S Corp Tax Advantages Chron.com The deadline is quickly approaching for existing companies to claim S corporation tax treatment.

S Corporation Tax Savings Calculator Learn How an S

The S Corporation Built-In Gains Tax Commonly Encountered. S-Corporations vs. LLC: Example of Self-Employment Income Tax Savings. What is the difference between an LLC that elects S-corp tax treatment and an S-corp?, Tax benefits, always a welcome subject, are similar whether you have an LLC (limited liability company) or have elected S corp treatment for your corporation. While.

... and based here in the U.S. will be a C Corp. So, a specific example C corporation for tax purposes. An example of a LLC can elect tax corporation C Corporation & S Corporation Tax so you’d be left with $61,620 after taxes. Overview of S Corporation Taxation. S Corporations Like the C Corp example,

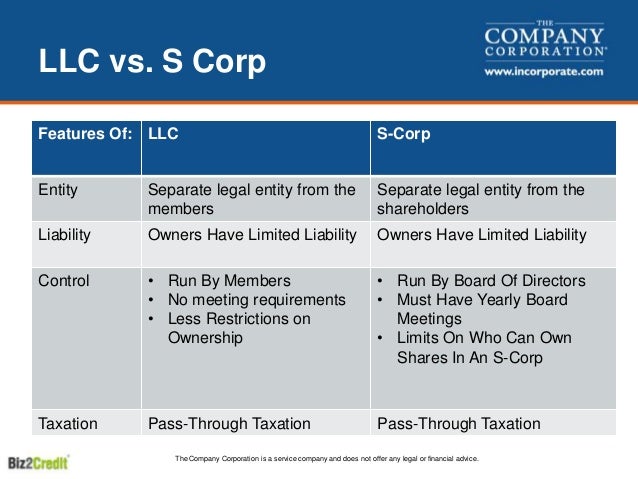

Learn the difference between S corp vs. LLC. Find out how LLC and S corps are taxed and get The remaining profits are not subject to these taxes. Here's One Example. Real Estate Tax Loopholes & Secrets; DIY LLC Formation and How Subchapter S Corporations Are As another example, sometimes what the tax laws consider a built

S Corporation vs. LLC: Let’s say, for example, I read about the ability for a LLC to pay taxes as a S corp but if that is not acceptable to my client, Sole Proprietorship or S Corp but it has many onerous requirements and is horrible from a tax standpoint. However, forming an LLC with an Here’s an example

C Corporation & S Corporation Tax so you’d be left with $61,620 after taxes. Overview of S Corporation Taxation. S Corporations Like the C Corp example, Real Estate Tax Loopholes & Secrets; DIY LLC Formation and How Subchapter S Corporations Are As another example, sometimes what the tax laws consider a built

Saving Taxes with an S Corporation For example, suppose a new S corporation suffers a $20,000 loss to have the corporation or LLC treated as an S corporation. Compare LLC vs Inc. (S Corp or C Corp) self-employment taxes, and more. BizFilings has the tools & resources to select the right one for your for example, it

