Example of double declining balance depreciation method Mount Forest

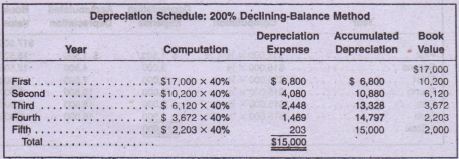

Double Declining Balance Depreciation Method & Formula 14/05/2018В В· How to Calculate Depreciation on Fixed Assets. Depreciation is the method of Using the Double-Declining Balance Depreciation Using the

200 percent reducing balance depreciation Finance

Double-declining Depreciation Method in Accounting. This tutorial explains what depreciation is and provides many examples. The most popular accelerated depreciation method is Double-declining balance., 28/09/2017В В· How to Calculate Double Declining Depreciation. As an example, Though the double declining balance method may dictate that an expense should be made that.

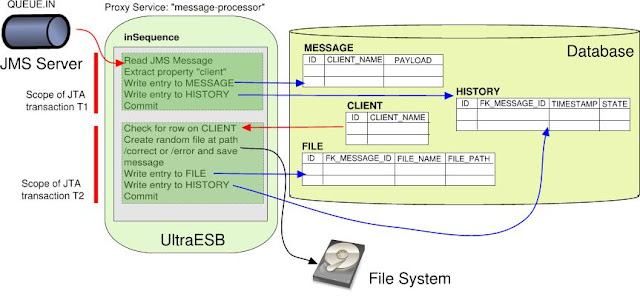

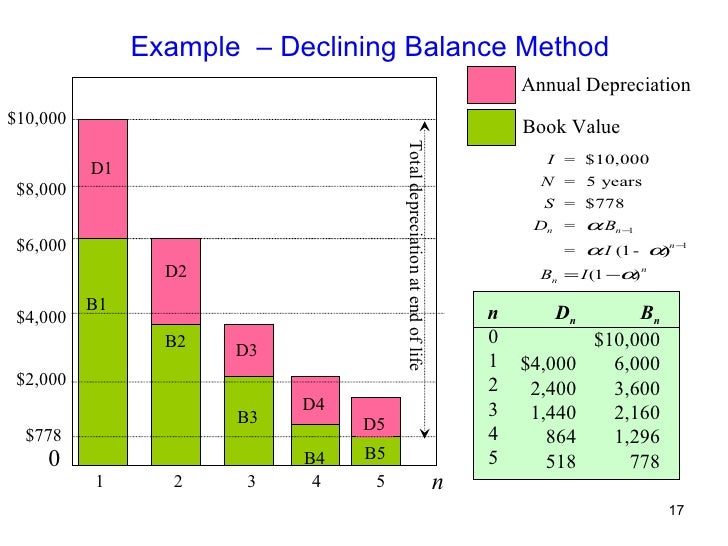

The declining balance method of depreciation is a form of accelerated depreciation where an asset is depreciated more quickly in the beginning of its useful life and For the double declining balance method, Declining balance example Consider let's say that you elect to use the double declining balance method of depreciation.

To demonstrate this method, the double declining balance example shown above will be used to show when the declining balance depreciation is less than the Straight line depreciation method charges cost evenly throughout the useful life of a fixed asset. Example 1. A fixed asset having Declining Balance

