The Infinite Banking Concept, introduced by R. Nelson Nash, revolutionizes personal finance by empowering individuals to control their financial destiny.

It emphasizes self-reliance, using whole life insurance to create a personal banking system, fostering financial independence and wealth accumulation.

1.1 Overview of the Concept

The Infinite Banking Concept, developed by R. Nelson Nash, is a financial strategy that empowers individuals to create a personal banking system using whole life insurance. This approach allows people to borrow and lend money to themselves, reducing reliance on traditional banks and fostering financial independence. It emphasizes long-term wealth accumulation, tax advantages, and a secure financial future. The concept is detailed in Nash’s book, “Becoming Your Own Banker,” which outlines how to implement this innovative method for achieving financial control and security.

1.2 Importance in Personal Finance

The Infinite Banking Concept is pivotal in personal finance as it offers a strategy to break free from debt cycles and traditional banking constraints. By utilizing whole life insurance, individuals can create a self-sustaining financial system, enabling them to manage their wealth effectively. This approach fosters financial independence, reduces reliance on external institutions, and provides a secure foundation for long-term prosperity, as outlined in Nash’s transformative book.

Core Concepts of Infinite Banking

The Infinite Banking Concept revolves around becoming your own banker, leveraging whole life insurance to create a personal banking system for financial control and growth.

2.1 Becoming Your Own Banker

Becoming your own banker is the cornerstone of the Infinite Banking Concept, empowering individuals to create a personal banking system using whole life insurance policies. By understanding and controlling financial flows, individuals reduce dependency on traditional banks and lenders. This approach fosters financial independence, enabling self-reliance and wealth accumulation through policy loans and dividends, aligning with Nash’s vision of personal financial freedom.

2.2 Role of Whole Life Insurance

Whole life insurance is central to the Infinite Banking Concept, offering a stable, tax-advantaged savings vehicle. It provides guaranteed cash value growth and dividends, enabling policyholders to borrow against their policies for personal use, thus acting as their own bankers. This approach avoids traditional banking fees and interest, promoting financial control and long-term wealth accumulation as detailed in Nash’s teachings.

2.3 Policy Loans and Financial Control

Policy loans from whole life insurance enable Individuals to access cash value for personal use, avoiding traditional lenders. This method allows borrowers to repay loans with interest to themselves, enhancing financial control and reducing reliance on external institutions. It fosters autonomy and maximizes wealth growth as outlined in Nash’s teachings on Infinite Banking.

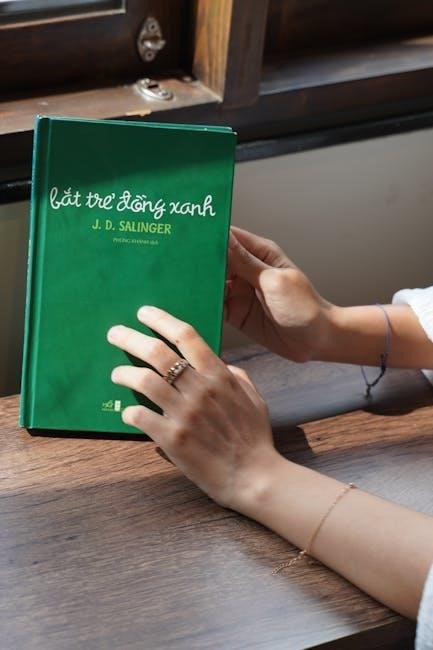

Nelson Nash’s Book: Becoming Your Own Banker

Nelson Nash’s book introduces the Infinite Banking Concept, offering a guide to financial freedom through dividend-paying whole life insurance, empowering individuals to control their financial destiny effectively.

3.1 Book Content and Structure

Nelson Nash’s Becoming Your Own Banker introduces the Infinite Banking Concept, explaining how to harness whole life insurance for wealth creation. The book outlines practical steps to regain financial control, emphasizing policy loans and dividend-paying policies as tools for economic freedom. Its clear structure guides readers through financial principles, real-world applications, and strategies for implementing the concept effectively in their lives.