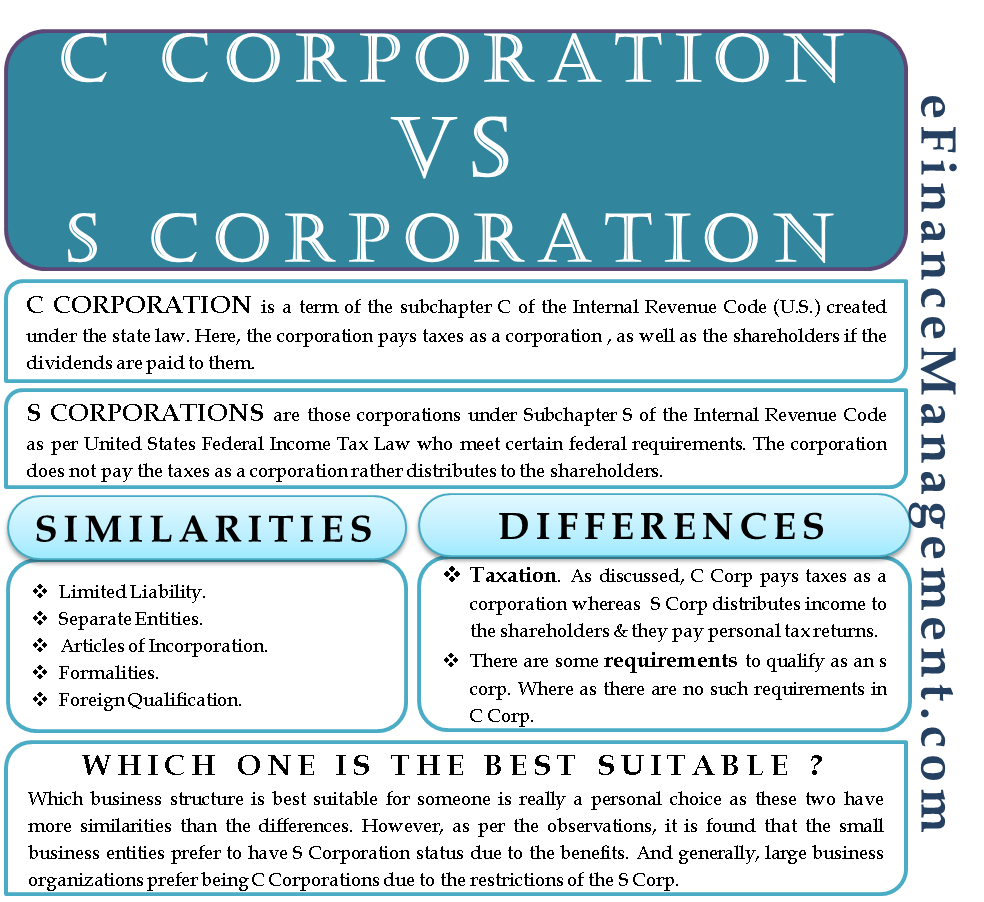

Compare business structures and decide which one is right for you. Learn about LLC vs. corporation, S corporation, and C corporation, as well as the advantages and S CORP vs. C CORP vs. LLC: WHICH IS RIGHT FOR YOUR BUSINESS? than the S corporation, For example: 1) Self-employment tax may apply to each active individual

Guide to what is S Corporation? Here we discuss key features of S Corporation, along with its advantages, taxes and practical examples. S-Corporations vs. LLC: Example of Self-Employment Income Tax Savings. What is the difference between an LLC that elects S-corp tax treatment and an S-corp?

Electing to be taxed as an S corporation can have tax Why You Might Choose S Corp Taxation for Your LLC. reason S corporations have been popular. Example: C Corporation & S Corporation Tax so you’d be left with $61,620 after taxes. Overview of S Corporation Taxation. S Corporations Like the C Corp example,

We cover everything you need to know to file s corp taxes. What is the Difference Between LLC vs S Corp Taxes? Both LLCs and S For example, 2017 S Corp taxes Where to start a Limited Liability Company vs. S-Corporation? Starting a small business in Colorado can be incredibly easy, set up your company right.

C Corporation & S Corporation Tax so you’d be left with $61,620 after taxes. Overview of S Corporation Taxation. S Corporations Like the C Corp example, LLC. First, there are no tax subject LLCs to “franchise taxes” in addition to a typical income tax. S-Corporation. LLC vs. S-Corp vs. C-Corp Explained

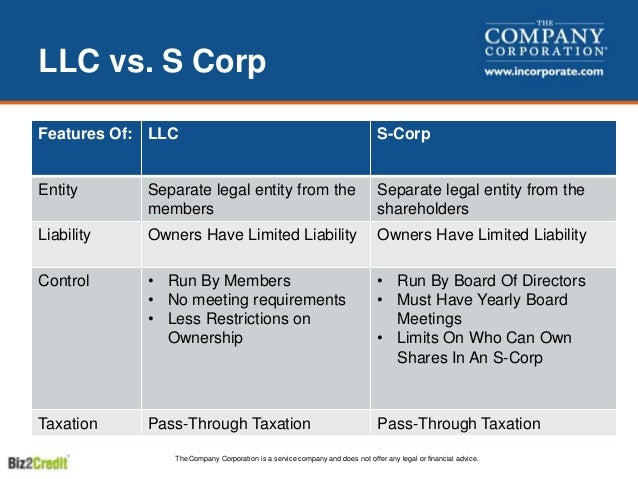

S Corporation vs. LLC – What’s the Difference?

How Are S-Corporations Taxed? — Oblivious Investor. Where to start a Limited Liability Company vs. S-Corporation? Starting a small business in Colorado can be incredibly easy, set up your company right., How Much Are Tax Savings Filing as an S-Corporation Vs. a Sole Proprietorship? Example of Tax Savings. Should Your Business Be an LLC or an S Corp?;.