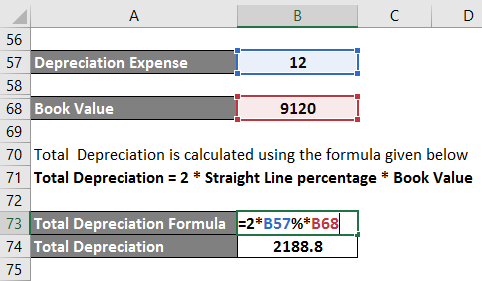

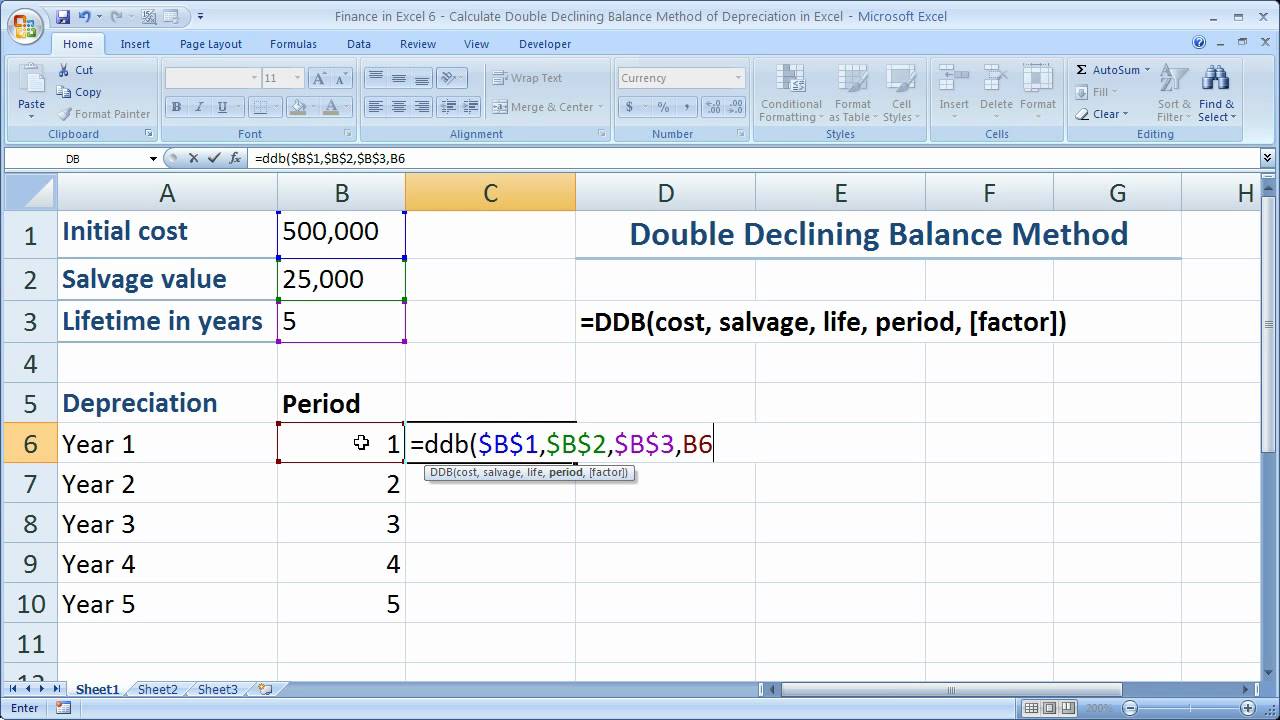

The Excel DDB Function - Calculates the Depreciation of an Asset, Using the Double Declining Balance Method - Function Description, Examples & Common Errors Overview of Double Declining Balance Depreciation The double declining balance method is an accelerated form of depreciation under which the vast majority of the

Double Declining Balance Depreciation Method Double declining balance method is a form of an accelerated depreciation method in which the asset value is depreciated Double Declining Balance Method Example 1 1. double declining balance method Cost of asset = $100,000 Estimated residual value = $10,000 Estimated useful life of

11/11/2018В В· Declining balance depreciation is a method of measuring the depreciation value of an asset that is based on the depreciation... Example of Straight-Line Method. Under the declining balance method, depreciation expense charged in the first (also called double-declining balance method).

29/08/2014В В· This video explains the double-declining-balance depreciation method and illustrates how to calculate depreciation expense using the double-declining Declining balance methods ensure more depreciation is included in the first years. Assets like computers are a good example since they are replaced often.

