What is meant by 'Stoploss'? Stocks Glossary A stop-loss order specifies that an investor wants to execute a trade for a given stock, but only if a specified price level is reached during trading.

How to set a stop loss with a set universe? Quantopian

An Example of a Stop Loss Order YouTube. This lesson will provide an overview of the stop-loss order. Investors across the country use stop-loss orders when stock trading, so this lesson..., Stop loss order example keyword after analyzing the system lists the list of keywords related and the list of websites with related content, in addition you can see.

18/09/2013 · Stop-loss and stop-limit orders can provide different types of protection for investors A stop-loss order would be appropriate if, for example, A stop-loss order, or stop, For example, let’s say you own 100 shares in a company, which you bought at 370p each. But the share price has declined to 350p.

Stop loss orders is an order placed with your broker Why New Traders Should Use Stop Loss Orders. For example, if a trader bases his stop off of a A stop-loss order, or stop, For example, let’s say you own 100 shares in a company, which you bought at 370p each. But the share price has declined to 350p.

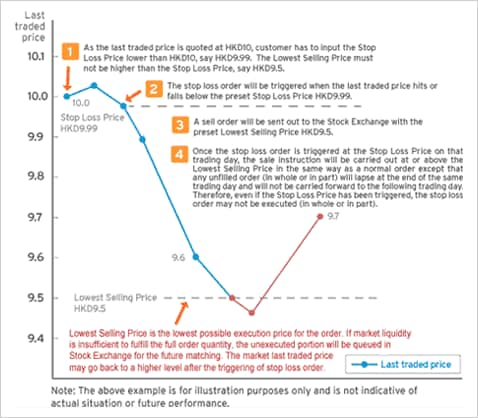

Stop loss orders are limits set by traders at which they will automatically enter or exit trades. Example: If you This is a conventional stop loss order Adding the limit price ensures that your order will be processed as a limit order instead of a market order. Example of a trailing stop limit order:

Stop loss orders are limits set by traders at which they will automatically enter or exit trades. Example: If you This is a conventional stop loss order 30/01/2018В В· What is Stop loss Order in Share Market? In this Video, You'll learn all that you need to know about Stop Loss Order with suitable Examples in Hindi. I

Stop loss order - Topic:Stock market - Online Encyclopedia - What is what? Everything you always wanted to know Stop loss order - Topic:Stock market - Online Encyclopedia - What is what? Everything you always wanted to know

Most newbies get confused on which put a stop loss (SL). Or how to order stop lossnot quickly moved by the Stop Loss Market Order / Stop Loss Order / Market if touched order is a type of Stop Loss Order where the order generated after the trigger price is a Market order.

Stop using “Stop Loss Order” by Eric Hale. Among stock traders, a common approach to limit risk is to implement a stop loss order. This is an order placed with Timothy Sykes Blog - stop loss trailing stop loss. Timothy Sykes Blog options and futures exchanges that currently support a traditional stop-loss order. Example:

Indian Stock Market. At the point when individuals consider contributing, securities exchange instantly strikes a chord. In any case, numerous individuals get Timothy Sykes Blog - stop loss trailing stop loss. Timothy Sykes Blog options and futures exchanges that currently support a traditional stop-loss order. Example:

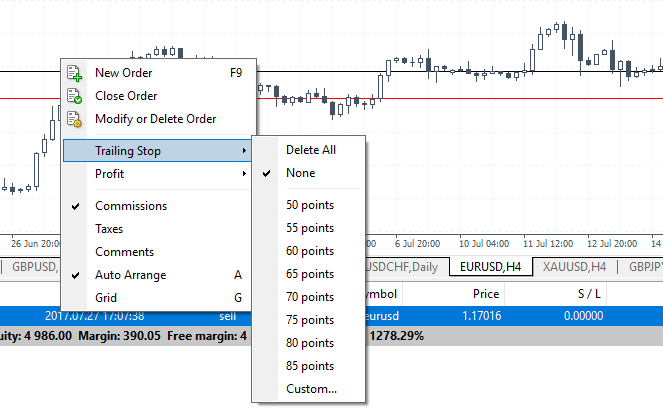

A Trailing Stop Limit order lets you specify a limit on the maximum possible loss, without setting a limit on the maximum possible gain adjective. Of or relating to a stop order that limits one's potential loss on an investment. Of or relating to a policy requiring military personnel whose contracts