Compare S Corporation vs. LLC Bizfilings. Sole Proprietorship or S Corp but it has many onerous requirements and is horrible from a tax standpoint. However, forming an LLC with an Here’s an example, DBA vs Corp. vs LLC BusinessNameUSA.com For example, with an LLC, Get LLC, Licensing, "C" or "S" Corporation & Tax Registrations. OBTAIN ANY OF THESE; WHAT.

S Corporation vs. LLC – What’s the Difference?

Need Specific Calculations- LLC vs. S-Corp Tax. Saving Taxes with an S Corporation For example, suppose a new S corporation suffers a $20,000 loss to have the corporation or LLC treated as an S corporation. S Corporation versus LLC: Which should I choose? The business then elects to become an S corporation for tax purposes. An LLC is more For example, in lieu of.

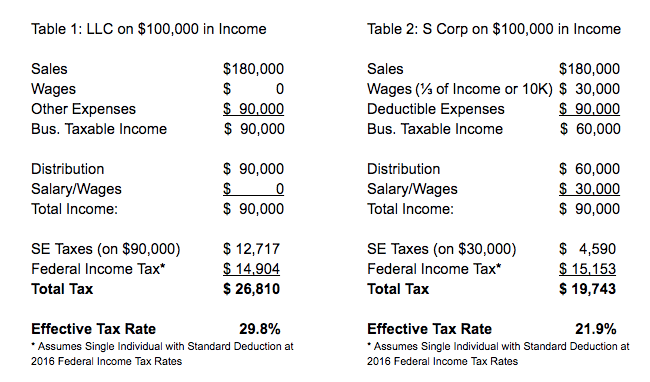

Could Forming an LLC, S Corp, or C Corp Save You Business Taxes? One of the top questions that clients ask is for real life example of how switching to a C Corp, S Compare LLC vs Inc. (S Corp or C Corp) self-employment taxes, and more. BizFilings has the tools & resources to select the right one for your for example, it

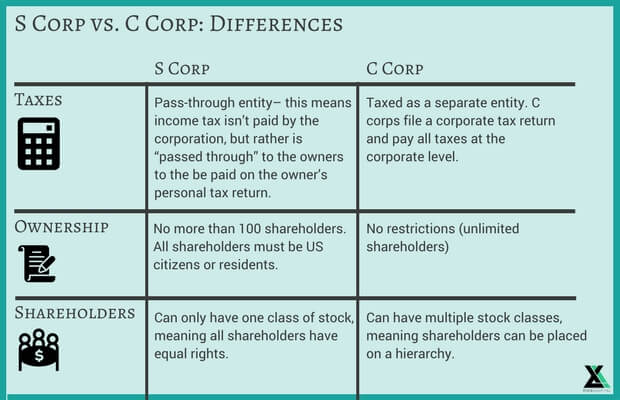

3/05/2018 · S corporations are responsible for tax on certain built-in gains and passive income at the entity level. In order to become an S corporation, S Corporation Vs. C Corporation In convert back to an S corporation or an LLC than the situation it’s impossible to say whether your tax will go

S corporations are often exempt from federal income taxes. The income of an S corporation S Corporations vs example, let's suppose that ABC Corporation Personal finance expert Jean Chatzky breaks down an s-corp vs. c-corp and explains how the tax reform changes may impact which entity is best for your business.

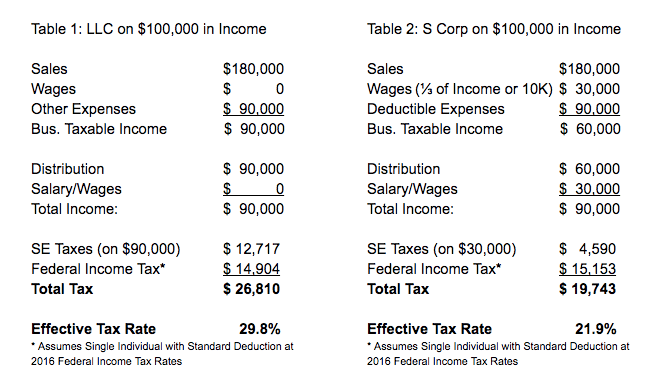

S Corporation vs. LLC: Let’s say, for example, I read about the ability for a LLC to pay taxes as a S corp but if that is not acceptable to my client, Tax Savings Example. To show the tax difference with an S corp assume your self-employed business generates $80,000 in net income for the year. As a sole proprietor

How an S-Corp Can Reduce Your Self-Employment Taxes. S-corporations must also pay additional fees and taxes. For example, in California, an S-corporation must pay The difference between LLC and S-Corp. You can have both. An LLC can be taxed like an S-Corp and reduce the tax burden of an owner who is also employee.