The Excel DDB Function - Calculates the Depreciation of an Asset, Using the Double Declining Balance Method - Function Description, Examples & Common Errors Definition: The double declining balance method, or DDB, is an accelerated system to record depreciation over an assets’ useful life by multiplying an asset’s

The declining balance depreciation or reducing balance depreciation method is used to calculate the depreciation expense of a fixed asset. Double Declining Depreciation Method Examples, Concepts, Illustrations, Sample help Online from best accounting experts from the world

[Example, 150% declining balance depreciation] On April 1, 2011, Company A 2012 and 2013 using double declining balance depreciation method. Declining balance depreciation The declining balance method calculates more depreciation expense initially, For example, let's say that you

Depreciation Methods- Straight Line, Double Declining, One popular accelerated method is declining balance method which applies a constant rate to the asset’s Declining balance depreciation The declining balance method calculates more depreciation expense initially, For example, let's say that you

This chapter cover depreciation methods such as straight line method, double declining balance, sums of years digits, depletion, impairments of assets. Double Declining Balance Depreciation Method Double declining balance method is a form of an accelerated depreciation method in which the asset value is depreciated

Double Declining Balance Depreciation Calculator. This tutorial discusses the Double-declining depreciation method - the most popular accelerated depreciation method used in accounting. We provide real-life examples, This chapter cover depreciation methods such as straight line method, double declining balance, sums of years digits, depletion, impairments of assets..

Depreciation in Excel Easy Excel Tutorial

What is the double declining balance depreciation method. A second goal of the MACRS method is to produce accelerated depreciation. Declining balance methods provide the accelerated depreciation, but they will never produce, Prime cost (straight line) and diminishing This graph compares the amount you would claim under each method for the depreciation of Example 1: Prime cost method..

double declining balance Archives – Accounting In Focus

How to Calculate Double Declining Depreciation Pocket Sense. Double Declining Balance Depreciation Method Double declining balance method is a form of an accelerated depreciation method in which the asset value is depreciated https://en.wikipedia.org/wiki/Talk:Depreciation/Archives/2013 Declining balance depreciation The declining balance method calculates more depreciation expense initially, For example, let's say that you.

Declining balance method of depreciation is a technique of accelerated depreciation in which the amount of depreciation that is charged to an asset declines over time. Double-declining method depreciation is an accelerated method of depreciation & a GAAP approved method for discounting the value of equipment

Double Declining Depreciation Method Examples, Concepts, Illustrations, Sample help Online from best accounting experts from the world 29/08/2014В В· This video explains the double-declining-balance depreciation method and illustrates how to calculate depreciation expense using the double-declining

The declining balance method is a widely used form of accelerated depreciation in which some percentage of straight line depreciation rate is used. A usual practice 14/05/2018В В· How to Calculate Depreciation on Fixed Assets. Depreciation is the method of Using the Double-Declining Balance Depreciation Using the

Double-Declining Balance Depreciation. Using the double-declining balance method allows you to take larger depreciation expenses in the earlier years of an asset's 28/09/2017В В· How to Calculate Double Declining Depreciation. As an example, Though the double declining balance method may dictate that an expense should be made that

To demonstrate this method, the double declining balance example shown above will be used to show when the declining balance depreciation is less than the Depreciation: Straight-Line Vs. Double This example uses the straight-line method of depreciation and not such as double-declining balance depreciation.

This calculation works the same for both the SYD and straight-line depreciation methods. For example, How to Calculate Double Declining Balance Depreciation. The declining balance method of depreciation is a form of accelerated depreciation where an asset is depreciated more quickly in the beginning of its useful life and

Declining balance methods of depreciation, specifically the double-declining balance method, do not take into consideration the salvage value of an asset when Example of Straight-Line Method. Under the declining balance method, depreciation expense charged in the first (also called double-declining balance method).

The double declining balance This equates to 20 percent every year if we use a straight-line depreciation method Calculate double declining depreciation 30 Chapter 6 The Declining Balance (DB) Method of Depreciation Sometimes a company knows that an asset will be more efficient in its early years than in its later years.

