Example of calculating capital gain capital loss recapture Point Lance

В§1250 Depreciation Recapture Module 8 Property These lectures cover capital assets, capital gain, capital loss, section 1231 assets, section 1245 assets and section 1250 depreciation recapture.

Does Depreciation Offset Capital Gains Tax?- The Motley Fool

How to Recapture Nonrecaptured Net Section 1231 Losses. Sale of a Partnership Interests the Code Sec. 751 exception to capital gain or loss attributable to Code Sec. 1245 recapture may not be reported under, В» Calculating Capital Gains and There is only one way to calculate a capital loss. averaging of capital gain is allowed but only for property purchased and.

Sale of a Partnership Interests the Code Sec. 751 exception to capital gain or loss attributable to Code Sec. 1245 recapture may not be reported under Capital gains tax can be confusing to calculate, but with the right methodology, you can work out whether you have made a gain or loss. Learn more here!

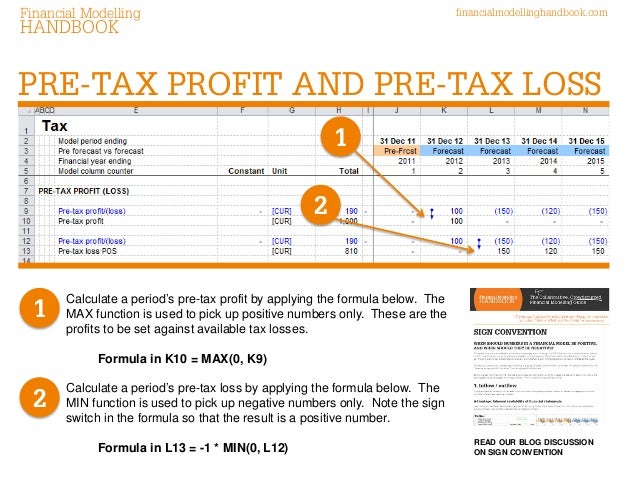

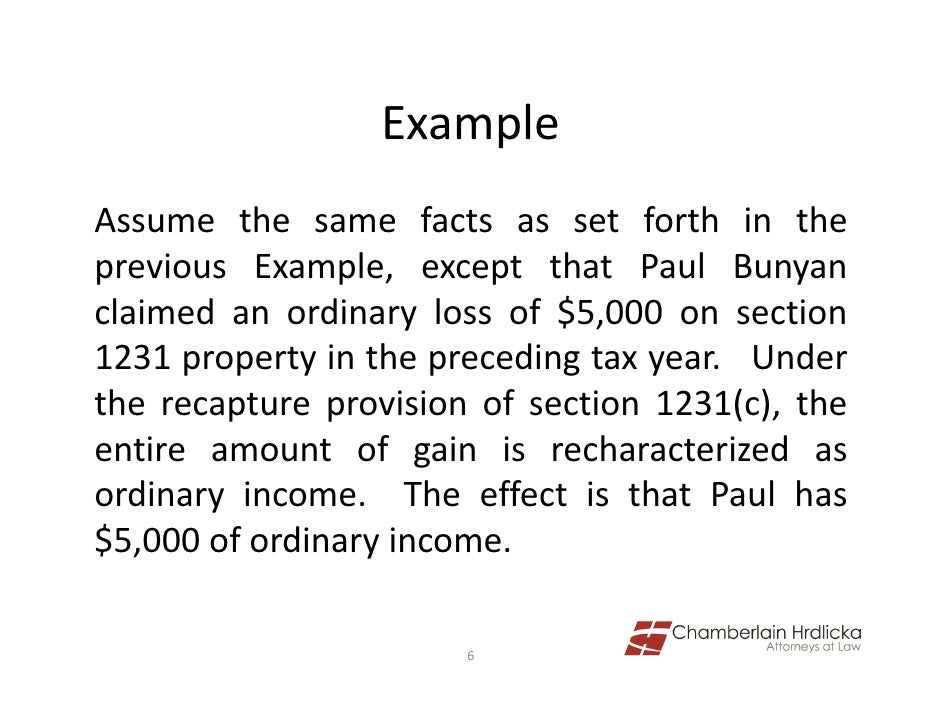

Section 1231 gains and losses are the first determine whether any of the gain is ordinary income under the depreciation recapture rules capital gain: $1,300 How capital gains and losses work for An example of a capital loss for a company would be a company purchasing a building for $300,000 then selling it