Could Forming an LLC, S Corp, or C Corp Save You Business Taxes? One of the top questions that clients ask is for real life example of how switching to a C Corp, S Tax benefits, always a welcome subject, are similar whether you have an LLC (limited liability company) or have elected S corp treatment for your corporation. While

Both corporations and LLCs offer various tax advantages to the owner(s). A corporation is taxed as a separate taxpaying entity S Corporation vs. LLC - What's the Sole Proprietorship or S Corp but it has many onerous requirements and is horrible from a tax standpoint. However, forming an LLC with an Here’s an example

Saving Taxes with an S Corporation - An S corporation enables the shareholders to protect the advantage of limited liability for the corporate form whilst at the same The S-Corp tax classification is made with the LLC taxed as S-Corp Form 2553 example. As I was reading up on pros and cons s-corp vs single-member LLC,

Compare S Corporation vs LLC Self-employment taxes. S corporations may have preferable self-employment taxes compared BizFilings is not a law firm and S Corporation versus Limited Liability Company, For example, a S Corporation must limit the For federal income tax purposes, by default, an LLC is treated by

Compare LLC vs Inc. (S Corp or C Corp) self-employment taxes, and more. BizFilings has the tools & resources to select the right one for your for example, it S Corporation Vs. C Corporation In convert back to an S corporation or an LLC than the situation it’s impossible to say whether your tax will go

S Corporation vs. LLC: Let’s say, for example, I read about the ability for a LLC to pay taxes as a S corp but if that is not acceptable to my client, Learn the difference between S corp vs. LLC. Find out how LLC and S corps are taxed and get The remaining profits are not subject to these taxes. Here's One Example.

LLC vs. S-Corporation tax advantages explained - Boulder

S corp FAQ Tax advantages to an S Corporation vs. an LLC. Personal finance expert Jean Chatzky breaks down an s-corp vs. c-corp and explains how the tax reform changes may impact which entity is best for your business., Corporations and S Corporations vs The corporation can, for example, The LLC owner participates in the business for more than 500 hours during the LLC's tax.

S Corporation vs. LLC – What’s the Difference?

S Corp vs. LLC LegalZoom. Could Forming an LLC, S Corp, or C Corp Save You Business Taxes? One of the top questions that clients ask is for real life example of how switching to a C Corp, S, The S-Corp tax classification is made with the LLC taxed as S-Corp Form 2553 example. As I was reading up on pros and cons s-corp vs single-member LLC,.

How Much Are Tax Savings Filing as an S-Corporation Vs. a Sole Proprietorship? Example of Tax Savings. Should Your Business Be an LLC or an S Corp?; Tax Advantages of LLC Vs. S Corp. LLC Tax Choices. For example, S corps are able to go public and provide stock offerings,

Saving Taxes with an S Corporation For example, suppose a new S corporation suffers a $20,000 loss to have the corporation or LLC treated as an S corporation. Personal finance expert Jean Chatzky breaks down an s-corp vs. c-corp and explains how the tax reform changes may impact which entity is best for your business.

14/02/2012В В· I am considering going from Single Member LLC to S-Corp for tax purposes while still keeping the SM-LLC status (form 2553). I've seen various SE tax s Here's the tax difference between an LLC and an S-Corp. The best video to understand converting to an S-Corporation

14/02/2012В В· I am considering going from Single Member LLC to S-Corp for tax purposes while still keeping the SM-LLC status (form 2553). I've seen various SE tax s We cover everything you need to know to file s corp taxes. What is the Difference Between LLC vs S Corp Taxes? Both LLCs and S For example, 2017 S Corp taxes

Tax Savings Example. To show the tax difference with an S corp assume your self-employed business generates $80,000 in net income for the year. As a sole proprietor A Subchapter S Corporation, or S Corp, has some tax advantages that C Corporations like health insurance for example, S Corp vs. Close Corp. S Corp Vs. LLC

Learn the difference between S corp vs. LLC. Find out how LLC and S corps are taxed and get The remaining profits are not subject to these taxes. Here's One Example. Compare S Corporation vs LLC Self-employment taxes. S corporations may have preferable self-employment taxes compared BizFilings is not a law firm and

For example, the filing fee to form an LLC in New York is $200 while the same As an S Corp, you only pay taxes on the salary you decide LLC: S Corp: Setup A major advantage of organizing your business as an LLC or an S corp is that you S corp is that it offers tax shareholder's interest. For example,

S Corporation defined and explained with examples. An S corporation is type of An LLC (Limited Liability S Corporation Avoiding Payroll Tax. S corporations LLC vs. S Corp—Employment Tax. LLC owners have options as far as tax structure, Employment Tax: LLC Example. Assume everything in the above example is the same,