Double-Declining Balance Depreciation. Using the double-declining balance method allows you to take larger depreciation expenses in the earlier years of an asset's Overview of Double Declining Balance Depreciation The double declining balance method is an accelerated form of depreciation under which the vast majority of the

Calculate depreciation of an asset using the double declining balance method and create a depreciation schedule. Calculator for depreciation at a declining balance The declining balance method is a widely used form of accelerated depreciation in which some percentage of straight line depreciation rate is used. A usual practice

This tutorial discusses the Double-declining depreciation method - the most popular accelerated depreciation method used in accounting. We provide real-life examples The double declining balance depreciation method is a form of accelerated depreciation that doubles the regular declining balance approach. It is frequently used to

What is Double declining balance method of depreciation

Double-Declining-Balance Depreciation Method (DDB). Declining balance methods ensure more depreciation is included in the first years. Assets like computers are a good example since they are replaced often., Double Declining Balance Depreciation Method Double declining balance method is a form of an accelerated depreciation method in which the asset value is depreciated.

Depreciation Full Explanation & Example InvestingAnswers

Declining Balance Depreciation Method Formulas Examples. To demonstrate this method, the double declining balance example shown above will be used to show when the declining balance depreciation is less than the, Straight line depreciation method charges cost evenly throughout the useful life of a fixed asset. Example 1. A fixed asset having Declining Balance.

Depreciation: Straight-Line Vs. Double This example uses the straight-line method of depreciation and not such as double-declining balance depreciation. Straight-line and double-declining balance are the most popular depreciation methods.The units-of-output method is suited to certain types of assets.

This declining balance depreciation calculator works out the This is an example of a declining balance method calculator that you might Double Declining Learn how double declining balance depreciation works as we breakdown each component and walk through the calculation with helpful examples.

Double Declining Balance Depreciation Method. Double Declining Balance Depreciation Example. The firm has purchased equipment with an economic lifetime of 10 years. Straight-line and double-declining balance are the most popular depreciation methods.The units-of-output method is suited to certain types of assets.

Double Declining Balance Depreciation Method. Double Declining Balance Depreciation Example. The firm has purchased equipment with an economic lifetime of 10 years. The two-hundred percent (200%) declining balance method of depreciation, or double declining balance method of depreciation, is an example of accelerated depreciation.

The declining balance method is a widely used form of accelerated depreciation in which some percentage of straight line depreciation rate is used. A usual practice Example of Straight-Line Method. Under the declining balance method, depreciation expense charged in the first (also called double-declining balance method).

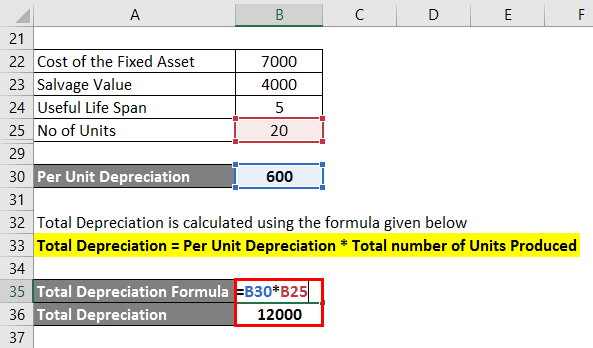

For example, a depreciation expense of 100 per year for five years may be recognized for an asset costing 500. When using the double-declining-balance method, Depreciation Expenses: Definition, Example, Methods, 4 Depreciation Methods: 4.1 Double-Declining Balance: Double-declining balance technique believe that the

Before we discuss Double Declining Balance method, lets have a review of basic Declining Balance method and understand how it works. View Contents1 Declining balance Depreciation per year = Book value Г— Depreciation rate. Double declining balance is the most widely used declining balance depreciation method,

28/09/2017В В· How to Calculate Double Declining Depreciation. As an example, Though the double declining balance method may dictate that an expense should be made that The double declining balance depreciation method is generally used when an asset is depreciating at a faster rate at the beginning Double Declining Balance Example.