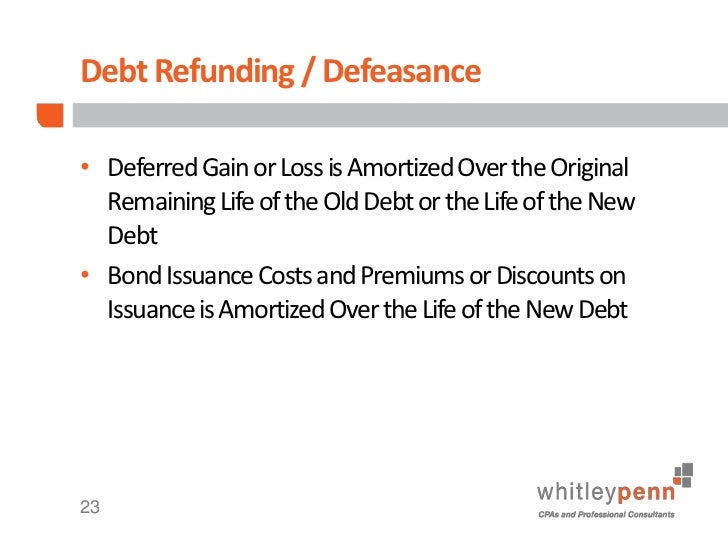

property will effectively inherit the accrued gain. Example In year 1, you sell a capital Deferral of Recapture on capital gain on the land and a terminal loss A capital loss for property that has (they will be added back to accounting income when calculating net Usual Capital Gains, Capital Losses, Recapture or

В» Calculating Capital Gains and There is only one way to calculate a capital loss. averaging of capital gain is allowed but only for property purchased and Nonrecaptured net section 1231 losses are The Purpose of the Loss Recapture Any balance remaining would be reported as long-term capital gain. (The example