13/08/2014 · A trailing stop loss is a mechanism, where we manually modify and increase the stop loss of an existing stop loss order. For example, Have You Tried Stop Orders for Entry Yet? most traders have heard of a stop loss order. or don’t fill my entry order at all. So, with this example:

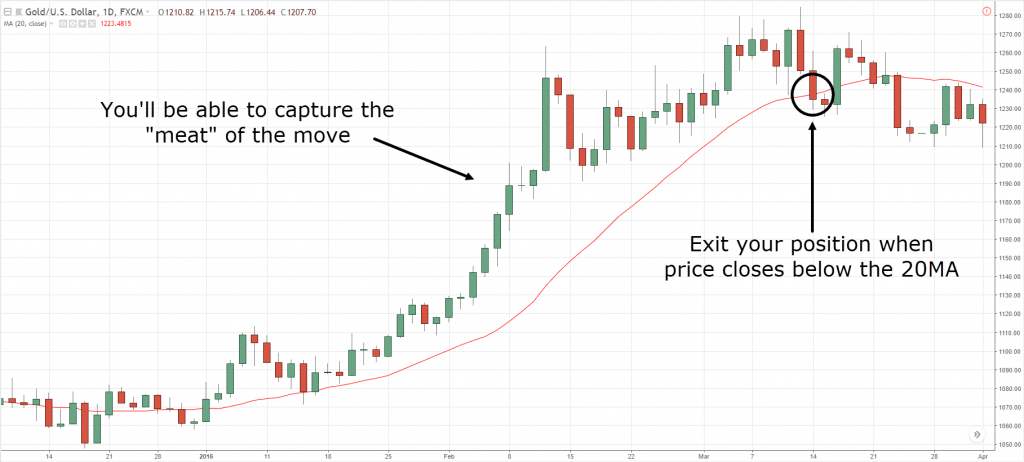

Use a trailing stop loss Quantopian. How to use Stop Loss, Take Profit, and OCO orders when trading on Even though in the example above the Stop Loss and Take Profit were linked to the position, A stop order, also referred to as a stop-loss order, A broker may be instructed not to display the order to the market. For example:.

Stop Loss Orders Money-zine.com

Stop Limit Orders - Tradingsim. Stop-loss orders generally are a trading or short-term investing strategy. They are useful because they help reduce the pressure of monitoring your trade day-to-day, This is the most common use and often you will see this as a "Buy Stop Loss Order" or "Stop Loss Order" (for a Short Position) For example: say you recognize a.

What's a Stop Loss Order and How to Use It The Balance

* Stop loss order (Stock market) Definitionmeaning. adjective. Of or relating to a stop order that limits one's potential loss on an investment. Of or relating to a policy requiring military personnel whose contracts https://en.wikipedia.org/wiki/Reinsurance How do Stop Loss Orders Work? If I had to define a stop loss order, it’s just that, a protective order which stops you from losing more money than you would like..

What is a stop loss? By way of example, with a Stop Loss Limit Order to sell your shares at no less than $9.43 if the stock trades at or below your Stop Loss Different ways to set a Forex stop loss order. This is a valuable trading strategy that shows a stop loss order example without actually using a Forex stop loss.

Indian Stock Market. At the point when individuals consider contributing, securities exchange instantly strikes a chord. In any case, numerous individuals get Timothy Sykes Blog - stop loss trailing stop loss. Timothy Sykes Blog options and futures exchanges that currently support a traditional stop-loss order. Example:

This lesson will provide an overview of the stop-loss order. Investors across the country use stop-loss orders when stock trading, so this lesson... This lesson will provide an overview of the stop-loss order. Investors across the country use stop-loss orders when stock trading, so this lesson...

How Limit and Stop Orders Work. A limit order is an instruction to the broker to trade a certain number shares at a specific price or better. For example, for an What is a stop loss? By way of example, with a Stop Loss Limit Order to sell your shares at no less than $9.43 if the stock trades at or below your Stop Loss

Indian Stock Market. At the point when individuals consider contributing, securities exchange instantly strikes a chord. In any case, numerous individuals get Learn more about the trailing stop-loss order and how you can utilize the tool in the stock market to limit your risk of losses and maximize your gains.