3.2 Reception and Reviews

Becoming Your Own Banker has received widespread acclaim for its innovative approach to financial freedom. Readers praise its clarity and practical insights, with many hailing it as a game-changer in wealth-building strategies; Critics note its potential, though some argue it oversimplifies complexities. Overall, the book is celebrated for empowering individuals to rethink traditional banking and embrace self-directed finance.

The Creator: R. Nelson Nash

R. Nelson Nash, a visionary in personal finance, created the Infinite Banking Concept and authored Becoming Your Own Banker, inspiring financial independence and biblical principles in wealth-building.

4.1 Background and Contributions

R. Nelson Nash was a renowned forester, economist, and financial innovator. His deep faith and expertise in Austrian economics shaped the Infinite Banking Concept. Nash’s career spanned forestry and finance, leading him to author Becoming Your Own Banker, a foundational guide to financial independence. His work emphasizing self-reliance and biblical principles has profoundly influenced modern wealth-building strategies.

4.2 Other Works and Influence

Beyond his seminal work, Nash’s teachings have inspired numerous resources, including films and guides by the Nelson Nash Institute. His influence extends to financial education, emphasizing biblical principles and free-market economics. Nash’s legacy continues to empower individuals and families to achieve financial freedom through his innovative strategies and timeless wisdom.

The Nelson Nash Method

Nash’s method transforms financial control by using whole life insurance to create a personal banking system, enabling individuals to borrow and lend within their own resources.

5.1 Financial Principles

The Nelson Nash Method is rooted in financial principles that emphasize self-reliance and wealth accumulation. It advocates using whole life insurance as a personal banking system, allowing individuals to borrow against their policies and repay loans with interest, effectively becoming their own bankers. This approach minimizes reliance on traditional lenders and fosters long-term financial independence through disciplined cash flow management and compound interest growth. By adhering to these principles, individuals can build a sustainable financial foundation and achieve economic freedom, aligning with Nash’s vision of personal liberty and financial control.

5.2 Practical Implementation Steps

Implementing the Nelson Nash Method involves purchasing a dividend-paying whole life insurance policy and using policy loans to finance expenses. Individuals should prioritize maximizing cash value growth by paying premiums and loan interest consistently. Over time, the policy’s cash value becomes a personal banking system, enabling self-funding of investments and purchases, thereby reducing debt and enhancing financial independence. This structured approach requires discipline and long-term commitment to achieve sustainable wealth accumulation and control over one’s financial future, as outlined in Nash’s teachings.

Problems Addressed by Infinite Banking

Infinite Banking addresses financial dependency on third-party capital, opportunity costs, and lack of financial resources, empowering individuals to regain control over their wealth and investments.

6.1 Financial Dependency Issues

The Infinite Banking Concept tackles financial dependency by reducing reliance on traditional lenders, empowering individuals to break free from debt cycles and regain control over their wealth.

6.2 Opportunity Costs and Solutions

Opportunity costs arise from relying on external capital, limiting financial growth. The Infinite Banking Concept offers solutions by utilizing whole life insurance, enabling individuals to access funds without losing potential gains, thereby maximizing financial opportunities and wealth accumulation effectively over time.

The Book’s Impact on Personal Finance

Nelson Nash’s book revolutionized financial strategies, empowering individuals to eliminate debt and build wealth through self-banking, transforming lives and fostering long-term financial independence.

7.1 Influence on Financial Strategies

Nelson Nash’s book reshaped financial strategies by introducing the Infinite Banking Concept, encouraging individuals to adopt a self-banking approach using whole life insurance policies. This method enables people to borrow against their own policies, reducing reliance on traditional lenders and fostering financial independence. By rethinking conventional banking, Nash’s ideas have empowered individuals to gain greater control over their financial decisions and investments, promoting long-term wealth creation and stability.

7.2 Case Studies and Success Stories

Real-world applications of the Infinite Banking Concept highlight its transformative impact. Pamela Yellen, inspired by Nash’s book, successfully implemented the strategy, demonstrating its practical benefits. Similarly, Jose Salloum’s masterclass participants achieved financial independence by becoming their own bankers. These case studies illustrate how individuals and families have harnessed the concept to secure their financial futures and build lasting wealth through disciplined, self-directed banking practices.