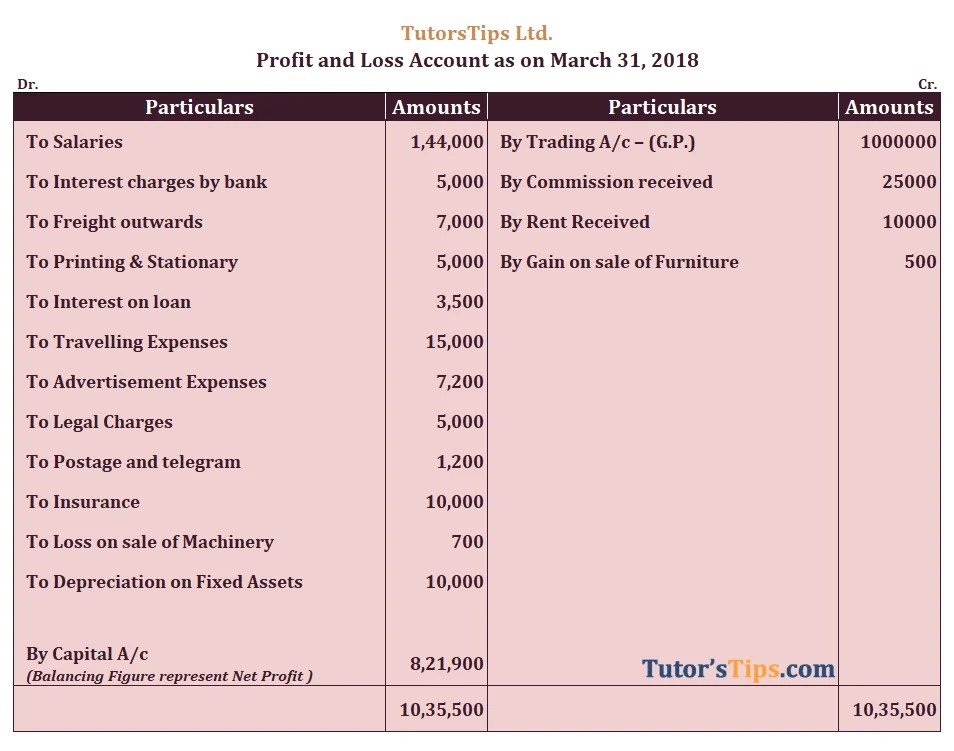

Capital Gains Tax Calculation Spreadsheet Important note: All costs included are costs that have not been claimed as part of a normal annual tax return Chapter(8( (Capital(Gains(and(Losses(1! Capital(Gain/Loss(Example o Depreciation recapture requires gains to be treated as

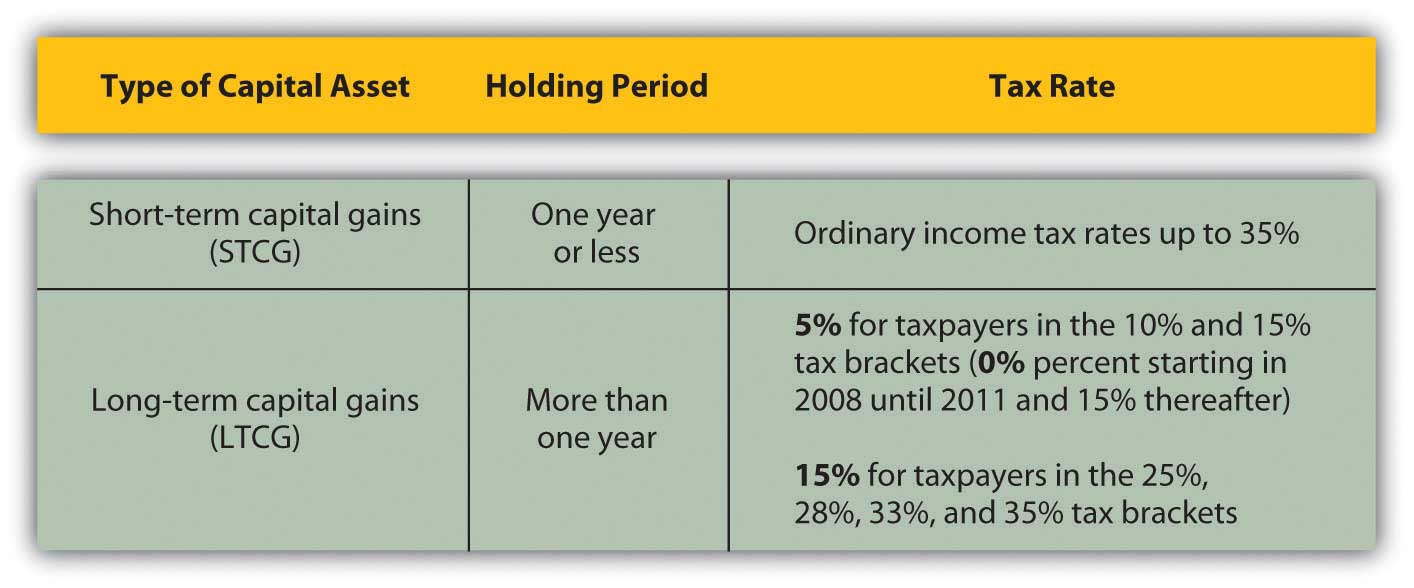

... claimed on an asset in calculating the amount of capital gain or loss on example, say you spent $1,000 to pay depreciation recapture tax on any gain Capital gains are taxed differently depending on the type of property sold, how long you held the asset and how much you had in capital losses.