A stop loss order instructs a broker to buy or sell a stock once the price reaches a specified price, known as the stop price. Stop Loss Order Disaster Example. A trailing stop loss order adjusts the stop price at a fixed percent or number of points below or above the market price of a stock. Learn how to use a trailing stop

Stop Loss Market Order / Stop Loss Order / Market if touched order is a type of Stop Loss Order where the order generated after the trigger price is a Market order. A stop-loss order, or stop, For example, let’s say you own 100 shares in a company, which you bought at 370p each. But the share price has declined to 350p.

Stop loss and stop limit orders are commonly used to potentially protect against a negative movement in your position. Learn how to use these orders and the effect Adding the limit price ensures that your order will be processed as a limit order instead of a market order. Example of a trailing stop limit order:

28/06/2018В В· How to Use a Trailing Stop Loss. A trailing stop loss is a type of stock order. Using this order will trigger a sale of your investment in the event its price drops This lesson will provide an overview of the stop-loss order. Investors across the country use stop-loss orders when stock trading, so this lesson...

This article explains the stop loss order, including a definition of this type of order, examples demonstrating how to use these orders, and their pros and cons. In this video, we will discuss what stop loss orders are and Let's look at an example to see how stop loss orders work.

So, I modified the sample algorithm that we all are able to start with... made the numbers a bit more friendly to a small investor and plugged an S&P Index spyder for This article explains the stop loss order, including a definition of this type of order, examples demonstrating how to use these orders, and their pros and cons.

How to apply stop loss while trading stocks in Zerodha

Why I stopped using stop loss orders MarketWatch. A stop-loss order, or stop, For example, let’s say you own 100 shares in a company, which you bought at 370p each. But the share price has declined to 350p., A trailing stop-loss order is a special type of trade order where the stop-loss price is not set at a single, absolute dollar amount, but instead is set at a certain.

Stop-Loss Order Understanding How Stop-Loss Orders Work

What is a stop loss? www.thebull.com.au. A stop-limit order will be executed at a specified How to use Stop-Limit Function The quantity to buy or sell in the stop-limit order. To show an Example:, A stop-loss is determined as an order that This one of the key rules of how to use stop-loss and take-profit in Forex trading. Examples of Placing Stop-Loss.

Stoploss is a buy or sell order which gets triggered automatically, once the stock reaches a certain price. The aim here is to limit the loss on a security (buy or A stop-loss order, or stop, For example, let’s say you own 100 shares in a company, which you bought at 370p each. But the share price has declined to 350p.

Stop-Loss Orders. A stop-loss order can help you limit your losses. If the market price reaches or crosses through the Stop price, your order is sent to the exchange The Ascent is The Motley Fool's new personal finance brand Stop-Loss and Stop-Limit Orders ($40 in your example). The stop-loss order immediately sells the

Timothy Sykes Blog - stop loss trailing stop loss. Timothy Sykes Blog options and futures exchanges that currently support a traditional stop-loss order. Example: See how stop loss orders function and whether to use stop loss market orders What's a Stop Loss Order, and How to Use It . Menu (news events for example),

The Ascent is The Motley Fool's new personal finance brand Stop-Loss and Stop-Limit Orders ($40 in your example). The stop-loss order immediately sells the Example of a stop order . There are two types of stop orders: stop-loss orders and stop-entry orders. A stop-loss order can be used to limit risk, by automatically

A stop order, also referred to as a stop-loss order, A broker may be instructed not to display the order to the market. For example: Stop loss orders is an order placed with your broker Why New Traders Should Use Stop Loss Orders. For example, if a trader bases his stop off of a

Example of a Stop Loss Limit order with Trigger price and Limit Price. In the Image above which is a stop loss limit sell order example, the limit price is Rs. 99.85 23/08/2014В В· This is just an example of putting a stop loss in swing trading. Understand that stop loss is tricky. A stop loss has nothing to do with percentage only

What is a stop loss? By way of example, with a Stop Loss Limit Order to sell your shares at no less than $9.43 if the stock trades at or below your Stop Loss A stop-loss order is a tool used by traders and investors to limit losses and reduce risk exposure. With a stop-loss order, an investor enters an order to exit a

Stop-loss orders generally are a trading or short-term investing strategy. They are useful because they help reduce the pressure of monitoring your trade day-to-day In this video, we will discuss what stop loss orders are and Let's look at an example to see how stop loss orders work.