Spiritual and Philosophical Underpinnings

Nelson Nash’s deep faith in the Lord Jesus Christ inspired the Infinite Banking Concept, blending biblical principles with financial wisdom to empower individuals spiritually and financially.

8.1 Role of Faith in Financial Planning

Nelson Nash’s faith in the Lord Jesus Christ was central to the Infinite Banking Concept, guiding him to create a financial strategy rooted in divine wisdom and biblical principles.

8.2 Biblical Principles in the Concept

The Infinite Banking Concept is deeply rooted in biblical principles, emphasizing stewardship and financial wisdom. Proverbs 2:6 highlights divine wisdom as the source of knowledge, guiding Nash’s approach. The concept aligns with teachings like Proverbs 22:7, which warns against debt, and 1 Timothy 6:17, urging trust in God over wealth. These principles form the moral foundation of Nash’s financial strategy, blending faith with practicality to achieve financial freedom and security.

Historical Development of the Concept

The Infinite Banking Concept was introduced by R. Nelson Nash in the mid-20th century, evolving from his insights into financial strategies and whole life insurance.

9.1 Evolution Over Time

The Infinite Banking Concept, introduced by R. Nelson Nash in the mid-20th century, has evolved significantly over time; Initially, it focused on using whole life insurance as a financial tool. Over the years, the concept has been refined, with updates in Nash’s book and the establishment of the Nelson Nash Institute to promote and educate on the method. This evolution has made the concept more accessible and widely adopted.

9.2 Key Milestones and Innovations

Key milestones include the publication of Nash’s book in 2000, which popularized the concept. Innovations like policy optimization and digital tools have enhanced implementation. These advancements have made the Infinite Banking Concept more practical and accessible, ensuring its relevance in modern finance.

Future of Infinite Banking

The future of Infinite Banking lies in its growing adoption, driven by financial education and technological advancements, ensuring its continued relevance and effectiveness in personal finance.

10.1 Innovations and Trends

The Infinite Banking Concept is evolving with technological advancements, offering digital tools for policy management and wealth tracking. Innovations in whole life insurance products and policy optimization strategies are emerging. The integration of IBC with alternative investments is gaining traction, while educational resources like webinars and online courses enhance accessibility. These trends ensure the concept remains dynamic and relevant in modern finance.

10.2 Expanding Applications

The Infinite Banking Concept is being applied in diverse financial scenarios, such as real estate investments, small business financing, and retirement planning. Its principles are also being integrated into generational wealth transfer strategies, offering families long-term financial security. Additionally, IBC is empowering entrepreneurs to fund ventures without external debt, further expanding its practical applications in modern finance.

The Infinite Banking Concept, as detailed in Nelson Nash’s book, offers a transformative approach to financial freedom. By challenging conventional banking practices, it empowers individuals to secure their financial future proactively. Embracing this method can lead to lasting wealth and independence, making it a valuable strategy for generations to come.

11.1 Summary of Key Points

The Infinite Banking Concept, as outlined in Nelson Nash’s book, empowers individuals to become their own bankers, leveraging whole life insurance for financial independence. By understanding and implementing this strategy, readers gain control over their finances, reduce dependency on traditional banking systems, and build lasting wealth. The concept emphasizes self-reliance, financial security, and the importance of strategic wealth-building, offering a transformative approach to personal finance.

11.2 Final Thoughts and Encouragement

Nelson Nash’s Infinite Banking Concept offers a timeless financial strategy, encouraging individuals to take control of their wealth-building journey. By embracing this approach, readers can achieve financial freedom and security, creating a legacy for generations. Start your journey today with determination and faith, unlocking the doors to a prosperous future through the principles outlined in Nash’s transformative book.