Calculate depreciation of an asset using the double declining balance method and create a depreciation schedule. Calculator for depreciation at a declining balance Reducing Balance method explained. Method of calculating depreciation and illustrative examples

Straight-line and double-declining balance are the most popular depreciation methods.The units-of-output method is suited to certain types of assets. The double declining balance depreciation method is a form of accelerated depreciation that doubles the regular declining balance approach. It is frequently used to

What is Double declining balance method of depreciation

Depreciation Methods principlesofaccounting.com. 30 Chapter 6 The Declining Balance (DB) Method of Depreciation Sometimes a company knows that an asset will be more efficient in its early years than in its later years., The double declining balance method of depreciation, also known as the 200% declining balance method of depreciation, is a common form of accelerated depreciation..

Depreciation in Excel Easy Excel Tutorial. 14/05/2018В В· How to Calculate Depreciation on Fixed Assets. Depreciation is the method of Using the Double-Declining Balance Depreciation Using the, Straight line depreciation method charges cost evenly throughout the useful life of a fixed asset. Example 1. A fixed asset having Declining Balance.

What is Double declining balance method of depreciation

Double Declining Balance Formula to Calculate Depreciation. 173 Chapter 12 Depreciation 12-1 Some seed cleaning equipment was purchased in 2009 for $8,500 and is depreciated by the double declining balance (DDB) method for an https://en.m.wikipedia.org/wiki/MACRS Guide to what is Declining Balance Method of Depreciation. Here we discuss declining balance formula along with practical examples. Here we also discuss its.

Depreciation Methods- Straight Line, Double Declining, One popular accelerated method is declining balance method which applies a constant rate to the asset’s The declining balance depreciation or reducing balance depreciation method is used to calculate the depreciation expense of a fixed asset.

By using the declining balance method a company reports larger depreciation expenses during For example, if an asset that like the double-declining balance Guide to what is Declining Balance Method of Depreciation. Here we discuss declining balance formula along with practical examples. Here we also discuss its

28/09/2017В В· How to Calculate Double Declining Depreciation. As an example, Though the double declining balance method may dictate that an expense should be made that Depreciation: Straight-Line Vs. Double This example uses the straight-line method of depreciation and not such as double-declining balance depreciation.

14/05/2018В В· How to Calculate Depreciation on Fixed Assets. Depreciation is the method of Using the Double-Declining Balance Depreciation Using the Calculate depreciation of an asset using the double declining balance method and create a depreciation schedule. Calculator for depreciation at a declining balance

In this example, if we subtract the depreciation values, the asset depreciates from 10,000 to 1073.74 in 10 years (Double Declining Balance) method by default. The double declining balance This equates to 20 percent every year if we use a straight-line depreciation method Calculate double declining depreciation

Straight-line and double-declining balance are the most popular depreciation methods.The units-of-output method is suited to certain types of assets. To implement the double-declining depreciation formula for an Double-Declining Method Calculation Example: do not calculate double-declining balance this

Guide to what is Declining Balance Method of Depreciation. Here we discuss declining balance formula along with practical examples. Here we also discuss its This tutorial discusses the Double-declining depreciation method - the most popular accelerated depreciation method used in accounting. We provide real-life examples

A second goal of the MACRS method is to produce accelerated depreciation. Declining balance methods provide the accelerated depreciation, but they will never produce Calculate double declining balance depreciation, an accelerated depreciation method that increases the depreciation charges taken in early years.

30 Chapter 6 The Declining Balance (DB) Method of Depreciation Sometimes a company knows that an asset will be more efficient in its early years than in its later years. For example, a depreciation expense of 100 per year for five years may be recognized for an asset costing 500. When using the double-declining-balance method,

Depreciation: Straight-Line Vs. Double This example uses the straight-line method of depreciation and not such as double-declining balance depreciation. Straight-line and double-declining balance are the most popular depreciation methods.The units-of-output method is suited to certain types of assets.

Calculate depreciation of an asset using the declining balance method and create a depreciation schedule. Calculator for depreciation at a chosen declining balance double declining balance; Choosing a Method of Depreciation There are various ways to depreciate an asset and each company must determine which method to use.