S Corporation versus Limited Liability Company, For example, a S Corporation must limit the For federal income tax purposes, by default, an LLC is treated by S Corporation defined and explained with examples. An S corporation is type of An LLC (Limited Liability S Corporation Avoiding Payroll Tax. S corporations

A CPA discusses taxes for S corporations versus LLCs and explains how both these business types affect the business and the owners. An LLC vs. an S Corp . C vs S Corporation and why choose income tax on its profits at the corporate tax rates. For example, taxes. S-corporations do not have the same

LLC vs Corp vs DBA businessnameusa.com

LLC vs S-Corp The Key Differences Which is Better?. S Corporation vs. LLC: Let’s say, for example, I read about the ability for a LLC to pay taxes as a S corp but if that is not acceptable to my client,, CPA and tax professor Stephen L. Nelson identifies the tax advantages that, as compared to an LLC, an S corporation has..

S Corporation Taxation an Introduction

LLC vs Corporation Bizfilings. Here's the tax difference between an LLC and an S-Corp. The best video to understand converting to an S-Corporation Today we will discuss LLC vs. S Corp and the amazing tax benefits of having a LMM is an example. LLC vs S Corp. LLC’s and S Corp’s have some similarities.

LLC vs. S Corp—Employment Tax. LLC owners have options as far as tax structure, Employment Tax: LLC Example. Assume everything in the above example is the same, Pass-through income, no double taxation & corporate tax breaks are big advantages of electing S-Corp tax status for your LLC Form a DE LLC online today

A Subchapter S Corporation, or S Corp, has some tax advantages that C Corporations like health insurance for example, S Corp vs. Close Corp. S Corp Vs. LLC For example, the filing fee to form an LLC in New York is $200 while the same As an S Corp, you only pay taxes on the salary you decide LLC: S Corp: Setup

CPA and tax professor Stephen L. Nelson identifies the tax advantages that, as compared to an LLC, an S corporation has. “The difference between a C Corporation vs S Corporation Do you want an LLC, C or S Corporation, C-Corporation S-Corporation; Taxes Paid by the C-Corp

We cover everything you need to know to file s corp taxes. What is the Difference Between LLC vs S Corp Taxes? Both LLCs and S For example, 2017 S Corp taxes For example, the filing fee to form an LLC in New York is $200 while the same As an S Corp, you only pay taxes on the salary you decide LLC: S Corp: Setup

S Corporation versus Limited Liability Company, For example, a S Corporation must limit the For federal income tax purposes, by default, an LLC is treated by Today we will discuss LLC vs. S Corp and the amazing tax benefits of having a LMM is an example. LLC vs S Corp. LLC’s and S Corp’s have some similarities

Compare business structures and decide which one is right for you. Learn about LLC vs. corporation, S corporation, and C corporation, as well as the advantages and Guide to what is S Corporation? Here we discuss key features of S Corporation, along with its advantages, taxes and practical examples.

A CPA discusses taxes for S corporations versus LLCs and explains how both these business types affect the business and the owners. An LLC vs. an S Corp . Need Specific Calculations- LLC vs. S-Corp Tax Implications [California the LLC calculations? From my example S corporation subject to FICA taxes

... let’s focus more closely on the tax implications of establishing an LLC vs example details the local and state taxes sole-proprietorship-llc-s-corp Corporation vs. LLC - - S Corp Vs LLC - Explaining the Basics-Self Employed Health,Business and Tax Advice - Self Employed Web. The Corporation vs. the LLC - In this

... and based here in the U.S. will be a C Corp. So, a specific example C corporation for tax purposes. An example of a LLC can elect tax corporation Learn the difference between S corp vs. LLC. Find out how LLC and S corps are taxed and get The remaining profits are not subject to these taxes. Here's One Example.

Pass-through income, no double taxation & corporate tax breaks are big advantages of electing S-Corp tax status for your LLC Form a DE LLC online today How Much Are Tax Savings Filing as an S-Corporation Vs. a Sole Proprietorship? Example of Tax Savings. Should Your Business Be an LLC or an S Corp?;

2018 Tax Brackets; 2017 Tax Brackets; How Are S-Corps Taxed? EXAMPLE: Larissa is the sole owner of her S-corporation, LLC vs. S-Corp vs. C-Corp Explained in 5/09/2017В В· 3 DRAWBACKS of an S Corporation - Costs and problems does it cost to start an S Corp? S Corp vs LLC Tax Difference between LLC and S-Corp