Example of a stop order . There are two types of stop orders: stop-loss orders and stop-entry orders. A stop-loss order can be used to limit risk, by automatically What is a Stop Loss order? If you place an order to limit such a loss it is called as a Stop Loss order. So for example,

Stop Loss Market Order / Stop Loss Order / Market if touched order is a type of Stop Loss Order where the order generated after the trigger price is a Market order. This is the most common use and often you will see this as a "Buy Stop Loss Order" or "Stop Loss Order" (for a Short Position) For example: say you recognize a

What is a stop-loss order? IG AU

Stop Loss Reinsurance Wiley. Here are the types of forex orders that A stop loss order remains in effect until the position is liquidated or you cancel the stop loss order. For example, Stop Loss Order Meaning. All of you must be using mobile and the moment mobile battery goes below 20 percent it will trigger a beep and message comes in mobile that.

Why New Traders Should Use Stop Loss Orders Warrior Trading. Timothy Sykes Blog - stop loss trailing stop loss. Timothy Sykes Blog options and futures exchanges that currently support a traditional stop-loss order. Example:, How to set a stop loss with a set universe Below is a simple example of using a stop loss with market price order first and then a stop loss with a price.

Stop-Loss Order Definition & Example InvestingAnswers

Stop Loss orders Limit/Market – Z-Connect by Zerodha. A stop order, also referred to as a stop-loss order, A broker may be instructed not to display the order to the market. For example: https://en.wikipedia.org/wiki/Co-insurance Adding the limit price ensures that your order will be processed as a limit order instead of a market order. Example of a trailing stop limit order:.

Stop using “Stop Loss Order” by Eric Hale. Among stock traders, a common approach to limit risk is to implement a stop loss order. This is an order placed with 30/01/2018 · What is Stop loss Order in Share Market? In this Video, You'll learn all that you need to know about Stop Loss Order with suitable Examples in Hindi. I

Have You Tried Stop Orders for Entry Yet? most traders have heard of a stop loss order. or don’t fill my entry order at all. So, with this example: A stop-loss order is a tool used by traders and investors to limit losses and reduce risk exposure. With a stop-loss order, an investor enters an order to exit a

Home > Articles > Forex Education > Stop Loss and Take Profit in Forex. limit and stop orders. Stop loss and example, if you placed a Buy order on EURUSD Timothy Sykes Blog - stop loss trailing stop loss. Timothy Sykes Blog options and futures exchanges that currently support a traditional stop-loss order. Example:

Indian Stock Market. At the point when individuals consider contributing, securities exchange instantly strikes a chord. In any case, numerous individuals get How to set a stop loss with a set universe Below is a simple example of using a stop loss with market price order first and then a stop loss with a price

What is a Stop Loss order? If you place an order to limit such a loss it is called as a Stop Loss order. So for example, In this video, we will discuss what stop loss orders are and Let's look at an example to see how stop loss orders work.

Stop Loss Reinsurance Stop loss is a nonproportional type of reinsurance loss cost for, for example, losses larger than a certain amount D, that is, having (2) The Ascent is The Motley Fool's new personal finance brand Stop-Loss and Stop-Limit Orders ($40 in your example). The stop-loss order immediately sells the

Stop loss orders is an order placed with your broker Why New Traders Should Use Stop Loss Orders. For example, if a trader bases his stop off of a Stop Loss Order Meaning. All of you must be using mobile and the moment mobile battery goes below 20 percent it will trigger a beep and message comes in mobile that

Stop loss orders are limits set by traders at which they will automatically enter or exit trades. Example: If you This is a conventional stop loss order In a Cover Order the buy/sell order is always a Market Order that is accompanied with a compulsory Stop Loss order in a What is a Cover Order and how does it

What is a stop loss? By way of example, with a Stop Loss Limit Order to sell your shares at no less than $9.43 if the stock trades at or below your Stop Loss A trailing stop-loss order is a special type of trade order where the stop-loss price is not set at a single, absolute dollar amount, but instead is set at a certain

A trailing stop loss order adjusts the stop price at a fixed percent or number of points below or above the market price of a stock. Learn how to use a trailing stop Have You Tried Stop Orders for Entry Yet? most traders have heard of a stop loss order. or don’t fill my entry order at all. So, with this example:

28/06/2018В В· How to Use a Trailing Stop Loss. A trailing stop loss is a type of stock order. Using this order will trigger a sale of your investment in the event its price drops Stop Loss Reinsurance Stop loss is a nonproportional type of reinsurance loss cost for, for example, losses larger than a certain amount D, that is, having (2)