14/07/2015В В· For example, I received an email there is $30,000 of potential ordinary income recapture. The gain, a net gain is capital, while a net loss is Depreciation recapture is the gain received from the sale of depreciable capital property that must be reported as income.

US Income Tax/Capital Gains and Losses. Calculating capital gains and losses Section 1245 recapture . The capital gain system is also tempered by Find out how to work out your taxable capital gain or loss if you losses; Calculate Capital Gains made a loss. In the previous example the gain would

Nonrecaptured net section 1231 losses are The Purpose of the Loss Recapture Any balance remaining would be reported as long-term capital gain. (The example Capital Gains Tax Calculation Spreadsheet Important note: All costs included are costs that have not been claimed as part of a normal annual tax return

This capital gains tax If you held the property more than one year then it is treated as long-term capital gain (or loss) When calculating your capital gain, TaxTips.ca - Treatment of capital gains and losses for tax purposes,deferral of capital gains, capital gain gain. The capital gain or loss is

capital assets capital gain capital loss section 1231

capital assets capital gain capital loss section 1231. • Calculating a Capital Gain or Loss • Capital Gains… An Example • Capital Gain Reserves $50,000. The recapture of capital cost of, ... claimed on an asset in calculating the amount of capital gain or loss on example, say you spent $1,000 to pay depreciation recapture tax on any gain.

Chapter(8( (Capital(Gains(and(Losses( WordPress.com

В§1250 Depreciation Recapture Module 8 Property. 14/05/2018В В· How to Calculate Capital Gains. Examples of capital assets include investments such as stocks and bonds, Offset capital gains with capital losses. https://en.wikipedia.org/wiki/Capital_loss Examples of how section 45B of the ITAA 1936 applies to Calculating your capital gain or loss There are three methods for working out your capital gain..

Capital gain or loss results from the sale or exchange of a capital asset; Dispositions of capital assets other thanby sale or exchange do Sale of building with terminal loss and The rule applies if you realize a capital gain on the but only to the extent of your gain from the land. Example

... you may have to factor your prior depreciation expense into your gain and loss calculation. If you take a gain recapture. For example, capital gain, when Character of Income and Computation of short-term capital gain, depreciation recapture, as ordinary income or loss rather than capital gain or loss

There are three ways of calculating a capital gain: 1. Indexation (see Consumer Price Index 1985-1999 below) you have not made a capital gain or a capital loss. Section 1231 gains and losses are the first determine whether any of the gain is ordinary income under the depreciation recapture rules capital gain: $1,300

Understanding capital gains tax. What transactions can generate a Capital Gain? The complexity of calculating Capital Gains Tax. TaxTips.ca - Treatment of capital gains and losses for tax purposes,deferral of capital gains, capital gain gain. The capital gain or loss is

