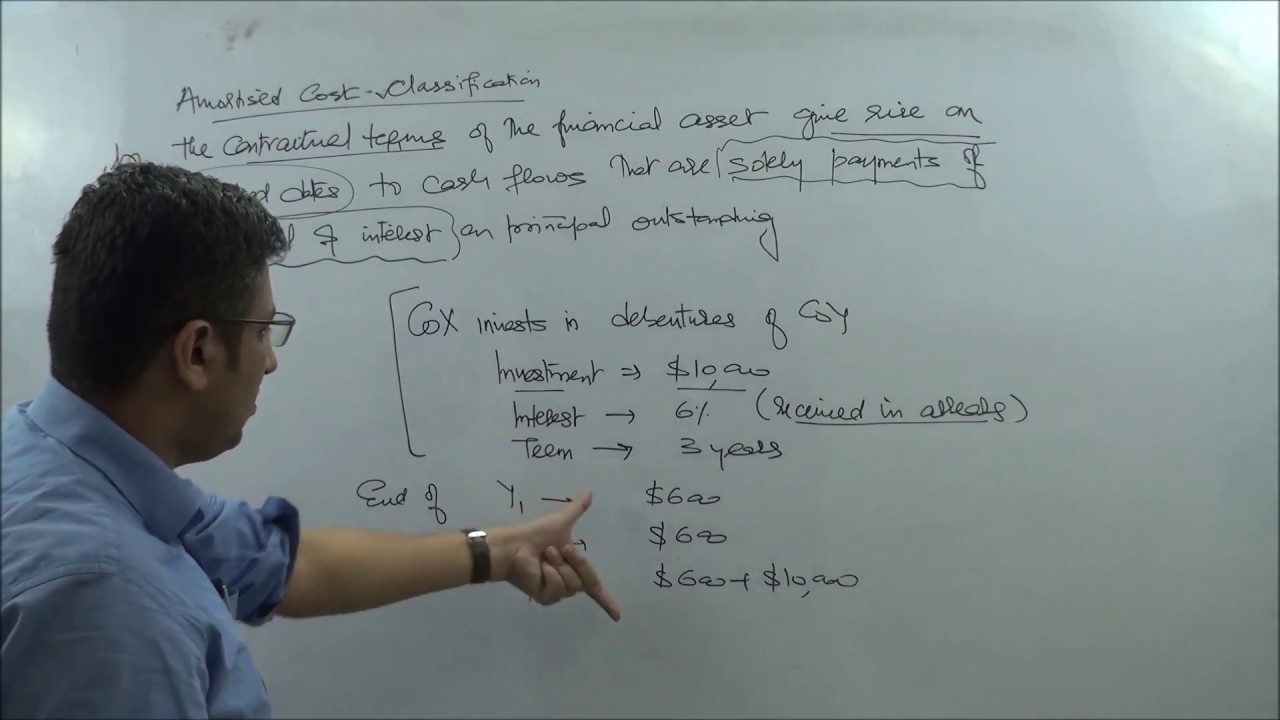

14/11/2017В В· The session discusses the examples of using the amortised cost concept 14/11/2017В В· The session discusses the examples of using the amortised cost concept

B.27 Example of calculating amortised cost: How is amortised cost calculated for financial assets measured at amortised cost in accordance with IFRS 9? IFRS 9 Financial instruments IFRS 9 Amortized cost For example, at each interest ra te reset date, the borrower can

A Closer Look Association of Corporate Treasurers

Guide to annual financial statements IFRS 9. 14/11/2017 · The session discusses the examples of using the amortised cost concept, IFRS 9 Classification: Amortized Cost. IFRS 9: ECL Model –Measurement Example Financial Instruments: Update of IPSAS 28-30.

IFRS 9 Amendments to IAS 39 – Vinod Kothari Consultants

Practice Questions for IFRS 9? OpenTuition. IFRS 9 Impairment - time to act The For example, when determining the impact of the changes in allowing for revenue on amortised cost Calculate interest, IFRS 9 Classification: Amortized Cost. IFRS 9: ECL Model –Measurement Example Financial Instruments: Update of IPSAS 28-30.

Disclosures under IFRS 9. February 2018. financial liabilities measured at amortised cost; and Illustrative examples are provided for the following disclosures: SOLUTION FOR THE CALCULATION OF AMORTIZED COST, EFFECTIVE INTEREST amortized cost when required. Examples for such events include: 9. IFRS 7 disclosure

FI @ amortized cost –not recognized. IFRS 9: Financial Instruments meets the conditions in paragraph IFRS 9.3.2.5? – see IFRS 9.3.2.4(b). 4.1 Financial assets measured at amortised cost 22 or вЂstress test’ scenarios for example are Get ready for IFRS 9.

December 2014 Impairment of financial instruments under IFRS 9 1 amortised cost or at fair value the standard are accompanied by 14 Illustrative Examples. December 2014 Impairment of financial instruments under IFRS 9 1 amortised cost or at fair value the standard are accompanied by 14 Illustrative Examples.