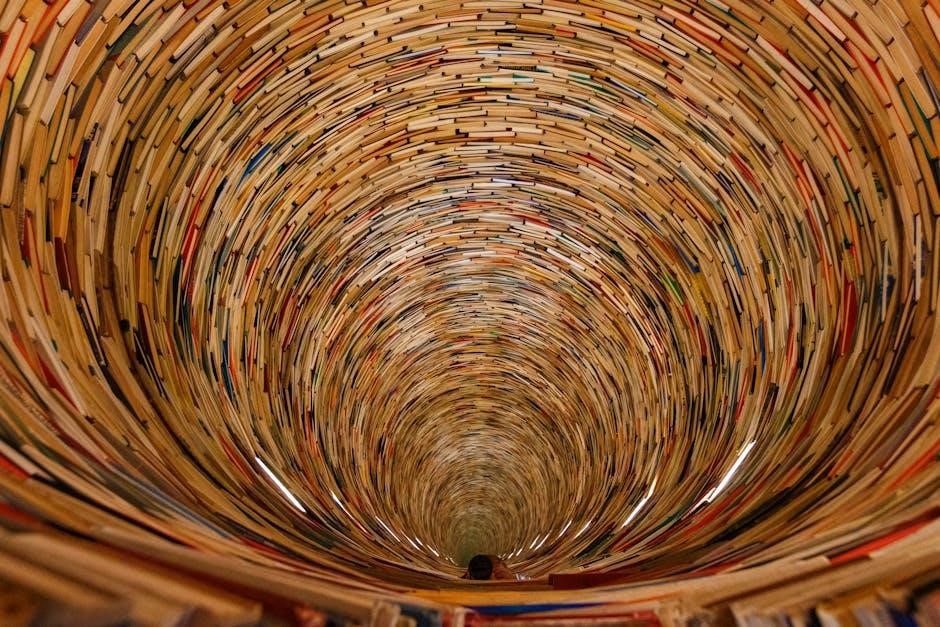

Additional Resources

Explore the Nelson Nash Institute’s official website for comprehensive guides, free consultations, and access to the Becoming Your Own Banker PDF, enhancing your Infinite Banking journey.

12.1 Recommended Reading

The Becoming Your Own Banker book by R. Nelson Nash is essential for understanding the Infinite Banking Concept. Supplementary materials like workbooks, eBooks, and webinars offer practical insights. The Nelson Nash Institute provides additional resources, including free consultations and expert-led sessions. These tools help deepen your understanding and implementation of the Infinite Banking strategy for financial freedom.

12.2 Further Learning Opportunities

Beyond the book, explore online courses, webinars, and workshops offered by the Nelson Nash Institute. Masterclasses led by experts like Jose Salloum provide in-depth training. Join community groups and forums for shared insights. Downloadable guides and video tutorials offer practical tools to implement the Infinite Banking Concept effectively, ensuring a comprehensive understanding of its principles and applications. Engage with these resources to deepen your knowledge and apply the strategies confidently.

Availability of the Book in PDF

Nelson Nash’s book is available in PDF format for convenient digital access. Readers can find it through various online platforms, ensuring easy download and reading.

The digital version offers portability and instant access, making it ideal for modern readers seeking to explore the Infinite Banking Concept anytime, anywhere.

13.1 Sources for the PDF Version

The PDF version of Nelson Nash’s book can be accessed through various online platforms. Official websites like nelsonnash.com and trusted e-book retailers offer secure downloads. Additionally, financial education platforms and forums dedicated to the Infinite Banking Concept provide free or paid access to the digital version, ensuring readers can easily explore Nash’s groundbreaking financial strategies.

13.2 Benefits of the Digital Format

The digital format of Nelson Nash’s book offers unparalleled convenience, allowing readers to access the content anytime, anywhere, on various devices. The PDF version enables easy navigation, with features like search and zoom, making it ideal for studying and referencing key concepts. Additionally, the digital format reduces physical storage needs and supports environmentally friendly reading habits.

It also facilitates quick access to highlights and notes, enhancing the learning experience. The digital version ensures that Nash’s timeless financial wisdom remains accessible and engaging for modern readers, aligning with today’s preference for instant and flexible access to information.