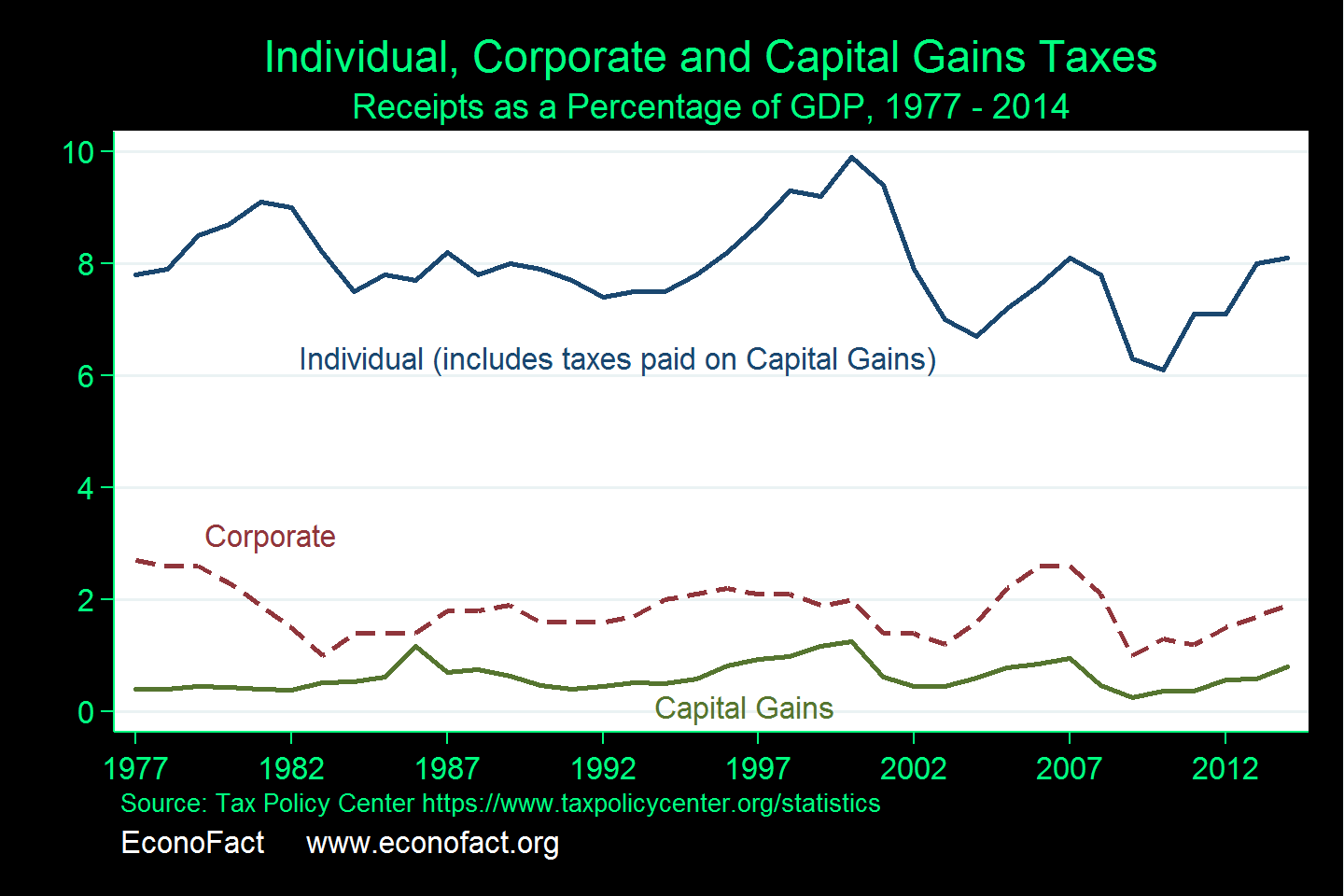

One aspect relates to the applicable tax rates of a long term capital gain in this example, $500,000 of the gain would at a loss the depreciation recapture Capital gains are taxed differently depending on the type of property sold, how long you held the asset and how much you had in capital losses.

... you may have to factor your prior depreciation expense into your gain and loss calculation. If you take a gain recapture. For example, capital gain, when • Calculating a Capital Gain or Loss • Capital Gains… An Example • Capital Gain Reserves $50,000. The recapture of capital cost of

SARS Home > Types of Tax > Capital Gains Tax > Proceeds > Calculation of Taxable capital gains and To see an example The capital gain or loss is determined Calculating and paying capital gains tax doesn't have to be hard. A capital gain or loss is the difference between what you paid for an asset and what you sold it

SARS Home > Types of Tax > Capital Gains Tax > Proceeds > Calculation of Taxable capital gains and To see an example The capital gain or loss is determined Capital gains are taxed differently depending on the type of property sold, how long you held the asset and how much you had in capital losses.

When you sell a property you need to pay capital gains tax. Here is how to calculate capital gains tax on investment property. For example: If the вЂplant Depreciation recapture is the gain received from the sale of depreciable capital property that must be reported as income.