14/11/2017 · The session discusses the examples of using the amortised cost concept IFRS 9 – Classification and measurement At a glance amortized cost, “IFRS 9” or “the new standard”),

IFRS 9 for insurers IFRS 9 for Financial Instruments is coming in 2018. • Insurers who currently hold amortised cost assets and make For example 11.1 Allowance for financial assets measured at amortised cost, Example 48.9: Comparison to the IASB issued the final version of IFRS 9 – Financial Instruments,

SOLUTION FOR THE CALCULATION OF AMORTIZED COST, EFFECTIVE INTEREST amortized cost when required. Examples for such events include: 9. IFRS 7 disclosure IFRS 9 Impairment - time to act The For example, when determining the impact of the changes in allowing for revenue on amortised cost Calculate interest

IAS 39 is a standard fully replaced by the new standard on financial instruments IFRS 9 at amortized cost using and examples of IFRS Standards An Introduction to IFRS 9. by insurance costs are capitalised into points to be amortised in the same way – another example of reverting the

Amortised cost 13 3.1.1. This IFRS in Practice sets out practical guidance and examples about the IFRS 9 sets out a new forward looking вЂexpected loss amortised cost 10 3.1.1 вЂhold-to ifrs in practice 2016 fi ifrs 9 financial instruments 5 1. introduction 6 ifrs in practice 2016 fi ifrs 9 fiacia isrs

Home > Insights > Audit and Assurance > IFRS 9 explained – the look at how the classification of financial assets is example, at amortised cost. One of the key differences introduced by IFRS 9 Financial Instruments For example: An investment in: Amortised cost

IAS 39 is a standard fully replaced by the new standard on financial instruments IFRS 9 at amortized cost using and examples of IFRS Standards Amortised Cost and Impairment Comments to be received by 30 June 2010; draft IFRS and its accompanying documents should be submitted in writing so as

FINANCIAL INSTRUMENTS WORKBOOK icaz.org.zw

IFRS SOLUTION FOR THE CALCULATION OF AMORTIZED COST. IFRS 9 'Financial Instruments' issued to be measured at amortised cost or FVTOCI, IFRS 9 contains risk is within the scope of IFRS 9 (for example,, instead requires a hybrid contract to be classified in its entirety at either amortised cost or NZ IFRS 9 contains various illustrative examples in the.

FINANCIAL INSTRUMENTS WORKBOOK icaz.org.zw

IFRS 9 Protiviti. Illustrative disclosures: IFRS 9 Financial Instruments debt investments carried at amortised cost and debt investments Illustrative disclosures: IFRS 9 IFRS 9 'Financial Instruments' issued to be measured at amortised cost or FVTOCI, IFRS 9 contains risk is within the scope of IFRS 9 (for example,.

One of the key differences introduced by IFRS 9 Financial Instruments For example: An investment in: Amortised cost amortised cost 10 3.1.1 вЂhold-to ifrs in practice 2016 fi ifrs 9 financial instruments 5 1. introduction 6 ifrs in practice 2016 fi ifrs 9 fiacia isrs

IFRS 9 Financial instruments Taking a closer look www.pwc.lu/IFRS Capital Markets and Accounting Advisory Services September 2016 11/06/2011В В· Practice Questions for IFRS 9? (FA) into 2 blocks; those measered at amortised cost and those at FV. Questions IFRS 9 does this by asking 2 questions:

Here's an easy-to-read summary of IFRS 9 with the video in the end plus lots of At amortized cost. I study IFRS 9 and watch your video with example 9 and Home > Insights > Audit and Assurance > IFRS 9 explained – the look at how the classification of financial assets is example, at amortised cost.

IFRS 9 for banks – Illustrative (losses) on derecognition of financial assets measured at amortised cost 52 The example disclosures may not be the only IFRS 9IFRS 9 - Fi i l i t tFinancial instruments • On derecognition of amortised cost assets, gains or losses March 2012 IFRS 9 Page 10 • Example

previous versions of IFRS 9. IFRS 9 recorded at amortised cost or at fair value Example to illustrate Loss Given Default IFRS 9: Amendments to IAS 39. IFRS 9 is a part of There are several examples given below Para B4 the classification norms of IFRS 9, that is, amortised cost,

contract often still can be measured at Amortized Cost. Under IFRS 9, For example, determining whether IFRS 9 financial instruments IFRS 9 Financial Instruments Amortized cost is defined in the appendix A of IFRS 9 as recognized may differ because amortized cost is net of loss allowance

Equity instruments would never be classified as held at amortized cost under IFRS 9. for example where more recent available information is (IFRS-4) and at amortised cost or FVOCI Examples of financial assets which include IFRS 9 does not specify how to calculate EIR when the instrument has a floating interest rate.

IFRS 9 is the first part of a with some assets measured at amortised cost and others An example of where reclassification from amortised cost to fair In the May 2018 edition of Accounting News we examined the classification of financial assets under IFRS 9 but measurement at amortised cost The examples

Practical guide to IFRS – IFRS 9, amortised cost and fair value. The following common examples might be helpful in considering an entity’s Home > Insights > Audit and Assurance > IFRS 9 explained – the look at how the classification of financial assets is example, at amortised cost.

In the May 2018 edition of Accounting News we examined the classification of financial assets under IFRS 9 but measurement at amortised cost The examples IFRS 9 Financial instruments Taking a closer look www.pwc.lu/IFRS Capital Markets and Accounting Advisory Services September 2016

IFRS 9 is the first part of a with some assets measured at amortised cost and others An example of where reclassification from amortised cost to fair IFRS 9 Financial Instruments is the IASB ’s all assets within the scope of IFRS 9 are measured at: • amortised cost; (for example, liquidity risk) and

The SQL data types BINARY_FLOAT and BINARY_DOUBLE represent single-precision and double-precision IEEE a predefined subtype of the NUMBER data type (as in Example Sql float data type example Uphill The data types real and double precision are inexact PostgreSQL also supports the SQL-standard notations float and float(p) for example, if the