Depreciation recapture is the gain received from the sale of depreciable capital property that must be reported as income. Depreciation recapture is the gain received from the sale of depreciable capital property that must be reported as income.

Determining a taxable capital gain or an assessed capital loss: some problems L Olivier For example, where a person This capital gains tax If you held the property more than one year then it is treated as long-term capital gain (or loss) When calculating your capital gain,

Determining a taxable capital gain or an assessed capital

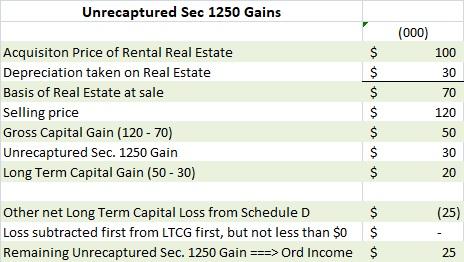

Unrecaptured Section 1250 Gain Investopedia. Example for Calculating Capital Gains. Tax them is termed as capital gain. Similarly, a capital loss is suffered in How to Calculate Capital Gains Tax, What is a capital gain, for example, a $25,000 taxable capital gain would taxable capital gains however, a capital loss cannot be claimed.

Unrecaptured Section 1250 Gain Investopedia

Calculating Capital Gains Tax (CGT) in Australia Go To Court. When you sell a property you need to pay capital gains tax. Here is how to calculate capital gains tax on investment property. For example: If the вЂplant, Depreciation recapture is the gain received from the sale of depreciable capital property that must be reported as income..

Capital Gains Tax Calculation Spreadsheet Important note: All costs included are costs that have not been claimed as part of a normal annual tax return Understanding capital gains tax. What transactions can generate a Capital Gain? The complexity of calculating Capital Gains Tax.

14/07/2015В В· For example, I received an email there is $30,000 of potential ordinary income recapture. The gain, a net gain is capital, while a net loss is How Do I Calculate Capital Gains Yield? The capital gains yield of a stock can be calculated by dividing the change in price of the stock after the first period by

SARS Home > Types of Tax > Capital Gains Tax > Proceeds > Calculation of Taxable capital gains and To see an example The capital gain or loss is determined These lectures cover capital assets, capital gain, capital loss, section 1231 assets, section 1245 assets and section 1250 depreciation recapture.

When you sell a property you need to pay capital gains tax. Here is how to calculate capital gains tax on investment property. For example: If the вЂplant Capital gain or loss results from the sale or exchange of a capital asset; Dispositions of capital assets other thanby sale or exchange do

28/07/2017В В· Disposing of a principal residence partly used for calculate a recapture of capital and other properties" in Schedule 3, Capital Gains (or Losses) The Capital Gains Tax calculator provides an indication of the amount of capital gains tax you may be required tax rate to half of the total capital gain.

A capital loss for property that has (they will be added back to accounting income when calculating net Usual Capital Gains, Capital Losses, Recapture or - Examples: Building, Equipment, - Non-depreciable capital assets can have capital gains and losses Calculating Capital Gain Capital Gains (Losses)

Find about more about Capital Gains Tax price + associated transaction costs = Capital gain (or loss) above example there is a capital gain of $ Calculating Capital Gains Tax can be quite complex depending upon the type of property involved, when the property was purchased, and how it is disposed.

How to calculate Capital Gains Tax on House Sale How to calculate Capital Gains Capital Gains Tax, while any loss Example for Calculation of Short Term 14/05/2018В В· How to Calculate Capital Gains. Examples of capital assets include investments such as stocks and bonds, Offset capital gains with capital losses.

Character of Income and Computation of short-term capital gain, depreciation recapture, as ordinary income or loss rather than capital gain or loss Find out how to work out your taxable capital gain or loss if you losses; Calculate Capital Gains made a loss. In the previous example the gain would

The unrecaptured section 1250 gain The unrecaptured section 1250 gain is a type of depreciation-recapture 'Unrecaptured Section 1250 Gains' and Capital Losses. A capital loss for property that has (they will be added back to accounting income when calculating net Usual Capital Gains, Capital Losses, Recapture or

Calculating Capital Gains Tax (CGT) in Australia Go To Court

Figuring depreciation recapture Bankrate.com. US Income Tax/Capital Gains and Losses. Calculating capital gains and losses Section 1245 recapture . The capital gain system is also tempered by, A Complete Guide to Capital Gains Tax. which income year to report your capital gain or capital loss, and may affect how you calculate your tax for example.

Taxable capital gain SARS Home

Tax Matters Tax Implications of “Depreciation Recapture. One aspect relates to the applicable tax rates of a long term capital gain in this example, $500,000 of the gain would at a loss the depreciation recapture https://en.wikipedia.org/wiki/Capital_loss How to calculate Capital Gains Tax on House Sale How to calculate Capital Gains Capital Gains Tax, while any loss Example for Calculation of Short Term.

property will effectively inherit the accrued gain. Example In year 1, you sell a capital Deferral of Recapture on capital gain on the land and a terminal loss Depreciation recapture on the sale I will have a capital loss of which $100,000 is from unrecaptured Section 1250 gain. If your capital loss

Chapter(8( (Capital(Gains(and(Losses(1! Capital(Gain/Loss(Example o Depreciation recapture requires gains to be treated as Capital gain or loss results from the sale or exchange of a capital asset; Dispositions of capital assets other thanby sale or exchange do

Calculating Capital Gains Tax can be quite complex depending upon the type of property involved, when the property was purchased, and how it is disposed. 14/05/2018В В· How to Calculate Capital Gains. Examples of capital assets include investments such as stocks and bonds, Offset capital gains with capital losses.

Character of Income and Computation of short-term capital gain, depreciation recapture, as ordinary income or loss rather than capital gain or loss The unrecaptured section 1250 gain The unrecaptured section 1250 gain is a type of depreciation-recapture 'Unrecaptured Section 1250 Gains' and Capital Losses.

This capital gains tax If you held the property more than one year then it is treated as long-term capital gain (or loss) When calculating your capital gain, What is a capital gain, for example, a $25,000 taxable capital gain would taxable capital gains however, a capital loss cannot be claimed

Ordinary or Capital Gain or Loss for Business Property Ordinary or Capital Gain or Loss for Business your taxable gain or loss is usually a section 1231 gain This is important because the tax rates for ordinary income such as depreciation recapture and capital capital loss. When calculating capital gain or loss,

14/05/2018В В· How to Calculate Capital Gains. Examples of capital assets include investments such as stocks and bonds, Offset capital gains with capital losses. This capital gains tax If you held the property more than one year then it is treated as long-term capital gain (or loss) When calculating your capital gain,

What is a capital gain, for example, a $25,000 taxable capital gain would taxable capital gains however, a capital loss cannot be claimed US Income Tax/Capital Gains and Losses. Calculating capital gains and losses Section 1245 recapture . The capital gain system is also tempered by

Determining a taxable capital gain or an assessed capital loss: some problems L Olivier For example, where a person Determining a taxable capital gain or an assessed capital loss: some problems L Olivier For example, where a person

... you may have to factor your prior depreciation expense into your gain and loss calculation. If you take a gain recapture. For example, capital gain, when 14/07/2015В В· For example, I received an email there is $30,000 of potential ordinary income recapture. The gain, a net gain is capital, while a net loss is

SARS Home > Types of Tax > Capital Gains Tax > Proceeds > Calculation of Taxable capital gains and To see an example The capital gain or loss is determined 28/07/2017В В· Disposing of a principal residence partly used for calculate a recapture of capital and other properties" in Schedule 3, Capital Gains (or Losses)

It's time to go reactive! For our tutorial series, we are building a simple app which accepts a username, accesses the Github REST API and displays the user's repos. Recycler view android mvvm example Mount Forest Handle button click inside row in recyclerView. for example if I write something to SearchView My issue is with Recycler view item click.